Thursday Feb 26, 2026

Thursday Feb 26, 2026

Wednesday, 9 August 2017 00:00 - - {{hitsCtrl.values.hits}}

FTAs are a global trend and all countries in the world are increasingly using them as an engine of trade-led growth. According to the World Bank, more than 50% of world trade is conducted under trade agreements. The fast growing South East Asian countries have an average of eight FTAs per each country. So, why some segments of the Sri Lankan society are opposing FTAs in general, and ETCA, in particular? Are there any rational behind such opposition?

FTAs are a global trend and all countries in the world are increasingly using them as an engine of trade-led growth. According to the World Bank, more than 50% of world trade is conducted under trade agreements. The fast growing South East Asian countries have an average of eight FTAs per each country. So, why some segments of the Sri Lankan society are opposing FTAs in general, and ETCA, in particular? Are there any rational behind such opposition?

Probably “ETCA” or Economic and Technology Cooperation Agreement was one of the top 10 most debated subjects which received the highest level of media attention in Sri Lanka during the last two years. People from all walks of life – from farmers and trishaw drivers to factory workers and then to doctors, architects, monks and politicians – most of the times without a clue of what it is, talk about it and point the finger at ETCA as the cause for many crises, failures or disasters in the country.

Those behind this unsubstantiated propaganda claim that it would destroy local jobs, industries, services and is beneficial only to India as in the case of the current FTA between two countries or India-Sri Lanka Free Trade Agreement (ISFTA), to which the current trade balance in favour of India has been attributed. However, the data show that 94% of imports from India came outside of ISFTA while Sri Lanka used preferences granted under ISFTA for 65% of its exports in 2015, indicating Sri Lanka benefited more from it than India.

Interestingly, this blame game is taking place while ETCA is still at a very early stage of drafting and negotiation. Whatever the motives behind this misinformation and misinterpretation of facts/figures, one has to make any rational judgment of its advantage to the country only on the basis of a proper study of costs and benefits of ETCA.

Contradicting most negative claims levelled against ETCA, available empirical research point to the evidence of potential benefits from it. According to a recent Commonwealth study, a full-fledged FTA with India will result in 74% increase in Sri Lankan exports to India. The study also identified 10 export products which could increase exports from $35 million to $655 million.

Another forthcoming study based on quantitative and qualitative research shows that a comprehensive deal covering all areas of cooperation including services, investment, and technology, could bring in more gains than from an agreement focusing only on one sector such as trade in goods. However, these benefits will highly depend on finding effective solutions to the outstanding issues of ISFTA, which were shown to be the major reasons for the poor performance in terms of utilisation of preferences granted under the FTA.

Amongst the major challenges, it is imperative to address implementing issues of ISFTA including non-tariff barriers related to  testing, inspection and certifying of Sri Lankan exports as well as issues of rules of origin and commencing as a parallel process along the negotiations on ETCA to remove quotas on major exports of Sri Lanka to India. While Mutual Recognition Agreements (MRAs) could play a powerful role in minimising or eliminating NTBs, to be more effective, such MRAs have to be backed by strong institutional and compliance mechanisms on the side of Sri Lanka.

testing, inspection and certifying of Sri Lankan exports as well as issues of rules of origin and commencing as a parallel process along the negotiations on ETCA to remove quotas on major exports of Sri Lanka to India. While Mutual Recognition Agreements (MRAs) could play a powerful role in minimising or eliminating NTBs, to be more effective, such MRAs have to be backed by strong institutional and compliance mechanisms on the side of Sri Lanka.

Second, Sri Lanka needs to make sure that the scope of the ETCA is adequately deepened, in particular, in terms of trade facilitation and widened to cove trade in services, investment, various aspects of technology cooperation, in addition to trade in goods. In respect of services, it is important to strategically to select service sectors for liberalisation keeping politically sensitive elements of Mode 4 of trade in services, in particular, movement of independent persons, outside ETCA until appropriate legal and regulatory structures are put in place.

