Thursday Mar 05, 2026

Thursday Mar 05, 2026

Friday, 22 February 2019 00:00 - - {{hitsCtrl.values.hits}}

The following information is presented to the readers of this newspaper by the senior management of the Walkers CML Group with reference to the guest column by Tennekoon Rusiripala titled ‘Prudential banking and saga of MTD Walkers’. “The following is a factually accurate and widely known, and easily overlooked, account of a pioneer in the Sri Lankan construction and infrastructure industry, MTD Walkers PLC (Walkers CML Group). The information is presented with the intention of fostering an environment where factually sound and objective dissemination of information is encouraged, with particular reference to how the company, and the company’s stakeholders, are overcoming current obstacles,” the group noted. Following is the statement:

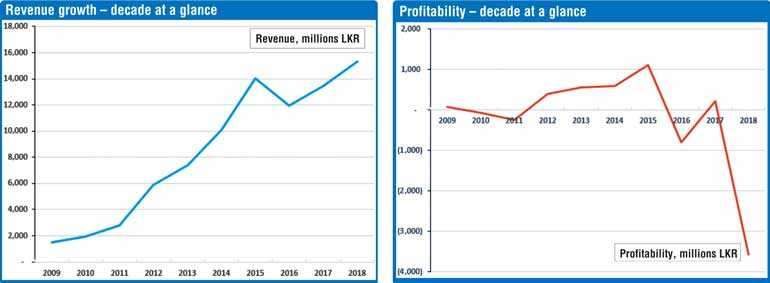

Over the course of the past eight months, in line with onset of some loud, partisan, and inflammatory reporting on our company, the senior management of the Walkers CML Group has remained united and entirely focused on realigning the company and its operations in order to fulfil commitments and continue business as Sri Lanka’s seventh oldest company.In order to begin digesting this information, we must delve into the recent past of the Walkers CML group to see the overall picture of where this company came from, how it became one of the leading contractors in the country and how it plans to survive through current macroeconomic turmoil and continue building and reshaping Sri Lanka’s infrastructure.

The group has continually maintained a clear and defined organisational structure where each of the Group’s segmented verticals were run by qualified, competent and dedicated CEOs, while the Group’s largest subsidiary, CML MTD Construction Ltd., was run by three Executive Directors who were actively involved in all day-to-day operations

During this period the Group continued to set industry trends for project financing, win awards for financial reporting (gold award for Annual Report 2015/16), win awards for HR practices (Gold award at People Development Award 2014, 2015, 2016, and 2017), engage in major CSR projects, win awards for construction excellence and maintain the highest grading in multiple sectors for construction activities awarded in Sri Lanka (CS2 Grading)

Towards the tail end of financial year 2014/2015, the group made a decision to take active measures to limit dependence on large scale government infrastructure related projects for survival and expand operations to include other specialised fields in engineering – a shift which was made known to all stakeholders through the Executive Deputy Chairman’s message carried in annual report 2015/2016 and a shift that was welcomed as a move to ensure the company’s growth in coming years.Keeping in line with the shift to diversify operations, and following a detailed market survey and study lead by globally recognised consultants, the Walkers CML Group invested considerably in the heavy engineering sector through a Rs. 4 billion investment in Walkers Colombo Shipyard. This was the only shipyard commissioned since the opening of the Colombo Port under the British – a much-needed infrastructural capacity to guide the Colombo Port along the trajectory being built for it through the major developments in the surrounding area. How could Colombo attract cargo ships, container carriers, luxury yachts and commercial cruise liners if there was a fundamental absence of repair capacity – a requirement to maintain credentials needed to continue sailing on international shipping channels? While this line of thinking may not come to most of us, this is exactly the type of detail which was looked into through detailed consultations with global experts and it is the exact type of detail which was analysed by lenders prior to backing such a pioneering effort.

It should also be noted that the shipyard project commissioned by Walkers CML qualified for funding through the Asia Development Bank (ADB) after the entire group was examined through a stringent series of due diligence exercises including legal, technical, market study and financial.

