Friday Feb 27, 2026

Friday Feb 27, 2026

Monday, 4 May 2020 00:00 - - {{hitsCtrl.values.hits}}

The global economy has come to a screeching halt with the novel coronavirus creating a pandemonium across countries scrambling to impose lockdowns and social distancing measures in a bid to save lives.

Dubbed the ‘Great Lockdown’ by the IMF, this virus resulting crisis has erupted a decline in consumer spending, manufacturing and trading activities that has led to an erosion of business profits and a large surge in unemployment; the ingredients that make up a global recession. While a global recession presents many uncertainties, one thing has remained certain: the inevitability of Mergers and Acquisitions (M&A) in a post-recession scenario.

|

|

According to the IMF, the global economy has experienced four worldwide recessions during the period of the 1975 Vietnam War, 1982 energy crisis, 1991 Gulf War and 2009 Great Recession. Further to the above, the global economy also endured shorter recessions caused by the 1997 Asian Financial Crisis and the 2001 joint events of the dot com bubble and 9/11 attacks.

These events have established a precedence to the behaviour of the M&A market in times of global economic duress and hence sheds a light on the resurgence of the M&A market in a post crisis situation such as the one we are experiencing now in 2020.

Hence, for the purpose of this analysis, we will pay special attention to the trends in the volume of M&A activity in the new millennium, notably during the 2001 and 2009 recessions, whose business environments share similar characteristics to the current business landscape.

Global M&A trends during the 2001 and 2009 recessions

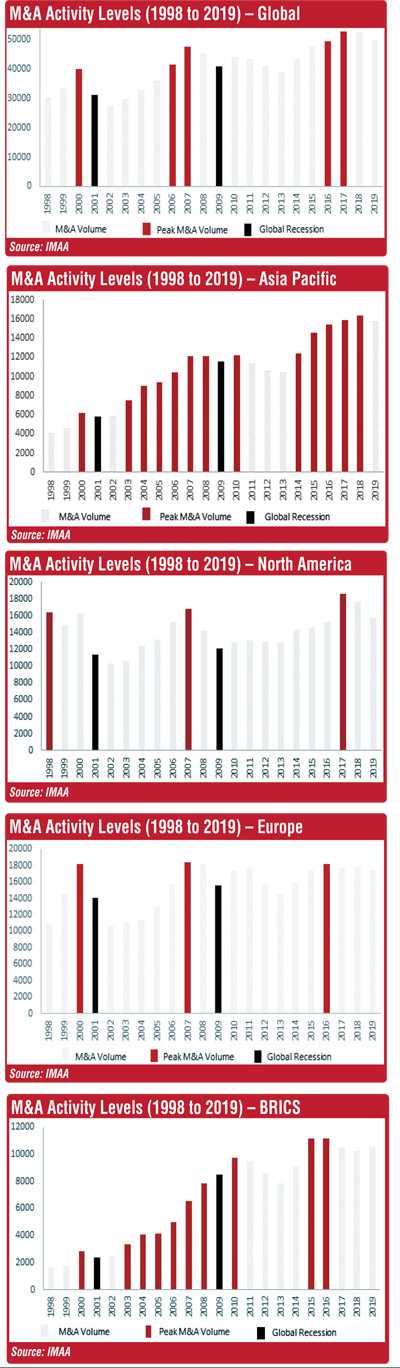

Global M&A was plagued by the 2001 recession which resulted in a 21.9% drop in the volume of transactions to 31,047 deals. After a recovery period of four years, M&A activity reached a peak of 41,407 transactions in 2006 which was surpassed once again in 2007. Recovery period is defined as the number of years the market takes to surpass its pre-recession M&A volume peak.

However, the 2008 financial crisis resulted in a 4.8% YoY decline in M&A deals despite the many government sponsored mergers in the Banking and Finance sector. The 2008 market was further aggravated with the onset of the 2009 recession which resulted in a 9.9% YoY decline in M&A activity.

In comparison to the 2001 recession, the 2009 recession underwent a longer recovery period of six years in the M&A market until it reached a new volume peak in 2015. M&A activity continued to grow until 2017, post which M&A volume declined 5.5% from 2017 to 2019.

Regional M&A trends during the 2001 and 2009 recessions

When further breaking down the market into regions, similar trends could be observed in terms of M&A deal volume during the 2001 and 2009 recessions.

