Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Wednesday, 20 May 2020 00:21 - - {{hitsCtrl.values.hits}}

In early March 2020, a friend who operates a medium sized business in Australia called me to discuss challenges faced by the business due to COVID-19 related Government restrictions and its negative impact on the sales.

We decided to prepare a six-month cash flow forecast to review the cash duration and discuss funding options with the bank to overcome any cash shortfall. When the cash flow forecast till 30 September 2020 was prepared, we realised that we had already bought our goods and had ample stocks in hand and had commitments to our suppliers to pay for these items but our collections from customers on a worst-case scenario was virtually zero or negligible.

Our cash duration based on the worst-case sales scenario was two months. That is, if we collected all dues from our customers and paid all the suppliers, employees, landlords and other service providers, we would be without cash in two months. We also knew the banks would not approve the extra funding without any sales. Therefore, we had the option of either do nothing and close the business in two months or take action proactively and ensure the continuity of the business beyond the forecast COVID-19 restriction period.

Our immediate thought was the need to improve sales in the new operating environment. The best option for the business was online sales and develop few promotions to convert stock to cash. With support from the digital marketing team, a sales plan was prepared to pull the customers into the online channel. Although this increased the cash duration by two extra months, bringing the cash duration to four months, the funding shortfall was still too large to present to the bank.

We then looked at the next option, which was cost reductions. We were able to come up with ideas to either reduce or manage costs differently and reduce the cash outflow. We were then in a position to present a decent application for extra funding and also propose how the business will repay the extra borrowing post September 2020. We also prepared a contingency plan to manage the business in the event the bank did not approve the full requirement.

The story above will be applicable to many companies around the world today. A Deloitte study shared a survey jointly conducted by Tsinghua University and Peking University which estimated that two thirds of SMEs in China ran out of cash within two months (85% within three months) during the COVID-19 crisis. The examples shared highlights the importance of having a smart and proactive cash management process for the survival and continuity of businesses in a COVID-19 operating environment.

SMEs in Sri Lanka play a critical role within the economy. According to national policy framework for SMEs, the sector comprises 75% of the total number of enterprises, provides 45% of employment and contributes 52% of the Gross Domestic Product. Therefore, continuity of SMEs into the future is essential for the growth of the Sri Lankan economy and also to prevent socio economic issues across the country.

Cash flow challenges in a COVID-19 environment

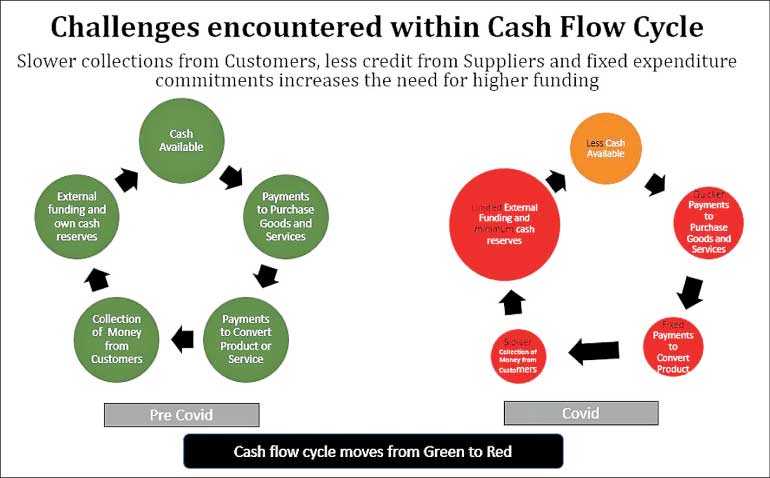

Cash flow cycles are a key component of a business. In a typical cash flow cycle, receipts and payments are generally managed to maintain a positive flow. When one component of the cycle has a problem, it causes stress at all levels and could destabilise the entire cycle. However, in a COVID-19 environment many components will have problems, this could disrupt businesses and threaten their existence.

The chart demonstrates the challenges we could face. Many businesses will move from a well-managed or in some cases from a tightly-managed cash flow cycle in a pre-COVID-19 environment to an almost broken cash flow cycle in a COVID-19 environment.

These are the typical challenges that will impact the cash flow:

– Lower purchasing power of consumers as they will have less money to spend

– Lower production due to drop in productivity on account of social distancing rules, low staff morale especially due to the uncertainty, high absenteeism due to transport issues

– Production constraints due to shortage of raw materials (import restrictions and closure of boarders)

– Inability to deliver products due to logistics issues

– Suppliers requesting early payment while the businesses propose the opposite and request extended credit periods

– Customers requesting longer credit periods while the businesses request payments in cash or lower credit periods

Options to ensure business continuity

The Government has already announced a Rs. 50 b loan package from the banks. Everyone will be in the queue and any support received from this scheme will help solve challenges at least partially. However, all businesses may not receive support as the banks will also have their risk management processes in place to mitigate losses due to defaults. Equally, it is not prudent to expect grants from the Government when its revenue is also negatively impacted. Therefore, most businesses will have to manage the cash challenges and the destiny of the business on their own.

