Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 20 January 2020 04:04 - - {{hitsCtrl.values.hits}}

Central Bank on Friday said the trade deficit contracted marginally in November 2019 (year-on-year), with both imports and exports declining.

During the first 11 months of 2019, the trade deficit contracted compared to the corresponding period in 2018, as a result of the significant decline in expenditure on imports along with a marginal increase in earnings from exports.

It said the deficit in the trade account contracted marginally in November 2019 to $ 762 million, from $ 785 million in November 2018. On a cumulative basis, the trade deficit contracted by $ 2,428 million to $ 7,214 million during the first 11 months of 2019 from $ 9,642 million in the corresponding period of 2018.

The terms of trade, i.e., the ratio of price of exports to the price of imports, deteriorated substantially by 9.0% (year-on-year) in November 2019, as export prices declined at a faster pace than the decline in import prices. Cumulatively, the terms of trade deteriorated by 1.6% during the first 11 months of 2019 in comparison to the corresponding period of 2018.

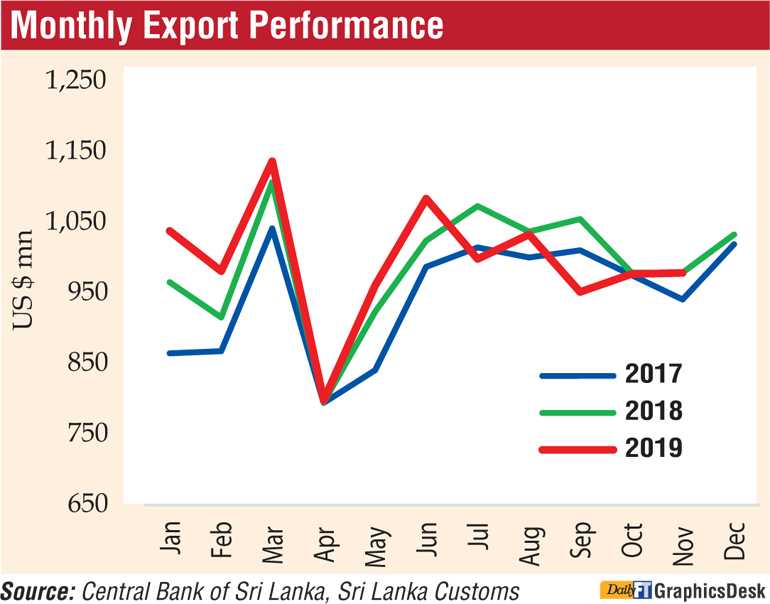

In comparison to November 2018, earnings from merchandise exports declined marginally by 0.1% to $ 979 million in November 2019, with all major subsectors broadly recording a similar trend.

Earnings from agricultural exports declined in November 2019 showing a mixed performance in its subsectors. On a year-on-year basis, earnings from tea exports declined as a result of lower average export prices in line with the fall in international market prices of tea, although export volumes of tea continued to increase.

In addition, earnings from spices declined in November 2019, mainly due to lower export prices of cinnamon and lower export volumes of cloves and pepper. Earnings from seafood exports also declined with lower demand from the US market. In contrast, earnings from export of minor agricultural products, mainly fruits, arecanuts and betel leaves, increased during the month, while earnings from coconut exports increased, driven by higher export volumes.

Earnings from industrial exports remained broadly unchanged in November 2019 in comparison to November 2018. Earnings from rubber products declined as a result of lower tyre exports, while earnings from machinery and mechanical appliances declined with lower performance of all subcategories.

Meanwhile, bunker and aviation fuel continued to decline mainly due to lower bunkering prices in line with lower crude oil prices in the international market, leading to lower earnings from petroleum product exports. However, the decline in petroleum product exports was mostly offset by higher exports of naphtha and fuel oil.

Conversely, earnings from textiles and garments increased in November 2019 supported by higher demand for garment exports from the EU and non-traditional markets. Export earnings from gem, diamonds and jewellery also increased as volume exported under all categories increased.

Earnings from mineral exports, which account for only 0.3% of total exports, increased in November 2019, year-on-year, led by ores, slag and ash exports. The export volume index in November 2019 improved by 11.6% (year-on-year), while the export unit value index declined by 10.5%, indicating that the decline in exports was driven entirely by lower prices when compared to November 2018.

Performance of merchandise imports

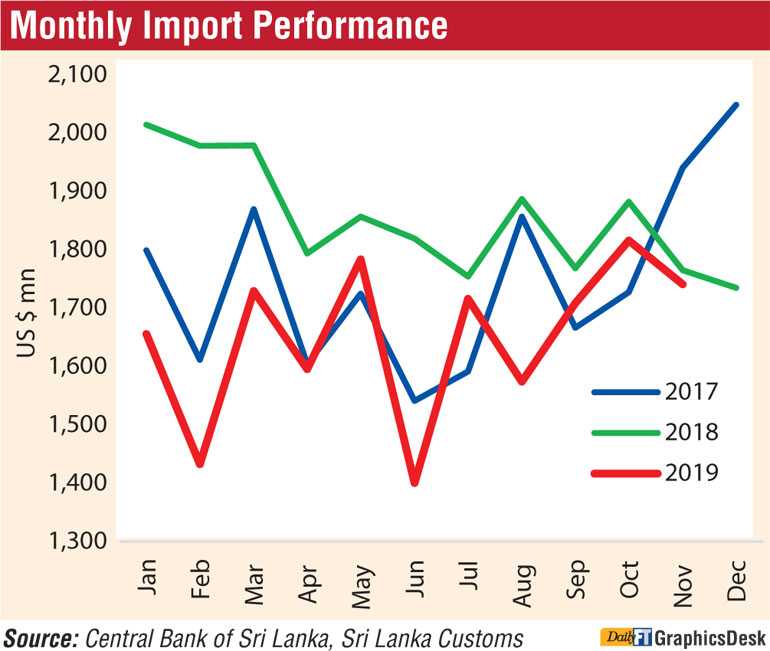

Contraction of merchandise imports continued for the 13th consecutive month with a moderate decline of 1.3% (year-on-year) in November 2019 to $ 1,741 million, driven by lower intermediate goods imports.

Expenditure on consumer goods imports increased in November 2019, led by food and beverages imports such as vegetables (mainly onions), sugar and dairy products due to both higher import volumes and prices, although non-food consumer goods category driven by lower personal vehicle imports continued its declining trend on a year-on-year basis.

However, reflecting the impact of the resumption of personal motor vehicle imports under concessionary permits, expenditure on personal motor vehicle imports remained at a relatively high level, on average, since July 2019, compared to values recorded during the first half of 2019.

Expenditure on imports of intermediate goods declined in November 2019, mainly due to lower expenditure on fuel, owing to both lower import volumes and international prices related to all subcategories, namely crude oil, refined petroleum and coal.

In addition, expenditure on base metal imports declined due to the base effect of higher imports of iron and steel in November 2018. However, import expenditure on wheat and maize increased mainly due to higher volumes, while textiles and textile articles increased, led by higher fabric and fibre imports. In addition, expenditure on cement clinkers, categorised under mineral products, increased substantially in November 2019.

Expenditure on investment goods imports increased in November 2019 with higher outlays in all subcategories. Accordingly, expenditure on machinery and equipment increased driven by medical and laboratory equipment, while expenditure on transport equipment increased with higher expenditure incurred on railway engines and carriages. In addition, expenditure on building material increased due to higher imports of articles of iron and steel related to bridges and bridge sections.

The import volume index increased by 0.3% while the unit value index narrowed by 1.7% in November 2019, indicating that the decline in imports was driven entirely by lower prices when compared to November 2018.