Further expansions were done in real estate sector where the Walkers CML group remains the only company to successfully implement an apartment styled housing project outside Colombo with over 500 units – all built through internally generated funds and zero borrowings. Furthermore, investments nearing Rs. 2 billion were made to secure approximately 800 perches of prime real estate around the country as investment in the company’s land bank. These investments were funded through a mix of internally generated funds as well as bank facilities secured through proper evaluation of intended projects and the market’s appetite.As commonly seen throughout South Asian countries, whenever there is a major change in political leadership, there is an immediate downturn in economic activities and nation building activities; Sri Lanka was no stranger to that norm and with the last major political change, the same slowdown was felt. This change occurred at a time when the Group’s order book was limited to a few high value projects for which personnel, equipment and resources were secured.

With the immediate change that came about, the Group was unable to deploy these resources as intended and more importantly was unable to secure the revenue streams which were to be generated through the deployment of those resources. Despite this pitfall, the Walkers CML Group remained resilient and very notably continued the employment of all staff (3,500+ employees) with the understanding that our illustrious history and excellence in engineering means nothing without our ability to care for our people.

With this temporary industry slowdown, there was a change in priorities and the business model for the infrastructure industry. The company did take longer than expected to identify this and realign itself and very notably miscalculated the ramifications of taking on too many small jobs which spread company resources too finely and prevented expected results being generated.

Having realised this erroneous approach, the company shifted focus to build an enviable order book to the tune of Rs. 60 billion, deliverable in 36 months (refer Daily FT article 26 June 2018), with a clear understanding of the intricacies of the gearing reflected in the company’s balance sheet. The company’s books will reflect a gearing of 70% which is widely regarded as highly geared; however considering the industry, and considering global best practices, it is not a cause for panic.

Two of the largest construction companies in the world, ACS of Spain and Hochtief of Germany, are geared at 87% and 82% respectively – this is a reflection of modern infrastructure sector funding where lending is based on project feasibility and not entirely on securitisation through collateral. This model is readily workable and deployable in Sri Lanka however, the recent spikes in lending rates makes is ever more challenging.Fortunately, the Group’s bankers were able to see beyond the surface and identify the need for this paradigm shift. Bankers understood that the traditional method of project financing where Government pays for all, would not take Sri Lanka to the next frontier. Bankers and Government welcomed initiatives from the Walkers CML Group to initiate BOT (Build Operate Transfer) and PPP (Private Public Partnership) models to finance large-scale infrastructure projects.

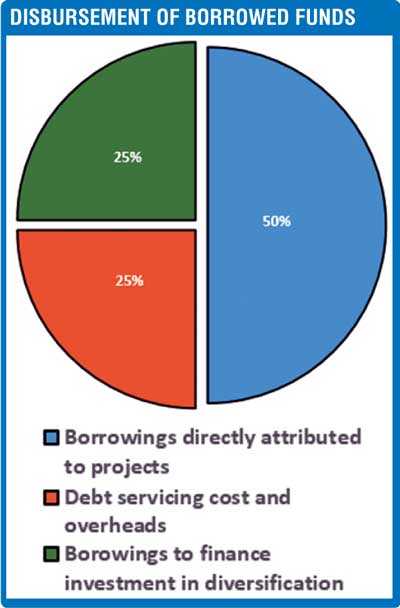

The borrowed funds were deployed directly into: project funding, diversification (shipyard and real estate), servicing the cost of delayed receivables from Government, servicing local borrowings with high interest rates and managing the impact of unforeseen rupee devaluation. Some of these funds were also used to maintain the company’s power generation sector – which has ceased operations over the past three years due purely to the malicious intent of others, adding a further Rs. 2 billion in loss of profit.

When evaluating the company’s position with the above information, the Group’s position can be summarised as a company pushing 15 billion in revenue with funding facilities segmented into: direct project funding (50%), diversification (25%) and in debt servicing and overheads (25%) – all very generic sans anything extraordinary.

