Monday Mar 02, 2026

Monday Mar 02, 2026

Wednesday, 18 December 2019 02:17 - - {{hitsCtrl.values.hits}}

Sri Lanka has just got a new President and a Parliamentary Election is around the corner to select the next level political leadership. There is a greater enthusiasm among citizen specially the youth and professionals to actively engage in cleaning up the “system” and foster a new culture that is conducive for the development agenda.

In the meanwhile there is an allegation that accountants are busy balancing the books within organisations and leave wider social and political issues to others. This perception is probably due to the accountants’ invisibility in the public domain as much as economists, lawyers and medical professionals do, despite the contributions made by the accounting professionals and institutions towards national economic matters.

However, the question remains whether the accounting professionals are doing enough in the nation building process, given that they have a lot to bring to the table in terms of economic policy; facilitating access to capital; promoting good financial management in Government; and combating against corruption.

Accountants were traditionally known as the masters of debits and credits and used to sit in the back office. The role of an accountant has been continually evolving and moving further away from the stereotypical image of bean counter to a business partner who can provide sound support and advice across the business. In a broader scale accountants can and must go even beyond to contribute towards national and global matters.

Accountants are known for their technical expertise, but as per my view, the two missing attributes which prevent them discharging their expected duties towards the nation are professionalism and patriotism.

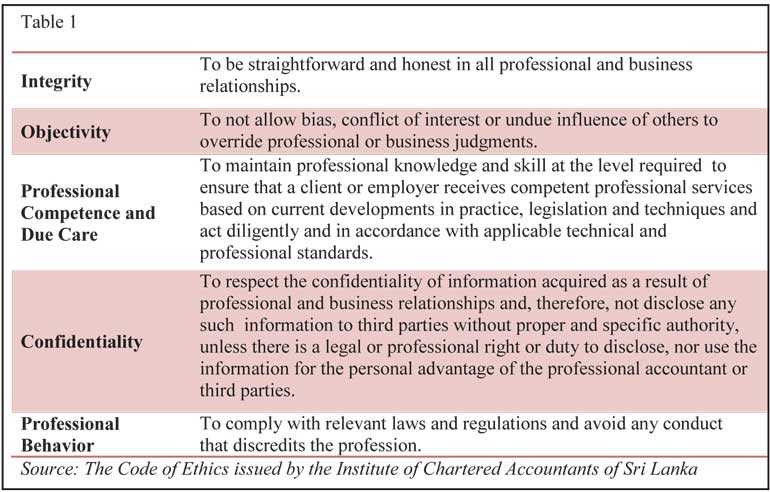

The Code of Ethics issued by the Institute of Chartered Accountants of Sri Lanka, which is mandatory for all members of the institute states that the distinguishing mark of the accountancy profession is its acceptance of the responsibility to act in the public interest and accordingly a professional accountant shall comply with the fundamental principles shown in table 1.

The Code provides detailed guidance on the above and then unfolds specific provisions separately for professional accountants in public practice and professional accountants in business. This is a good reference to all accountants although the compliance is not mandatory for non-members of CA Sri Lanka.

Accordingly, let me discuss a few areas where the professional accountants can make greater contributions in the nation building process.

a. Development of the growth agenda of the country

In the current economic context, accountants can play a key role as the torch bearers in the nation building. They can use their financial expertise to suggest various economic and financial measures to uplift the deteriorating economy and boost economic as well as industrial growth.

The newly-elected President has declared his commitment to execute the manifesto titled ‘The ten principles of inclusive governance’ and the accountants can provide intellectual input towards operationalising the action plan while also raising constructive criticisms where necessary.

As per my knowledge, the intellectual forums like Viyathmaga, its Accountants’ Forum and Think Tank are currently working on this and other accounting professionals can contribute towards the cause even as individual contributors.

b. Maximising Government revenue

There are three institutions that provide revenue for the Government – the Department of Inland Revenue, Sri Lanka Customs and the Excise Department, of which Inland Revenue Department provides close to 50% of the revenue.

Sri Lanka’s total tax income as a percentage of GDP was 12% in 2018, which is a very low percentage when compared to other developing nations. Non-payment of taxes and tax evasion are major impediments to achieve the desired tax revenue.

The accounting professionals who are employed and those who function as tax consultants should not resort to tax evasion, but rather engage in providing tax education and ensure the due taxes are paid by the entities and individuals, without forgetting the fact that the non-payment of taxes and tax evasion according to the new Inland Revenue Act is a criminal offense. This is an area where the integrity and professionalism of accountants must come into play.

c. Prevent corruption

The World Economic Forum estimates the global cost of corruption to be $ 2.6 trillion annually and in the Sri Lankan context corruption is one of the biggest allegations for the political regimes over the last few decades.