It could be observed that in all regions, M&A activity reached peak levels prior to both the 2001 and 2009 recessions, mirroring peak economic activity and bull markets that existed as precedents to the dot com bubble in 2000 and the housing bubble in 2008. During the 2001 recession, all regions recorded a decline in M&A activity within the first year of the recession.

However in the 2009 recession, all regions recorded double digit declines in the first year of the recession with the exception of the Asia Pacific and the BRICS regions.

Notably, the BRICS region recorded a growth of 8.2% YoY in M&A activity during this period as many cross-border M&A deals took place as investors from recession hit markets looked for diversification opportunities in the high growth BRICS region.

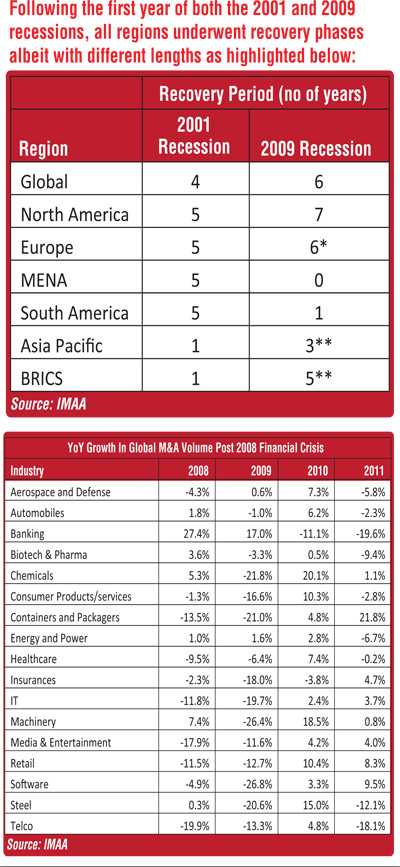

In summary, it could be observed that the global market took four to six years to recover to its M&A volume peak following a global economic recession.

At the same time, regional recovery periods for M&A activity stood within a range of five to seven years following a global economic recession. The severity of the recession results in a longer recovery period as evidenced above.

Regardless of the time period however, it is conclusive from the data above that M&A activity is inevitable after a period of crisis.

Industrial M&A trends during the 2009 recession

For the purpose of understanding M&A activity between industries during post-recession periods, let us analyse the market following the onset of the Great Recession in 2009, which compared to the 2001 recession, is the most similar in terms of market structure and global developments to date.

It could be observed that in 2009, M&A activity witnessed growth in the Banking sector as Government sponsored M&A activity took place on account of the many corporate bailouts and liquidations of banking giants such as Lehman Brothers and Bear Sterns.

Two years after the financial crisis however, there was a double digit YoY growth in M&A activity in capex heavy, manufacturing oriented industries such as chemicals, consumer products, machinery, retail and steel. The largest deals (in terms of value) in 2010 were observed in similar capex heavy industries such as Telecommunications, Healthcare and Media. These deals resulted in the solidifying of market share for most acquirers (America Movil’s acquisition of Carso Global and Telmex) while some acquirers witnessed greater control over supply chains (Coca Cola’s acquisition of its bottling business).

What can we expect in the M&A market in this recession?

The Great Lockdown we are currently facing is expected to result in a 3.0% global GDP contraction according to the IMF; a scenario worse than the Great Recession in 2009 which only witnessed a 0.1% global GDP contraction.

As evidenced above, the severity of the recession leads to a longer recovery period for M&A activity hence we cannot rule out that a global M&A recovery of four to six years could be longer this time, especially as lockdowns prevent businesses from conducting due diligence and face-to-face meetings.

However it is also inevitable that as observed in the 2009 recession, many capex heavy manufacturing oriented industries such as chemicals, consumer products, machinery, retail and automobile will no doubt be hampered with their high operating leverage becoming unsustainable in a demand stagnant economy.

Further, Airlines and the Hospitality industry face an unprecedented existential crisis with low to zero bookings in lieu of travel restrictions. These industries would face liquidity and going concern issues, which for an investor with a long term outlook would present many M&A targets with depressed valuations that could be profitably acquired.

At the same time, an investor with a medium term outlook could also find opportunities in technology; the stock market darlings that are now at record low valuations. Same goes for essential energy companies which are hampered by the lowest oil prices in history.

In conclusion, the Great Lockdown should not quarantine you as a corporation or an investor from seeking out mid to long-term oriented business and investment opportunities in the M&A market, especially as it is inevitable that such deals would resurge post this recession period. A significant upside can be earned by investing in a market with depressed valuations, the likes of which we are seeing today.