Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 8 July 2019 00:00 - - {{hitsCtrl.values.hits}}

Sri Lanka is facing economic headwinds with a slowdown in GDP growth rate, depreciation of the rupee, changes in weather patterns, policy reforms and weak investor sentiment amidst the slow recovery from the recent unfortunate events on 4/21.

Despite the difficult and volatile economic backdrop, opportunities exist to create business and economic value. “Business leaders will have to remain strategically focused and be flexible and agile enough to diversify exposure where necessary,” says PwC Sri Lanka Partner/Advisory Leader Channa Manoharan.

With PwC’s experience working in both developed and emerging markets across 158 countries that have undergone similar economic resurgence and turned around their economies, PwC offers three critical strategies for Sri Lankan companies to stay ahead of the curve.

Venturing to overseas markets to diversify exposure

An impressive number of Sri Lankan businesses have strong brands and unique capabilities which would be in demand globally, if these companies are ready to venture beyond Sri Lanka. During times of economic pressures locally, overseas expansions will not just provide the companies better opportunities to weather difficulties in the domestic markets, but it will also help strengthen Sri Lanka’s position on the global map.

Some of Sri Lankan companies have seen nearby emerging markets in the South Asian region mainly as production bases like the apparel industry. Now, many companies see these countries as consumer markets, as recently discovered by some local confectionery and FMCG companies targeting countries like Bangladesh, Myanmar and Indonesia. Increasingly, companies in the power sector have been expanding to Africa for these same reasons. PwC has seen a steep upsurge in the number of enquiries from local companies seeking help with overseas expansion. The growing ‘outbound’ business illustrates the growing appetite on the part of local companies to explore the opportunities outside of Sri Lanka.

There are several examples of Sri Lankan companies in financial services, power and leisure sectors that have successfully expanded regionally in order to capitalise on scale benefits from larger markets, taking advantage of the low cost of production, favourable trade concessions and ultimately diversify country risks.

Contrary to popular belief, overseas expansion doesn’t have to be capital-intensive, as companies can make use of multiple cost-effective strategies such as joint ventures, strategic alliances, franchising and licensing to globalise its business presence in regional markets. Value accretive acquisitions/partnerships in overseas markets with less volatility will provide faster growth opportunities for businesses in Sri Lanka.

Focus on core competencies; why more isn't always better

As markets and businesses evolve, many owners and business leaders find that adjustments need to be made. Often this can involve selling all or part of a business that no longer performs to its potential, or no longer fits the strategic vision. Making these tough decisions are a sign of strong management and active ownership.

“Non-core assets develop in many contexts and are common in Sri Lanka. These could be in the form of non-performing loan portfolios for banks, branch networks, or entire subsidiaries of corporations, for example, or even real estate portfolios, or parts of conglomerate businesses that have evolved over time and now need to be rationalised. Relying on core strength and competitive advantage is key during times of uncertainty,” says PwC Mergers and Acquisitions Associate Director Kavinda Weerakoon.

Selling off non-core assets will enable a company to raise funds to support its core business at a time where cash flow, credit position, liquidity and more financial and economic factors may be adversely affected.

From PwC’s experience, divesting a business successfully can take a long period, sometimes a few years, from initial idea, through planning and preparation for the sale, through closing of transaction. PwC Sri Lanka recently assisted a large diversified multinational, focus on its core business by divesting non-core assets that did not contribute to its long term growth strategy in Sri Lanka. The multinational also benefited by freeing up management time and reducing overall business complexity.

Grow technological capabilities and thereby become resilient to new economic realities

Technology has transformed the way companies are doing business while impacting the day-to-day lives of individuals. However, despite many countries embracing the technological revolution for their long-term sustainability, Sri Lanka continues to backtrack and has failed to take the advantages of technology.

In this regard, many local companies are well below the curve in terms of digital adoption according to a World Bank study, where Sri Lanka was ranked at 130 out of 183 countries in 2016. The failure by local companies to embrace modern technology is also resulting in these companies falling behind in terms of profit.

According to a Harvard Business Review research, companies which embraced modern technology reported 18% higher gross margins and 4% higher net income margins than companies which lagged in adoption primarily due to improved efficiencies and data-driven decision-making.

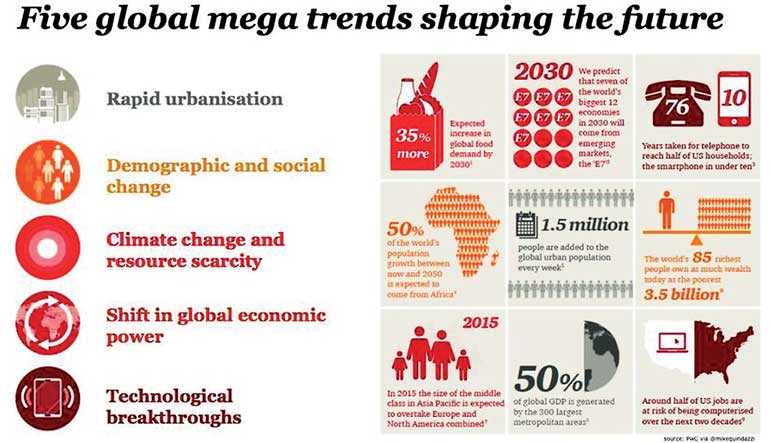

PwC has identified technological breakthroughs as one of five Megatrends which are reshaping the world. According to PwC’s Global CEO survey, 51% of CEOs are now making significant changes on how they use technology to assess and deliver on wider stakeholder expectations. Learn more about the megatrends on www.pwc.lk/issues/megatrends.html.

Sri Lankan businesses have the potential of leapfrogging into technologies such as Blockchain, machine learning and Artificial Intelligence (AI), which can play an important role in improving efficiency of production processes, building customer engagement tools and assist develop globally competitive businesses. These coupled with a focus on Sri Lanka’s unique strengths like access to world-class talent and its geo-strategic location, we are hopeful that the country can emerge stronger from these challenges than ever before.

With offices in 158 countries and more than 250,000 people, PwC is among the leading professional services networks in the world, working together to build trust in society and solve important problems. PwC helps organisations and individuals create the value they’re looking for, by delivering quality in assurance, tax and advisory services.

PwC’s Mergers and Acquisitions team helps companies originate, create, execute, and realise value from deals. Through data driven insights, PwC helps businesses realise the potential of their mergers, acquisitions and divestitures and capital markets transactions.