Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 26 August 2020 00:38 - - {{hitsCtrl.values.hits}}

BOI Director General Sanjaya Mohottala - Pic by Lasantha Kumara

By Charumini de Silva

The Board of Investment (BOI) has started implementing a comprehensive roadmap to redefine Sri Lanka as a multi-billion dollar industry-conducive destination by 2025.

The comprehensive strategy is focused on prioritised sectors, with a structured approach to attract target-oriented foreign direct investments (FDIs) and to spur economic growth.

“Sri Lanka can leap forward to a knowledge and investment-driven economy. For this, we need a comprehensive strategy to transform the economic landscape and a conducive investment climate. On our part, to attract more investments, the BOI has to reimagine the approach,” BOI Director General Sanjaya Mohottala told the Daily FT in an exclusive interview.

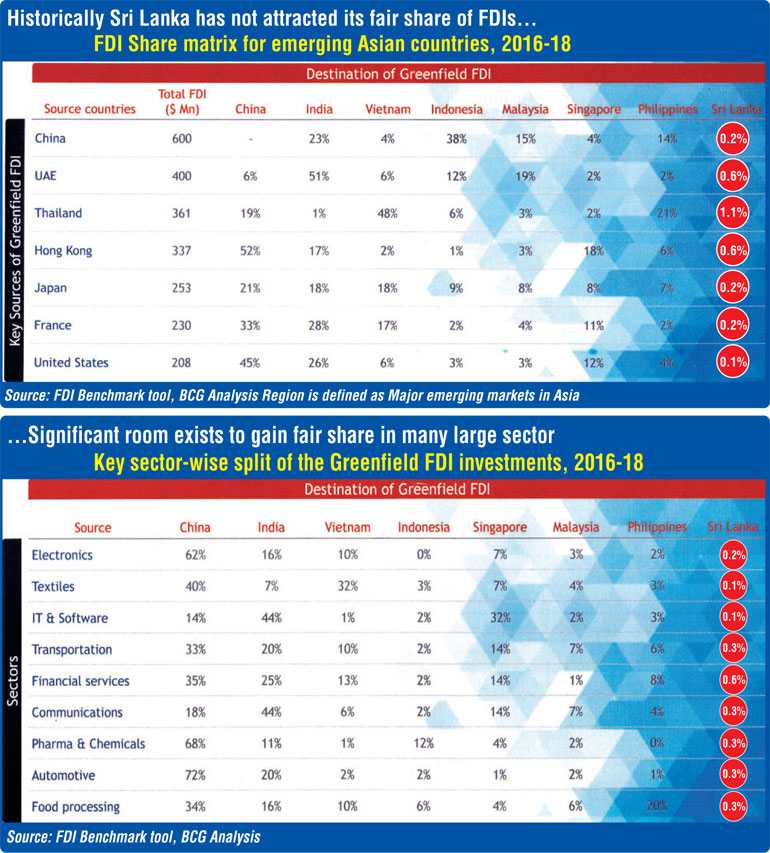

“Historically, Sri Lanka has not attracted its fair share of FDIs. Despite global challenges, there is significant room to enhance foreign investments in many sectors,” he emphasised.

It was in this context that the BOI has developed a comprehensive new roadmap, clearly identifying the country’s progress in terms of attracting FDIs to date, what sectors that can attract the most FDIs, and what policies and actions are needed to maximise potential. To achieve the Government’s Vision 2025, export diversification is a critical thrust, and for this to be a success, attracting FDIs is key, the BOI DG emphasised.

Mohottala said the new strategy has prioritised five broad sectors — manufacturing (electronics and electrical, expanding value addition in apparel and pharmaceuticals), ICT (software development, BPM/KPM, IT training/education, and emerging technologies); hospitality and tourism (MICE tourism, adventure tourism, wellness and eco-tourism); agriculture and food processing (rubber, agri/processed foods and fisheries), and construction and infrastructure (rapid transit, ports, and airports).

Additionally, BOI will be identifying high potential sub-sectors under these five broad areas. For example, within the pharmaceuticals sub-sector will be biopharmaceuticals, injectables, APIs, neutraceuticals, etc.

According to the BOI, four critical prerequisites to enhance FDIs are: a favourable market environment that includes attractive markets with socio-political stability and strong industry clusters; supportive legal and regulatory framework – strong fiscal, financial and regulatory incentives and a stable regulatory regime; labour force – availability of skilled labour force at competitive cost; and enabling factors – availability of well-developed infrastructure and strong investment promotion agency.

