Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 8 March 2017 00:00 - - {{hitsCtrl.values.hits}}

Whilst the world is experiencing volatility fuelled by the drastic decisions taken by US President Donald Trump, Sri Lanka is grappling with fiscal, political and corruption issues that are tainting the good work of the current Government.

Whilst the world is experiencing volatility fuelled by the drastic decisions taken by US President Donald Trump, Sri Lanka is grappling with fiscal, political and corruption issues that are tainting the good work of the current Government.

The two drastic decisions by President Trump that shocked the world were the executive order to move away from the TPP agreement and the decision to ban visitors from eight countries into the US, which is a violation of the very principles of the UN charter on freedom of travel.

But the good news is that the US, accounting for almost 20% of the 72 trillion dollar world economy, is growing at 1.9% with unemployment at a commanding 4.8% performance whilst the Dow Jones has crossed the 21,000 mark which is good not only for the US but also for the world.

A tough year experienced. Q4 GDP dropped to 2.5% in 2015 whilst in 2016 Q1 it picked up to 2.7% and bounced back to 4.1% in Q2 2016. But the reality is that if an island economy like Sri Lanka does not grow over 7%, a typical consumer cannot feel it.

In this backdrop we see that the Sri Lankan consumer is challenged on many fronts as per the latest Nielsen consumer insight report. Let me pick up the key aspects:

Overall consumer confidence dropped from a commanding 87 way back in October 2015 to a low ebb of 46 as at July 2016.  However by December 2016 it picked up to 54 but January 2017 remains flat which is worrying.

However by December 2016 it picked up to 54 but January 2017 remains flat which is worrying.

Meanwhile, 80% of consumers say that job prospects will not get better in the next 12 months whilst 90% say that personal finances will be unsatisfactory and 92% state that their purchasing power will deteriorate in the next 12 months. This clearly depicts the overall consumer sentiments in homes and it normally connotes the feeling towards the Government in power. Research reveals that when the stomach of a Sri Lankan consumer is challenged, the government in power loses its popularity.

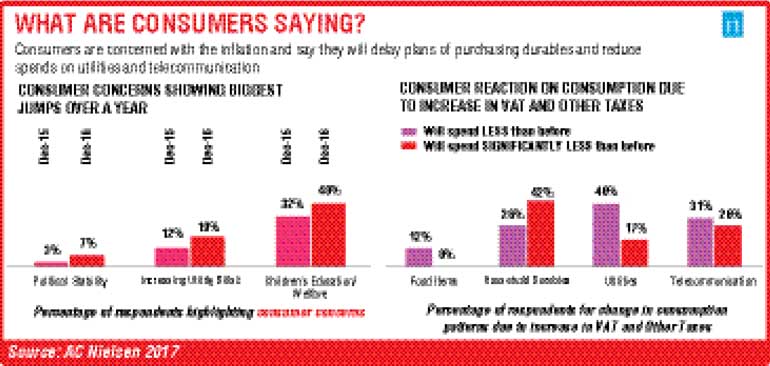

In the backdrop of the overall poor consumer confidence if one does a deep dive the Sri Lanka consumer is stating that the increasing spend on children’s education and increasing food and utility bills is affecting the home affairs of a Sri Lankan consumer as per the Nielsen report.

If one does a deep dive almost 46% say that they do not have spare cash whilst it is up 13% on a quarterly basis, savings in children’s education dropping by 10% which are indications of the drastic changes we see on the household side of Sri Lanka.

Latest research reveals that people are moving away from using personal care products like shampoos on a regular basis, reducing the ‘usage’ of the product, whilst in some categories like sanitation and hygiene the penetration going down indicates the pressure on the purse. In the months of January and February, FMCG companies struggling to achieve their budgeted numbers is a result of these underlying issues.

Consumers say the top three issues of the country are economy, politics and corruption. If we examine what ails the economy of the country similar to the last 10 years there are many factors that will emerge such as shrinking global markets, debt payment issues, etc. But the issues faced politically are very worrying given that on a daily basis there are protest campaigns which is in essence the agitation of different segments of people.

A multilateral organisation states that the Government loses 100 million due to a single protest in the streets of Colombo. The Coalition Government at play adds to the pressure of pursuing reforms in the economy which further reduces the competitiveness of the nation.

Many thought that the Yahapalanaya promise would eradicate corruption but sadly the breadth and scope has only increased and I guess in the next nine months it will only increase further, given the provincial government elections being planned. This also inhibits private sector participation with the public sector given the many statutory bodies set up to curtail corruption legally.

In the backdrop of what consumers say nationally, from a consumer point of view the key three issues are political stability, increasing utility bills and the increasing costs of children’s education. Sadly one cannot see a breakthrough on these fronts given the drought extending to 14 districts and that the basics like rice, dhal, sprats, cowpea and sugar are all imported and given the currency fluctuations the prices of such products will only increase. This adds to the woes of the Sri Lankan consumer sadly.

An interesting insight. While in most markets consumers are moving towards convenience, which means supermarket behaviour is expanding, in Sri Lanka the reverse was at play in 2016. From 23% of shoppers purchasing products from supermarkets in 2015, in 2016 the number has dropped to 19%. On the other hand grocery shopping has increased from 46% to 53%, which is a significant jump. This clearly indicates people are becoming more rational in their purchasing habits. I guess FMCG companies will have to re think the distribution and partnership strategies for the balance part of the year.

Another significant trend seen is that from the incremental sales experienced in the Sri Lankan market, 67% of this comes from local companies as against the 55% registered by multinationals. This means that people are moving away from power brands to local brands whilst one must also state that the quality parity is mitigating to the extent that local brands are gaining ground. This bodes well for Sri Lanka just like what has happened in India.

Given the changing consumer dynamics like the use of smart phones we see that internet usage has increased to a penetration of 32%. What is more important is that the investment by companies on digital media communication has increased proportionately. Even though the national budget increased the cost of data usage, the behaviour has not yet changed. In fact this is the future and this budget proposal is against global trends which is strange.

Given the challenges in the macro economy, with Sri Lanka having debt payment challenges, we now see the issues related to a typical Sri Lankan household increasing. Whilst policymakers are grappling to manage the situation, IMF stipulations mandate that the people must pay for the increasing costs. The issue is, how much can one stretch without affecting the political equilibrium in the process?

(Dr. Rohantha Athukorala is an award-winning marketer and business personality who has worked in top British multinationals for almost 20 years and can be contacted on [email protected].)