Saturday Feb 07, 2026

Saturday Feb 07, 2026

Tuesday, 20 October 2020 01:01 - - {{hitsCtrl.values.hits}}

Eight out of 10 small and medium businesses (SMEs) in Sri Lanka struggled to continue operations and meet financial obligations due to the impacts of the COVID-19 pandemic, according to a new report.

The report, ‘Gendered Impacts of COVID-19 on Small and Medium-Sized Enterprises,’ by Women in Work, a partnership between IFC, a member of the World Bank Group, and the Australian Government, shows women-owned businesses were least likely to have taken a loan from a financial institution and significantly more likely to borrow from family and friends to meet their financial obligations during COVID-19.

Presenting a snapshot of the impacts of the pandemic, the report is based on surveys of SME clients of four financial institutions and from the distribution network of one fast moving consumer goods company. It shows almost three quarters of SMEs surveyed experienced decreased sales. Nearly two thirds of the SMEs saw their sales drop by more than 25% on their pre-COVID monthly average.

“Overall, our research shows little difference between the impacts on businesses – whether they were owned by men, women or jointly owned,” said IFC Country Manager for Sri Lanka and Maldives Amena Arif.

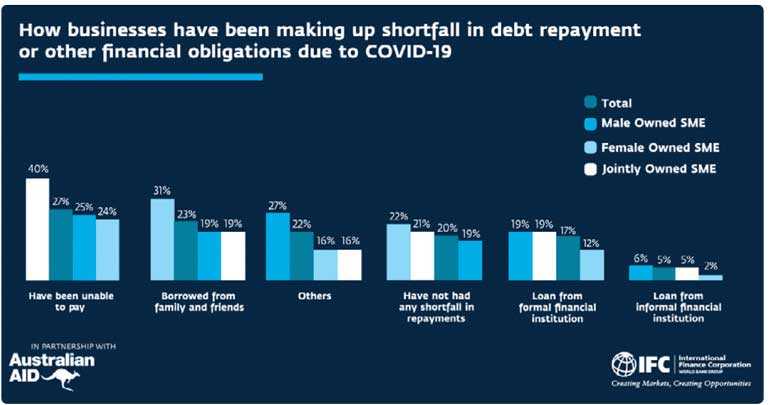

“But it was clear women were less likely to access loans from formal banks to support their businesses and more likely to take a more traditional route, borrowing from family and friends. They were also much less likely to use digital business channels. This highlights potential areas for future work with financial institutions to tailor their support to meet the unique needs of female and male business owners.”

Around one million SMEs—25% of which are women-owned—account for about 45% of total employment in Sri Lanka. This study finds that companies in the manufacturing and construction sectors are the hardest hit, followed by the services sector. Despite the challenges, almost three-quarters of the SMEs surveyed predicted they will continue to operate indefinitely.

Eighty per cent of SMEs experienced difficulties meeting operating expenses and had some shortfall in debt repayment or ability to meet financial obligations due to COVID-19. Moreover, over three-quarters of SMEs reported difficulties accessing their usual financial services.

In response, the IFC-DFAT report offers recommendations, including increased access to working capital solutions and other loans for Women-owned Small and Medium Enterprises (WSMEs), better access to business-related training, and greater support to help small businesses shift to digital business channels.

“We hope the report’s recommendations will be a useful input into creating a more resilient Sri Lankan economy in which women-owned businesses make a greater contribution,” said Australian High Commissioner for Sri Lanka David Holly.

The findings are based on a survey completed by 413 SMEs from across the country between 22 June and 22 July.