However, one must understand that the political leadership cannot engage in these activities without the support of the professionals, mostly the accountants, and hence the accountancy profession acting in the public interest is an important part of national governance architectures that confronts corruption.

IFAC has conducted a study on this and found where governance is strong; the role played by professional accountants in tackling corruption is amplified. The study further noted that professional ethics, educational requirements, and monitoring and oversight mechanisms are fundamental to the positive role played in tackling corruption. Hence, the respective professional bodies have a greater role to play in scrutinising their members’ compliance with the established Code of Ethics.

In order to end the notion that “silence is always safer” requires greater focus on strong governance and compliance structures, environments that are encouraging for self-reporting, and protections that apply to everyone working with any organisation or for any profession. While we empower individuals to do the right thing, adequate safeguards must also be established to protect the whistleblowers and those who stand by the right thing.

d. Climate action

Climate change is an urgent, global, and systemic issue that can threaten the sustainability of organisations, markets, and economies. IFAC commits to work with the global accountancy profession to build the knowledge and capacity of accountants to advance the Sustainable Development Goals (SDGs) and be the global voice on climate action on behalf of the profession. IFAC calls on the member organisations and individual accountants to embrace climate action and be part of the solution.

Professional accountants in their various roles at governance, strategic, and operational levels have a significant contribution to make in helping governments, capital markets, and businesses develop and implement plans for climate change mitigation and adaptation. Professional accountants can involve in climate action in the following areas:

Accountants can further leverage their expertise in the field of non-financial information on how companies can make right changes to reduce their environmental footprint and costs. Helping businesses to report on their performance in an integrated way using the Integrated Reporting

e. SME development

The SME sector is considered to be the back bone of the economy as it accounts for more than 75% of the enterprises, contributes around 60% to the GDP and provides 45% of the employment. Intensive actions are required at building capacity for SMEs by the Government and the accounting profession, especially Small and Medium-sized Practices (SMPs), has an opportunity to contribute significantly to these efforts.

Some of the areas where the professional accountants can look into would be; outsourcing lower-level activities (Ex. Book keeping), forming strategic alliances with other SMPs and other professionals, becoming a ‘one-stop’ referral centre to other service providers. It is also important for the professional accounting bodies to invest in training and empowering the professional accountants who are catering to this segment.

f. Transform SOEs

State-Owned Enterprises (SOEs) play a significant role in the country’s economy and are present in key sectors including ports, energy, banking, insurance, trading, etc. SOEs are vulnerable to mismanagement and corruption because of potential conflicts between the ownership and policy making functions of the Government, and undue political influence on their policies, appointments, and business practices.

The internal control, monitoring and governance frameworks seem inadequate to deal with these problems and most of the entities do not have proper management information reporting mechanism for better decision making. Further, certain entities do not have proper financials and monitoring mechanism of the performance.

One of the key areas where corruption is assumed to be at the highest levels is the procurement function. Professional accountant can play a major role in enhancing the governance of these institutions via sound internal controls, improve management information reporting for better decision making and provide expert input to maximise the returns. One of the main behavioural contributions that can be made by the professional accountants employed in these institutions is to keep themselves away from malpractices, bribery and corruption, and undue political favouritism.

The current Government has initiated a mechanism to recruit professionals for the board positions of SOEs via a robust and transparent mechanism, and I hope the patriotic professionals will make use of this opportunity to give their contribution to the country.

g. Enhance finance literacy

In general, financial literacy means a blend of knowledge, skill, attitude and behaviour required to make sound financial decisions and eventually realise individual financial security. Effects of lower financial literacy are greatly magnified in the rural public and small-medium business community. This phenomenon not only weakens the financial management of the general public but also allows ill-minded financial institutions and intermediaries to exploit them.

Therefore, one of the greatest contributions professional accountants can make to the society is to educate the general public on the financial and economic concepts and help improve their financial literacy. In my view this is one of the major weapons we can use to alleviate poverty in the country.

Change starts today

This article attempted to capture a list of identified areas where the accountants can contribute in their efforts towards nation building. There are many more areas where accountants can play a significant role in elevating this country to the next level and make it the real wonder of Asia in its true sense.

As I have repeatedly highlighted in the article, professional ethics and true patriotism are the vital ingredients to be complemented with knowledge and expertise in achieving the desired results.

We as the brand ambassadors of the accounting profession also have a duty to ensure that accountancy should be attractive as a career choice to young people who are increasingly looking to enter the professions to serve the greater good and hence accountants need to be constantly reminded that ethical behaviour is at the core of our profession.

(The writer is a Chartered Accountant, Management Consultant, International Speaker, Leadership Coach and Corporate Trainer. He can be reached via [email protected] or [email protected])