Whilst there is no one size fits all actions to mitigate cash flow risks, businesses should also not assume that addressing the cash flow is the responsibility of the accountants. Improving cash flows requires inputs from all functions in the business. It’s a team effort and should be led by the head of the business.

The following actions and thoughts are options businesses could consider to address cash flow challenges and business continuity.

Understand the duration business can survive with existing cash and bank facilities

Understanding cash duration should be the first action. Whilst positive net assets and a good current ratio is nice to have, liquidity is the most important factor to survive in the current environment. The best option is to use the worst-case sales scenario and calculate how long the business can continue with available funds. This should lead to actions that will improve the cash duration thereby enabling continuity of the business.

Identify the need for the business to change and take action

Conducting business activities similar to the pre-COVID-19 environment is potentially high risk. Therefore, a review should be conducted to assess whether the business model, business practices, products suit the current environment.

Further, if there is a need to change, managing it requires good leadership, a positive attitude and a change in mind-set. Business leaders and their key resources should think out of the box, be innovative and plan actions that ensure business continuity.

Provide leadership to business organisation

Business leaders should not lose control under pressure. This is a tough time for all. Leaders should set the tone (tone from the top is important), give direction and motivate teams to work as one unit to deliver the expected outcomes.

If leaders do not stay strong, teams too will feel the pressure and will not be able deliver. Motivated teams will contribute with ideas and suggestions for the business to survive and continue.

Identify the new products or services to sell and how to sell

Consumer behaviour in the new environment will force organisations to change, modify or discontinue existing products, introduce new products, or change to a totally different product. Understanding the market and changing the product or service offerings to suit the market needs is a key enabler for business survival and continuity.

A good example is the new product offer by a well-known inbound and outbound travel company offering vehicle transport options for office staff. They are changing to a new business as the existing business delivers virtually zero revenue. This company will now have the potential to earn some cash revenue when compared with zero revenue if they continue as is.

Flexibility of the business to change products or services to meet market requirements

Agility of the production facility and other functions to meet the new requirements successfully are equally important. Inability to meet marketing requirements means loss of revenue which in turn will impact cash flows of the organisation threatening the existence of the business.

All functions should work together, be flexible and where relevant make sacrifices to meet the new objectives.

Reduce costs and operate on a shoestring budget

Business should only incur costs that are absolutely essential. Unless a project is delivering immediate sales and cash profit, projects should be postponed. All cost savings will help improve cash flow. Every single line of costs should be examined and justified.

Cost reduction is a sensitive and emotional process. Good leadership, team work, being open minded and transparent are essential ingredients to achieve successful cost reductions. There should be no sacred cows within the business. Every cent saved will help improve the cash flow and contribute to the overall objective.

Effectively managing collections and payments

Customers and suppliers are key stakeholders. They are both interlinked to the business. We cannot continue without them. They are equally impacted by the current environment. Business has to thread on a fine line when managing collections and payments.

Businesses need to understand that a supplier payment due in the business books, is a receivable in the suppliers’ books and vice versa for the receivable from our customers. The ideal option for any business is to delay the supplier payment and collect quickly from the customer. But the reality will be different as they will also have similar business challenges and will want to delay payments or collect early.

Whilst the ideal option should be pursued by businesses, a happy medium should be reached based on each individual circumstance. Its vicious cycle and survival of the customers and suppliers will be equally important for the existence of the business.

Invest new capital

Many businesses look for capital even in a normal operating environment. Shortfall in funding can be overcome short term by using own capital or bank funding but both these options may not be feasible currently.

However, other sources of funding such as new issue of shares, venture capital funding, non-bank financing should be considered. Access to these funds may not be readily available and could also be expensive, but if there is no other alternative they should be considered to ensure business continuity.

Conclusion

Existence of the SME sector post-COVID-19 environment is key to overcome Sri Lanka’s economic challenges and recovery. Ensuring the survival and continuity of these businesses is key to our economic recovery.

Whilst the Government can help, it is the primary responsibility of the owners of the businesses and its stakeholders to support each other and ensure this sector remains strong and survives the current crisis. If the businesses survive and continue, opportunities that will come up post-COVID-19 environment will compensate for all the hardships encountered currently.

(The writer is an Independent Director and has held senior finance roles in many countries for British American Tobacco.)