Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Tuesday, 19 November 2019 00:00 - - {{hitsCtrl.values.hits}}

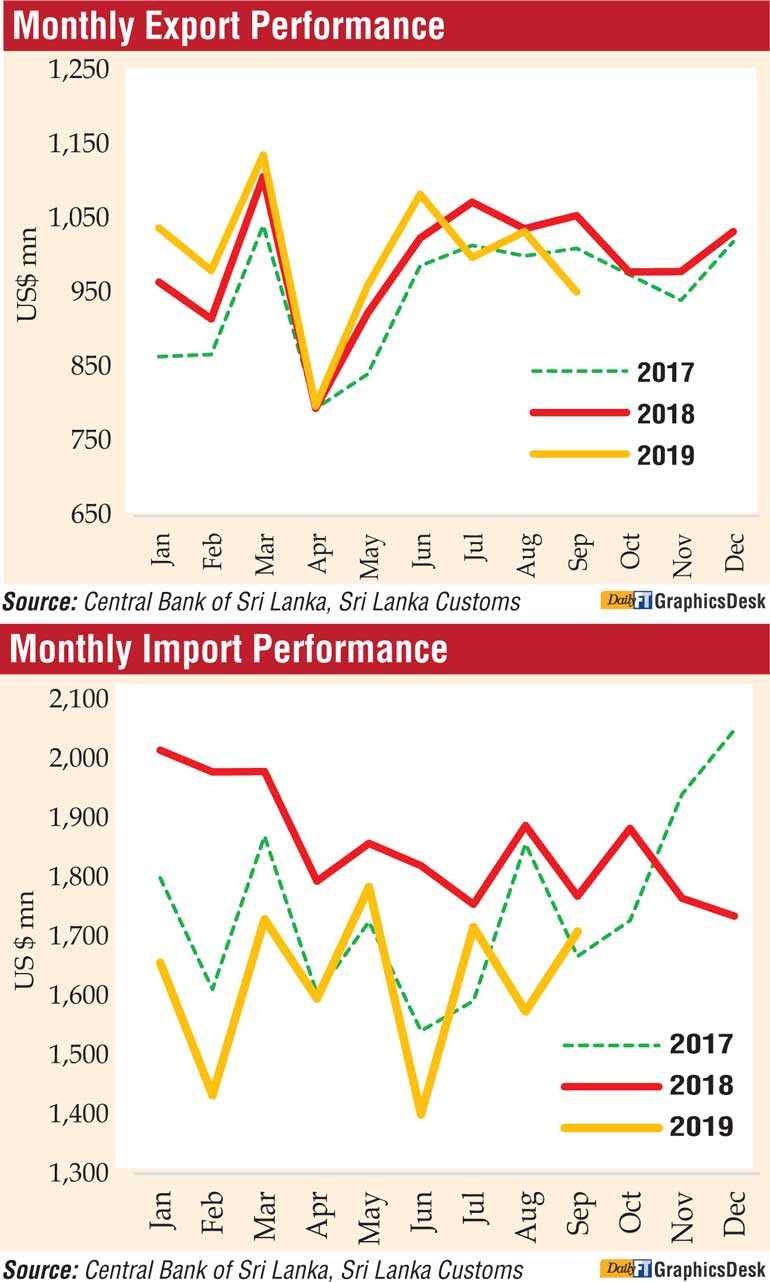

Exports only grew by 1% during the first nine months of 2019, recording $ 8.9 billion when compared with the $ 8.8 billion for the same period last year, but the latest Central Bank external performance report also showed that slow exports, coupled with 11 months of declining imports, had shrunk the trade deficit by $ 2.3 billion.

Exports in September only grew by 1.7%. The deficit in the trade account widened in September 2019 to $ 758 million, in comparison to $ 713 million in September 2018. However, on a cumulative basis, the trade deficit contracted by $ 2,341 million to $ 5,613 million during the first nine months of 2019, in comparison to $ 7,953 million for the corresponding period of 2018.

