Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 9 August 2017 00:00 - - {{hitsCtrl.values.hits}}

Lanka Ceramic Plc has announced a restructuring of operating assets of the company to give maximum value to shareholders and allow for capital to be raised at a reasonable cost to finance existing as well as future operations and to reflect the real net worth of the company based on growth potential.

Lanka Ceramic Plc has announced a restructuring of operating assets of the company to give maximum value to shareholders and allow for capital to be raised at a reasonable cost to finance existing as well as future operations and to reflect the real net worth of the company based on growth potential.

The board is of the view that the number of shares of the company is not in line with the capital needed by a company of its size and operation hence has recommended that the number of shares in issue be reduced by 80% to facilitate raising fresh capital at a price more reflective of the intrinsic value of its own operation.

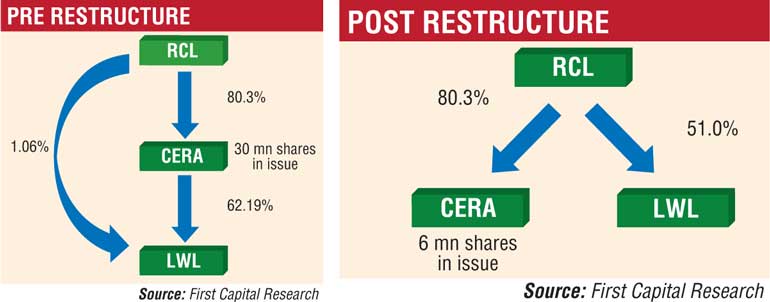

The proposed restructuring of operating assets (excluding 62% stake in Lanka Walltiles Plc) will eventually lead to rationalisation of the shareholder structure in the group companies which also includes Royal Ceramics Plc.

The board has resolved that the company offer to repurchase 24 million issued voting ordinary shares (80%) out of 30 million in issue in the proportion of four shares out of every five held at Rs. 190 per share. Such considerations will be in the form of cash or offer to transfer 1.4148 ordinary shares of Lanka Walltiles Plc in respect of the entitlement of the shareholders as per the proportion proposed and in respect of the offer for repurchase of shares over and above the entitlement of additional shares of shareholders who do not accept the offer, the settlement of consideration to be by way of transfer of shares of Lanka Walltiles Plc (LWL) and not for cash.

The move is subject to shareholder approval for a Special Resolution at an EGM being received. This is because the transfer by the company by way of a consideration of 62% stake in LWL is a disposition of more than half by value of the assets of the company and is a transaction having the effect of substantially altering the nature of business carried out by the company - in this instance managing and holding investments in subsidiary companies, which is a major transaction.

If in the event that shareholders holding more than 5% shares request for a cash consideration instead of shares of LWL as consideration, Lanka Ceramic Directors have the discretion to not proceed with the repurchase of shares.

The resolution to repurchase is to be effective subject to there being no changes in the current regulations prior to the completion of the repurchase that may have an adverse impact on the expected value to be received by shareholders, thereby varying the value as a result of which the varied value may not be considered the ‘fair value’.

The proposed restructuring is also subject to the approval of the Securities and Exchange Commission for the transfer of shares of LWL from the company to the shareholders accepting the offer.

Currently, Royal Ceramics holds 24 million shares of Lanka Ceramics which results in RCL obtaining 27,846,293 shares of LWL in consideration of the share repurchase by Lanka Ceramics. This move will result in RCL holding 51% stake of LWL, making RCL the parent of LWL. RCL will hold 4.8 million shares in Lanka Ceramics post-restructure, thereby continuing to hold an 80.3% stake in the entity.