Way forward for creating a compelling investment climate

In its roadmap, the BOI has identified key challenges under each pre-requisite, what needs to be resolved through multi-agency involvement, and by when. This exercise makes the roadmap very practical and action-oriented.

In terms of stable Government policy, a key requirement to ensure a compelling investment climate, existing challenges include inconsistent policies, with ad-hoc changes impacting investor confidence. For this, BOI DG Mohottala said the formulation of consistent long-term investment policies is needed to ensure predictability for investors.

Another challenge is the limited export basket, and to address this, BOI has identified five broad sectors, referred earlier, for export diversification. High import dependence on raw material, especially for apparel and rubber, is another challenge, and it is being addressed via the establishment of a textile zone in Eravur, a dedicated pharma zone in Hambantota, and increasing rubber production with public private partnerships to reach 200,000 tons.

Setting up of five or more specialised or sector-specific industrial zones will enhance the concept of dynamic industry clusters. At present, existing industrial zones are 95% utilised, and the very few unutilised zonal lands and limited number of new zones have been constraints in the past.

Advanced and integrated infrastructure with improved access to potential lands is also critical towards creating a compelling investment climate, and this is being resolved with the on-going new highways and expressways, whilst investments into rapid transit and the existing rail network will improve public transportation.

In terms of land, introduction of a summary process with regards to land acquisitions for BOI projects has been recommended, as well as enabling BOI projects to construct and operate with BOI authority within designated areas without incumbents.

To enhance market access, BOI has suggested it must have additional Free Trade Agreements (FTAs) with key economies – China, Japan, EU, UK, and the US.

BOI has also identified that the time-consuming line agency approval process is a deterrent to attract investments, hence the importance of establishing a one-stop-shop within the BOI to grant approvals within a stipulated time period, with line agency participation, is being pursued. A step improvement in Sri Lanka’s ranking in the Ease of Doing Business Index is another stimulant to woo more investors, and BOI believes streamlining procedures with digitisation is the way forward.

Ensuring an educated and skilled workforce is another key factor to ensure a compelling investment climate. At present, the lack of a specialised workforce to cater to emerging industries is a big issue, especially for the ICT sector. According to the BOI, State universities produce only 26,000 graduates per annum, and 15,000 graduates are produced from private universities and external degree programs.

On the other hand, existing vocational training institutes cater to 130,000 students. However, at present, there is a major skill demand and supply gap, in addition to evolving technical skills needed across various sectors.

BOI believes workforce constraints can be mitigated by increasing the output of graduates pursuing major disciplines, and up-skilling and re-skilling other graduates. The desired goal in the medium term is to increase ICT graduates from the existing figure to 25,000; Engineering and Science graduates to 10,000; Agriculture graduates up to 1,000; Chemistry graduates to 500; and Management graduates from 6,000 to 10,000.

This could be achieved by establishing at least several additional private universities offering programs in specialised areas, especially in ICT and Engineering, and increasing the graduate output from Government universities. Increasing the number of students passing out and being reskilled from vocational training institutes by 1.5 times is another suggestion.

Apart from reviewing existing labour laws, BOI has mooted the establishment of a National Fund to finance the private sector for up-skilling the workforce. Since foreign investors have complained about complicated procedure for getting work/occupational visas, the need to establish a structured visa program without hindering local talent has been mooted.

The BOI roadmap has also taken into cognizance the issue of low women’s participation in the labour force, for which solutions include training and creating a conducive and flexible environment for women to work. The uneven geographical distribution of industries is another reason for low women’s participation, and among recommendations are increasing women’s participation in the labour force from 35% to 50% through the development of industry and agri strategies.

Need for BOI 2.0

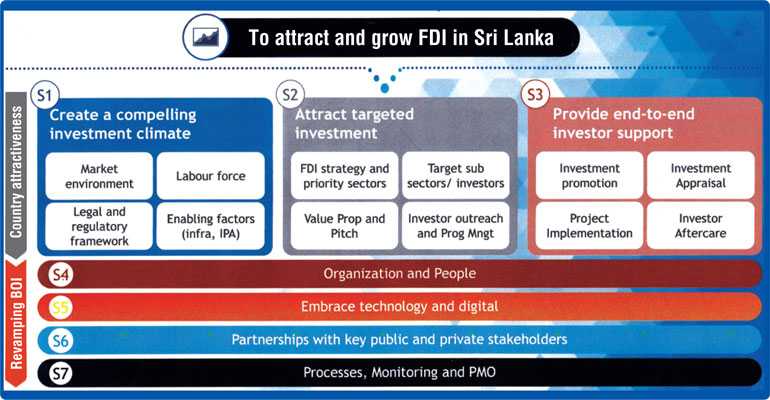

In fulfilling the need for a reimagined approach by the BOI, the first step is the new roadmap developed, which has defined the FDI strategy and prioritised sectors, along with sub-sectors and identifying anchor or catalyst investors.

