Friday Feb 27, 2026

Friday Feb 27, 2026

Thursday, 28 May 2020 00:00 - - {{hitsCtrl.values.hits}}

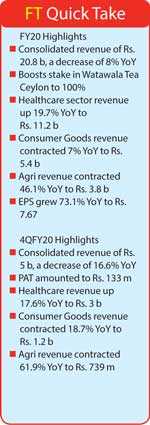

Fuelled by strong growth in its healthcare sector, diversified Sri Lankan conglomerate Sunshine Holdings PLC has reported notable growth in bottom-line performances during the year ended 31 March (FY19/20).

During this period, the group posted consolidated revenue of Rs. 20.8 billion, delivering a 60% Year-on-Year (YoY) increase in Profits After Tax (PAT).

The group’s top-line performance saw a decline in growth by 8% YoY, mainly due to the sale of the tea plantation business represented by Hatton Plantations PLC during the first quarter as well as the revenue contraction of group’s consumer goods sector. Group’s healthcare and consumer business together contributed 78% to Sunshine’s top-line, while agribusiness sectors of the group contributed 18% of the total revenue.

During the month of May, the group boosted its stake in the branded tea company, Watawala Tea Ceylon Limited (WTCL) to 100%, which effectively increased its exposure to Consumer sector. It reduced the group interest in oil palm and dairy, by transferring the stake in Watawala Plantations PLC to a new joint venture called Sunshine Wilmar Ltd. The strategic move is in line with the group’s strategy of taking a significant step in its growth plan while expanding its presence in Sri Lanka’s booming consumer goods sector. The transaction which obtained shareholder approval during March, was only completed in May due to the closure of the Colombo Stock Exchange due to COVID-19 lockdown.

Profit after tax (PAT) for the period in review rose to Rs. 1.8 billion, which include a one-off gain from the sale of Hatton Plantations PLC, which amounted to Rs. 341 million. The strong positive results were carried through to the group’s Profit After Tax and Minority Interest (PATMI) which grew by 102.4% YoY to Rs. 1.1 billion.

Group’s healthcare and agribusiness sectors were significant contributors to PATMI, accounting for 44% and 34%, respectively.

Commenting about the group’s performance, Sunshine Holdings group Managing Director Vish Govindasamy said: “The financial year under review experienced two unexpected events — the Easter bombings and the country-wide lockdown due to COVID-19 pandemic — where the combined effect caused tremendous impact on every sector in the economy. The novel coronavirus especially, which is the cause of the most-affected economic headwind in history, was a true test for organisations like us to showcase resilience, responsiveness and readiness in such a crisis. However, we are pleased to note that as a group, we displayed a resilient and entrepreneurial spirit in the face of such difficulties, continuing our valuable contribution to the economy by ensuring undisrupted services to all our stakeholders by maintaining highest standards of safety and convenience.”

“Due to the divestment of the group’s tea plantation business, our agribusiness sector experienced a decline in revenue growth while group’s consumer goods sector also saw a contraction in revenue due to market disruptions. However, it is noteworthy to mention that our healthcare sector continues to yield strong growth momentum from last due to the group’s well-articulated strategies to improve quality and internal efficiency,” Govindasamy added.

As the largest contributor to group revenue, Sunshine Healthcare grew its revenue by 19.7% YoY to Rs. 11.2 billion on the back of both volume and price growth in the pharma and medical devices sub-sectors. Higher volumes, stable rupee, and increased contribution from the medical devices sub-sector propelled EBIT margin by 200 bps (basis points) in FY20 compared to the same period last year.

“In healthcare, we expect strong growth in the first quarter, especially in medical devices and pharma sub-divisions. We are closely monitoring the changes in the exchange rate, which is sensitive to our margins. The sector will continue to focus on improving the product range and service quality. During the lockdown, Healthguard’s operations were disrupted, but we were able to identify several opportunities in improving its digital capabilities. During the first quarter, we will look to improve Healthguard’s online business further,” added Govindasamy.

Sunshine’s Consumer brands – spearheaded by premium brands like ‘Zesta’ and ‘Watawala Tea’ – recorded revenues of Rs. 5.4 billion during the period in review, down 7% YoY. PAT from the Consumer segment contracted by 39.2% YoY, to stand at Rs. 297 million for FY20. The decrease was mainly due to higher investment in advertising and promotions relating to the relaunch of the ‘Zesta’ brand and market disruptions during 1QFY20. According to Govindasamy, the consumer business would continue to invest behind its brands to scale the domestic businesses. “The Consumer business will have a challenging first quarter due to the COVID-19 pandemic, especially due to disruption in logistics. The company would continue to invest behind its brands to scale the domestic businesses. We also expect a slower recovery in the gift boutique business, which is predominantly dependent on tourism.”

The group’s agribusiness sector, led by Watawala Plantations PLC (WATA), recorded revenue decline by 46.1% YoY to Rs. 3.8 billion due to the divestment of HPL. However, the palm oil segment together with dairy recorded an 8% YoY growth mainly due to better performance of the palm oil sector driven by the shift in palm oil yield curve. PAT for FY20 amounted to Rs. 755 million, up 16.1% YoY.

In agribusiness, the group expects to see moderate growth in volumes for the palm oil segment due to the shift in yield curve while prices are expected to be stable in the short term. The RSPO (Round Table for Sustainable Palm Oil) audit is completed and expects to receive the certificate during FY21.

The dairy subsector has reached a total of 810 milking cows, and the total number of animals stands at 1,460. Govindasamy noted that the group expects to rationalise the feed cost further and increase selling price due to higher demand.

Revenue of the group’s renewable energy business amounted to Rs. 313 million in FY20, down 12.1% YoY from Rs. 356 million during FY19, as a result of lower rainfall in the catchment areas coupled with plant maintenance activities. The sector PAT was negative at Rs. 8 million for FY20, compared to a profit of Rs. 63 million last year. The group also ventured into solar power with its new company, Sky Solar, with an installed capacity of 1MW.