Thursday Feb 26, 2026

Thursday Feb 26, 2026

Friday, 1 March 2019 00:00 - - {{hitsCtrl.values.hits}}

By Uditha Jayasinghe

After a lacklustre year, the Central Bank projects Sri Lanka will grow by 4% in 2019, recovering from unimpressive growth of about 3% last year and helped by a friendlier external environment despite high debt repayments and political risk.

Releasing the second monetary policy review for 2019, the Monetary Board of the Central Bank reduced the Statutory Reserve Ratio (SRR) by 1 percentage point to 5% with effect from 1 March with the aim of injecting Rs. 60 billion into the market to spur growth and reduce liquidity shortages, but kept policy rates unchanged to offset a spike in inflation and spillover into imports.

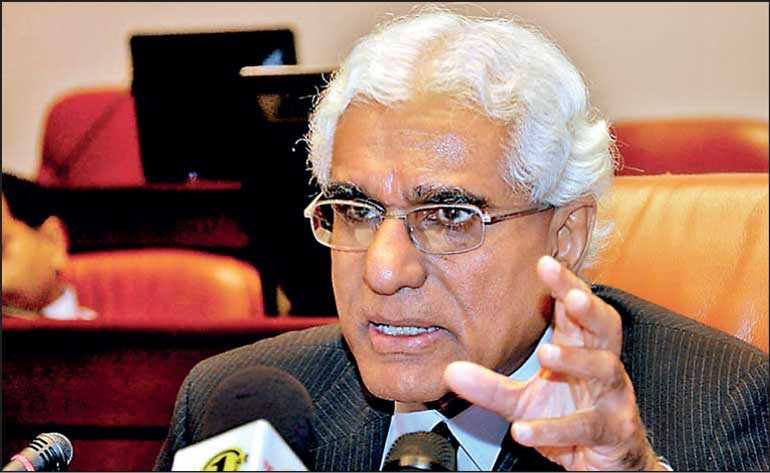

The Monetary Board kept the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank at 8% and 9%, respectively. Central Bank Governor Dr. Indrajit Coomaraswamy said the move could assist growth to improve but was conservative in his estimates for 2019.

“I think 4% is reasonable, it’s a good place to be. I think it’s better to under promise and over deliver,” he told reporters. The Central Bank’s projection is higher than the 3.5% predicted by the World Bank, but lower than the 4.2% projected by Standard Chartered Bank.

The Governor acknowledged Sri Lanka is still experiencing subdued growth, which is expected to be about 3% in 2018,and is still struggling with a persistent output gap.The Central Bank estimates growth potential to be 5%, which is lower than the 5.5% projected by the monetary authority in 2018, but growth has consistently been lower than expected. Despite improvement in exports the trade deficit widened to $10.3 billion in 2018 and the rupee depreciated by 19%. However, so far in 2019, the rupee has appreciated by 1.8% and is expected to be relatively more stable than the previous year.

By end January, gross official reserves stood at $ 6.2 billion, which was equivalent to 3.4 months of imports. Broad money (M2b) growth decelerated 13%, year-on-year in 2018 driven by the contraction in net foreign assets of the banking sector. Private sector credit expanded 15.9% year-on-year, which was more than expected in spite of a marginal deceleration in December 2018.

In absolute terms, private sector credit increased by Rs. 762.1 billion during 2018, which was higher than Rs. 613.4 billion during 2017. As per the Quarterly Survey of Advances, credit to all sectors increased in 2018Q4 compared to the previous quarter, except for the Industry sector.

“We think the 3% growth last year is an understatement and subdued growth argues for relaxation of policy. Broad money growth is within the expected range, interest rates remain high and inflation is subdued. Food price inflation has been negative. Inflation has come from items such as education, housing rentals, and health costs,” he said.

However, the hostile external environment, which saw interest rate increases in the US, has ebbed, Dr. Coomaraswamy noted, giving way to a more dovish policy that could see about one round of policy tightening in 2019. This has resulted in capital returning to emerging and developing markets including Sri Lanka with an estimated $ 30 million in inflows so far this year. Tensions around US and China trade talks have also moderated with an agreement likely in the coming weeks and international oil prices have also become more benign.

“We have been seeing an increase in credit across the board and there is also a possibility that core inflation may increase, driven by some administrative price adjustments. In an election year, there is always the possibility of some fiscal slippage, which pumps excess aggregate demand into the system. So, in this environment, the Monetary Board thought it wise to leave the policy rates as they were.”

However, despite the SRR reduction of 100 basis points and the infusion of Rs.90 billion into the system in November, liquidity shortages have persisted,prompting the Monetary Boardto reduce SRR by 1 percentage point and release Rs.60 billion into the market.

The Governor observed that the Central Bank estimates a liquidity shortage of about Rs.100 billion in the market, which would be partially met by the SRR change. The remaining Rs.40 billion would be supplied by market forces, partly to offset any spillover into imports that would put pressure on reserves.

Talks with the International Monetary Fund (IMF) last week have been “constructive” Dr. Coomaraswamy said, but declined to give details as it would be “premature” to make comments on the process.

“Discussions have gone well and we will know in a few days where we stand, but the Finance Minister went to Washington to signal that the Government is keen to remain engaged with the IMF, and the Managing Director also said they would seek to show some flexibility, so the talks are taking place in that spirit. We wish to ensure we have a program that is in the interest of the country and does not place a burden on the people. The IMF has to work within its framework but I get the sense they are trying to be flexible within that framework,” the Governor said, indicating that the Government would put the Extended Fund Facility program on track. If an agreement is reached, both sides could recommence the program as early as March.

Despite modest growth,Dr. Coomaraswamy was insistent that Sri Lanka should not be tempted to relax policy rates and induce sugar highs through lower interest rates that would pump up consumption without any structural changes within the economy to boost imports and attract investment.

“The relation between credit expansion and growth has gotten weaker but what does still happen is when there is an increase in credit expansion, there is a high propensity for the additional demand to leak into imports. So, we have to be very careful that we don’t relax policy too early because that inevitably leads to balance of payments pressure and ultimately to a balance of payments crisis. This is why the Monetary Board is being cautious in the way it exercises its monetary policy formation.”