In proposing a “BOI 2.0”, the strategy document recommends a new BOI Act and a fresh investment law for effective realisation of the objectives of the roadmap. Introduction of carefully-crafted, sector-specific tax incentives to compete with peer countries and, a simplified tax structure, are some of the other recommendations.

BOI is also focused on developing specific value propositions to prospective investors, and conducting a targeted multipronged investor outreach program. Additionally, the BOI will be focused on areas such as providing end-to-end investor support, organisation, and people, embracing technology and digital, enhancing partnerships with key public and private stakeholders, and improving process, monitoring and project management capabilities.

Noting that investor outreach, program management, enhanced investor facilitation, and after care have been identified as areas for improvement in the new roadmap, Mohottala stressed transparency in investment policies, regulations, and accessibility are also taken into consideration in the move to proactive and structured approach to target investments.

“Many countries have been highly successful at growing investment inflows through targeted FDI strategies. It is also important to have target sub-sectors and 1,000 high potential companies across priority sectors. Developing clear value propositions and creating a high-impact investment discussions -with private sector participation - and a multi-pronged approach are key factors,” Mohottala emphasised.

“We have identified high potential sub-sectors and are in the process of targeting companies for outreach. There are seven key channels used for outreach, which include: direct reach-out to stakeholders, leverage on existing and trade platforms, hosting in-country roadshows and visits, setup investment corridors, direct reach out to network of expatriates, connect with trade agencies and consulates and leveraging public relations,” he said.

The BOI DG believes Sri Lanka has a unique opportunity to expand value chain and high-end products in the apparel sector in particular, as compared to global peers. In that context, he said the Eravur Fabric Park will contribute significantly going forward.

The BOI has also recognised electronics as a new sector that could attract long-term FDIs under the manufacturing category. “Overall, Sri Lanka can be competitive in the sector. However, we cannot be complacent, and must focus as needed on vocational training, and improve labour productivity. We must also look at improving investor attractiveness, by introducing incentives on exports as well as domestic manufacturing, and reduce tariff barriers in high impact sectors,” the DG said. Sub sectors within electronics and electrical include sensors and switches, IOT devices, printed circuit boards (PCBs), electrical panel boards, and mobile phones etc.

Game-changers

According to Mohottala, the ICT, hospitality and tourism, and rubber sectors have been identified as “game-changers” in the new roadmap.

The ICT sector has a vision to enhance its earnings from $ 1.2 billion to $ 3 billion by 2025, while increasing employment opportunities from the current 100,000 to 300,000.

“The National Export Strategy (NES) has already initiated key actions in the ICT sector by creating an enabling environment for fostering IP creation, implementing a country branding program focused on growing champion firms and the overall industry, improving supply of skilled, highly qualified professionals to satisfy the growing IT-BPM market growth, attracting new contracts and investments to grow the industry, establishing dedicated ICT research centres, and organising ‘Start-up in Sri Lanka’ campaign to facilitate return of members of the Sri Lankan diaspora and setting-up of IT companies,” he elaborated.

Pointing out that there are only a few IT parks, and all of them are currently concentrated in Colombo, the Director General said there are more needed in and around Colombo, as well as in key regions such as Gampaha, Kandy, Jaffna and the Southern Province.

With regard to the plan to support the hospitality and tourism industry, the BOI in discussion with line agencies has identified the need to develop new segments such as theme parks, entertainment, cruises, golf course resorts, and MICE, while further attracting investments in hotels. The goal is to increase the earnings from $ 3.6 billion in 2019 to $ 7 billion by 2025, and direct employment to over 600,000 from 400,000 currently.

BOI will support tourism-related initiatives that are already underway to improve connectivity to tourism experiences, improve conservation, preservation and management of natural and cultural assets, develop and implement a national learning and development framework to enhance and build capability, ensure focused destination development via transformative tourism projects (TTPs), and establish strategic partnerships with global media groups and identify brand champions.

For the rubber sector, through focus on sub-sectors such as solid tyres, pneumatic tyres, gloves and gaskets, the goal is to increase earnings from $ 0.9 billion to $ 1.8 billion by 2025.

Specific initiatives include promoting new smallholdings in non-traditional regions, accelerated replanting of end-of-economic life rubber farms with high yielding clones, setting up a network of certified district nurseries, establishment of a dedicated rubber industrial park known as “The Rubber City”, and refinements to current technological practices in rubber production.