Third, in view of outstanding economic asymmetry between two countries, Sri Lanka should seek a special and differential treatment in terms of a larger negative list, favourable rules of origin and a longer period of phasing out of tariffs as was in the case of ISFTA.

Fourth, on the domestic side, it is important to educate and raise awareness of customs officials on and the business sector on the concessions available under FTAs, facilitate testing, inspection and certification, create awareness of standards and regulatory requirements in importing countries including India among Sri Lankan exporters, and establish Help/Information Desks at borders that can address trade facilitation issues in a timely manner.

Fifth, in order to benefit from the market access opportunities of ETCA, Sri Lanka should produce what trading partners demand. It has been pointed out by Indian counterparts that Sri Lanka has utilised only around 50% of quotas given under ISFTA. While the size, as well as certain conditions of quotas, could easily be trade-restrictive leading to under-utilisation, this could also be due to supply side constraints in Sri Lanka, and hence, there is an urgent need to enhance the supply-side capacity of Sri Lankan exporters.

Finally, one cannot overemphasise the importance of securing the cooperation of civil society and partnership with business sector through consultation since it is people who will utilise ETCA and gain from it. It is important is to prepare the local business sector, particularly the SMEs to capture the huge market opportunities that would be created under ETCA. At the same time, business sector should work with the government to correct the misinformation and misinterpretations about the impact of ETCA on the economy and the society.

Multilateral trade negotiations are the first best mechanism to create market opportunities as the WTO promotes non-discriminatory, fair and equitable international trading system. Such a process would simultaneously open Sri Lanka’s and all its foreign markets, achieving the maximum benefits from trade, raising living standards and stimulating growth across the world.

Though the GATT/WTO led multilateral negotiations produced remarkable results over the last six decades, they usually take a long time as the whole membership is involved in the decision making process and the most recent round of negotiations is currently stalled. An important alternative course, actively pursued by all countries, is to engage in regional and bilateral trade agreements (RTAs and BTAs) as well as Comprehensive Economic Partnership Agreements (CEPAs).Though there are some costs associated with these agreements, they can be negotiated within a relatively shorter period of time because such deals take place among a few countries or between two countries.

As the Doha multilateral trade round has not been moving as expected, in a world of increasing protectionism, countries find no other alternative for seeking market access except to depend on regional and bilateral trade agreements. To date, 445 agreements have been notified to WTO while 279 are in force. After the FTA between Mongolia and Japan, now all WTO members have at least one FTA.

According to the World Bank and OECD data bases, trade agreements cover more than 50% of total world trade. There are 260 trade agreements in the Asia-Pacific region, of which 87% are categorised as FTAs. An interesting observation is that South East Asian countries record an average of 8 FTAs per country. In terms of the value of trade, 33% of region’s total world exports and 44% of region’s total world imports were under FTAs during 2012-2014 with wide variation among countries.

Most South-East and North-East countries (including Brunei, Myanmar, Lao PDR, Malaysia, Korea and Singapore) have conducted over 70% of their trade under FTAs during the same period while some smaller countries such as Mongolia, Marshal Islands, and Micronesia reported the least shares followed by Maldives, Bangladesh and Sri Lanka.