The Group was adamant to actively reduce debt, the possibility of a rights issue and private placement were discussed at Board level with detailed study and evaluation. Investment banks were engaged to advise on possible strategies to reduce debt and even identify investors; NDB Investment Bank, CAL and CTCSLA together with Commercial Bank of Ceylon, were all consulted and mandated at various points over the recent past.Through these initiatives, the Group has competed over 3,500 apartments for the Urban Regeneration Program under the Urban Development Authority, five major water treatment and distribution projects, and approximately 400Km of highways and roads in the past five years (including greenfield projects and a part of the Island’s first expressway), and brought stable power to the Northern peninsula at the height of the civil conflict. The debenture issued in 2015 was another initiative to reduce debt by opting for cheaper borrowings to fund projects. All major commercial banks in the Island subscribed to the debenture given their intricate understanding of the projects at hand and the intended disbursement. The need to make a part settlement and defer balance for a later date was indeed done due to severe cash constraints but was done through all proper channels with subscribers’ understanding and is within the debenture covenant.

Banks, today, are run by some of the most lateral thinking and brilliant minds Sri Lanka has to offer. Undermining their efforts to sustain the operations of a 165-year-old company by veiling those efforts as “falling prey” is not only insulting to the banking institutions but more importantly highlights a fundamental disconnect in the understanding of the topic in discussion coupled with a nauseating and distasteful need to sensationalise. The management of the Walkers CML Group has no reason to ponder “getting away scot-free”; the management of the Walkers CML Group has been liaising with banks, creditors and stakeholders over the past eight months without shying away and has only continued to work in good faith to pave the way through which these obstacles can be overcome so that all obligations can be met and projects be implemented.

Hindsight is 20:20 and the management does not intend to recluse itself from poor decisions and bad calls but must note: insinuation that the recent difficulties faced by the Walkers CML Group is unique only to the group (refer related article on Daily FT front page article 31 January 2019) and that it is due to, general malpractice, and wanton disregard is nothing short of vitriolic diatribe and contributes nothing to readers of this newspaper.

With regard to there being a “gross violation of regulatory requirement” on the part of any of the Walkers CML Group’s bankers – this notion is again riddled with a fundamental misunderstanding of high-level banking procedures and what seems to be an intentional mischaracterisation of the matter at hand.

The management makes no attempt to trivialise the company’s current situation, it is critical but it is also one that can be overcome. Animadversion from media based on information taken out of context has not only added further burden on the company but is also irresponsible and causes unwarranted panic in industry – which can lead to a domino effect. Thankfully, we continue to have banking leaders who are capable of accurately dissecting critical situations to ensure the best and most reasoned out course of action is followed in the interest of a customer.

This is what prudent bankers with the correct experience and training do – evaluate a company’s projects together with its management and deliberate on the lending potential and risks involved. While it may result in a far more newsworthy story, prudent bankers do not allow themselves to be influenced or coerced nor do they collude, certainly not to give unfair advantages while jeopardising their own institutions. It is imperative that any misrepresentation on the prudency and detail oriented nature of bankers be dispelled.

The boards of all lending institutions have deduced, through detailed deliberation and proper nonaligned evaluation, that the relevant companies under the Walkers CML Group are worthy of running on debt – hence the lending. The same institutions, through a keen understanding of the business model, understood the group’s potential and shift to project based lending (as opposed to collateral based lending) and invested in the company’s debentures – this merely reaffirms the trust and confidence placed in the company and indeed the lending institution’s understanding of the overall business model.The management would also like to note that the figures published in the article, with particular reference to bank lending, are grossly inaccurate– an inaccuracy which has been publicly noted and corrected (refer page 7, Daily FT 20 February 2019).

Transferring a limited understanding of a complex and diverse set of affairs of a group of companies which has stood the test of time and been an icon of the Sri Lankan infrastructure industry is careless and prejudicial. As a company, the management of Walkers CML looks forward to better times to come in the immediate future and also look forward to more informative and less theatrical editorials, be it about the Walkers CML Group or any other topic.The management of the Walkers CML Group does not wish to further deliberate on the repeated references and insinuations against Jehan Amaratunga who is currently the company’s Deputy Chairman. We understand that this matter has been addressed previously by the relevant authorities and adequately answered and as such the senior management does not understand why this matter is raised over and over again.