Meanwhile, the terms of trade, which represent the relative price of imports in terms of exports, deteriorated by 2.5% year-on-year as export prices reduced at a faster pace than the reduction in import prices. Cumulatively, the terms of trade deteriorated by 0.4% during the first nine months of 2019 in comparison to the corresponding period of 2018.

Earnings from merchandise exports declined notably by 9.8% year-on-year to $ 952 million in September 2019, as a result of the decline in exports in all three major sectors. Earnings from textiles and garments declined for the first time since July 2018, on a year-on-year basis, led by a notable decline of 13.9% in garment exports to the US owing to the base effect, despite a 3.2% growth in exports to the EU market. Export earnings from petroleum products continued the declining trend observed over the recent past, mainly due to lower exports of aviation fuel owing to subdued airline activities in Sri Lanka after the Easter Sunday attacks.

In addition, led by lower exports of footwear, export earnings from leather, travel goods and footwear declined, while earnings from rubber products declined due to lower tyre exports. However, earnings from gems, diamonds and jewellery exports increased.

Earnings from agricultural exports declined in September 2019, contributed by lower earnings from all subcategories except vegetables and minor agricultural products. Earnings from tea exports declined in September 2019 due to the combined effect of lower export volumes and average export prices in line with the fall in prices in international markets.

In addition, earnings from spices declined, mainly due to lower export volumes of cinnamon and pepper, while seafood exports declined with lower export volumes broadly in line with seasonality. However, earnings from vegetables and minor agricultural products increased, driven by fresh vegetables, fruits and edible nuts exports.

Earnings from mineral exports also declined in September 2019, year-on-year, due to subdued performance in all subcategories.

The export volume index in September 2019 decreased by 1.7% year-on-year, while the export unit value index declined by 8.2%. Accordingly, both volume and unit value contributed to the subdued performance of exports during the month.

Expenditure on merchandise imports contracted for the 11th consecutive month with a 3.3% decline year-on-year in September 2019 to $ 1,711 million, driven by lower consumer goods and intermediate goods imports.

While food and beverages imports increased marginally, a decline in expenditure on consumer goods imports in September 2019 was observed as a result of the decline in nonfood consumer goods imports. Import expenditure on personal motor vehicles declined in September 2019, on a year-on-year basis. However, in absolute terms, motor vehicle imports remained at a relatively high level since July 2019 compared to the values recorded during December 2018 through June 2019, mainly reflecting the impact of personal motor vehicle imports under concessionary permits.

Meanwhile, expenditure on food and beverages imports increased, mainly driven by imports of potatoes categorised under vegetables, where higher volumes were imported as a result of lower domestic supply.

Expenditure on imports of intermediate goods declined in September 2019, mainly due to lower expenditure on fuel, owing to lower prices as well as lower volumes of refined petroleum products. In addition, expenditure on base metal imports declined in September 2019, driven by lower iron and steel imports. However, import expenditure on textiles and textile articles and mineral products increased, with higher fabric imports and cement clinker imports, respectively.

Meanwhile, expenditure on investment goods imports increased in September 2019, led by the increase in all subcategories. Accordingly, expenditure on machinery and equipment, mainly related to electric motors and generators, increased, while expenditure on transport equipment increased with higher imports of railway equipment and commercial vehicles such as tankers and bowsers, buses and commercial cabs.

In addition, expenditure on building materials increased, driven by articles of iron and steel related to bridges and bridge sections.

The import volume index increased by 2.8% while the unit value index dropped by 5.9% in September 2019, indicating that the decline in imports was driven entirely by lower prices when compared to September 2018.

Foreign investment in rupee denominated government securities recorded a net outflow of $ 7 million in September 2019. On a cumulative basis, net outflows from the government securities market amounted to $ 291 million during the first nine months of the year.

Foreign investment in the CSE, including primary and secondary market transactions, recorded a net outflow of $ 7 million during September 2019. Nevertheless, financial flows to the CSE recorded a net inflow of $ 15 million during the first nine months of 2019.

Further, long-term loans to the Government recorded a net outflow of $ 137 million during September 2019.