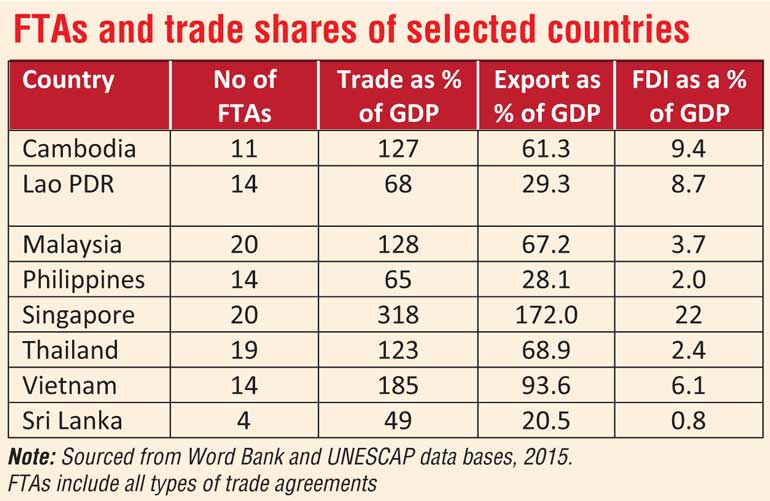

One interesting observation is that the fast-growing South-East and North-East countries have entered into a higher number of FTAs than the latter group of less advanced developing countries. The table shows clearly that the rapidly growing South East countries used FTAs as a major trade strategy and recorded higher trade/export contribution to GDP. Their FDI contribution to GDP is also high as they appeared to have benefited from the trade and FDI nexus.

In contrast, Sri Lanka which signed only four agreements has recorded remarkably lower trade and investment performance than all South East countries. In particular, it lags behind Cambodia, Lao PDR, and Vietnam which are treated as the less-advanced members of ASEAN and are classified by The United Nations either as economies in transition or least developed countries (LDCs).

Sri Lanka cannot afford to go behind the “boat” any longer. It is imperative for Sri Lanka to be better connected with the world taking a more strategic approach in future trade agreements, whilst addressing shortcomings in existing FTAs. There are a number of compelling reasons why Sri Lanka should follow this path:

Sri Lanka’s recent trade performance has been far from satisfactory, marked by a decline as a share of the country’s GDP as well as of world trade

Sri Lanka has lagged behind in pursuing FTAs, especially compared with countries in South and Southeast Asia, hence there is a need to catch up with the rest of the world

Both developed and developing countries are using FTAs as a major trade policy strategy for their trade-led growth. Like or not, Sri Lanka has to be part of this global phenomenon without being further isolated. FTAs are even more crucial for a trade dependent small country like Sri Lanka to go beyond domestic market and to achieve economies of scale.

In view of the changing dynamics of international trade, Sri Lanka should take advantage of the country’s location and low-cost connectivity with the rest of Asia, and establish a trade hub, a logistics hub, and a financial centre which are intrinsically interconnected, well-negotiated FTAs could play a critical role

FTAs could play a vital role in attracting FDI and integrating the Sri Lankan economy with global value chains

Realising the importance of integrating further with the rest of the world, Sri Lanka started negotiating FTAs with the Asian countries including China, India, and Singapore and intends to build similar trading partnerships with some selected countries in the West. Sri Lanka’s new policy direction to increase connectivity through FTAs is well justified not only in terms of its national objectives such as employment creation but also in view of growing popularity among both developed and developing countries to use such agreements as engines of growth and development.

In summary, one, Sri Lanka should use comprehensive economic partnerships agreements covering trade in goods, services, investment, and technology as a major strategy of its Export and FDI-led Development agenda, but some prioritisation based on analysis on costs and benefits is essential. Such a strategy should be part of a comprehensive trade development agenda and be in line with the New Trade Policy of the Government.

Two, the low or slow performing two bilateral and two regional agreements that Sri Lanka is a member demonstrate clearly that just singing a FTA is not sufficient at all for a country to capture benefits from such pacts. FTAs create only market access to foreign markets. In order to gain from such opportunities, Sri Lanka has to prepare domestic economy with enabling policies including tariff reforms, legislative and regulatory structures, trade logistics/facilitation, and in particular, producing what is demanded by foreign trading partners.

Three, international experience shows that a well-crafted negotiation strategy based on in-depth research with adequate domestic reforms and preparations could deliver expected results from such agreements.

(The writer is former Chief Economist and Director of Trade and Investment of United Nations ESCAP.)