Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 28 July 2017 00:00 - - {{hitsCtrl.values.hits}}

It was the continent that made headlines for all the wrong reasons: the great famine in Ethiopia and HIV pandemic in 1980s, the Rwandan genocide in 1990s, and the Somalian civil war in 2000’s grabbed headlines. By mid-2000 some of the African economies were on the brink, and sustained campaigning by international charities and global super stars compelled the G8 countries to write off nearly $40b of debt, providing much needed relief to 14 African countries.

It was the continent that made headlines for all the wrong reasons: the great famine in Ethiopia and HIV pandemic in 1980s, the Rwandan genocide in 1990s, and the Somalian civil war in 2000’s grabbed headlines. By mid-2000 some of the African economies were on the brink, and sustained campaigning by international charities and global super stars compelled the G8 countries to write off nearly $40b of debt, providing much needed relief to 14 African countries.

Nearly a decade after the financial crisis, Africa is viewed through a different lens by the world. As a company engaged in facilitating market entry for corporates as well as global investors, Stax is seeing renewed interest in African countries as of late. So, what has changed and what makes Africa hot?

In a world where the economic growth is sluggish, at best, and the aging population is rapidly increasing, we examine five factors that could help transform Africa from “problem child” to a “rising star”.

As a whole, Africa has become more peaceful and stable over the last decade. The level of armed conflict in Africa is lower now than any time since the 1970s. The World Health Organization reports that deaths through conflict in Africa declined by 95% between 2000 and 2012. This improved peace and stability is starting to reap economic benefits for the African nations.

In the 1990s, growth in Sub-Saharan Africa averaged roughly 2.0% a year, a slow rate by the standards of other developing economies. Between 2000 and 2007, Sub-Saharan Africa nearly tripled its growth rate to 6.0% a year. The combined GDP of African countries peaked at ~2.5B in 2014, but has since then seen a small dip due to weaker commodity prices and instability created within Arab Spring countries such as Egypt, Tunisia and Libya.

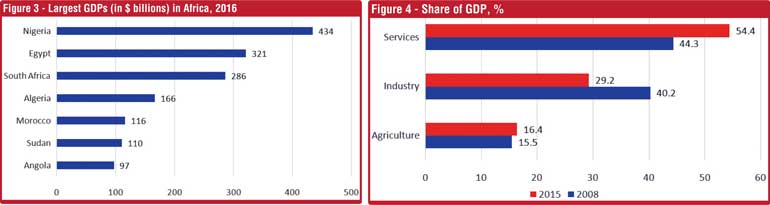

We analysed the average growth rate of African nations for the seven-year period between 2010 and 2016. Twenty-one countries out of the total 54 states, recorded an average growth rate of 5% or greater during this period. More than half of the 21 countries have a GDP per capita income below $1,000 (as per 2016 statistics), underscoring the low base that this growth had commenced from.

High growth African economies where 2016 GDP exceeds $10B, are shown in Figure 2. On one end of the spectrum, are countries such as Ethiopia that have consistently recorded double digit growth, but where per capita income is still well below $1,000. Gabon and Botswana with populations below 3M- recorded GDP per capita incomes exceeding $6,000, while maintaining average growth rates exceeding 5%. Most other countries recorded growth rates between 5-7%, with Kenya, Tanzania, Ghana and Congo recording GDPs greater than $40B.

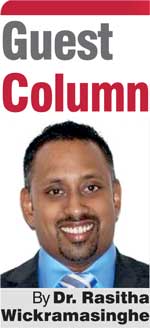

The larger African economies comprise of oil exporting countries such as Nigeria, Egypt and Algeria. The recent slump in oil prices has adversely affected these economies. Instability caused by the “Arab Spring” has also contributed to lower growth in Egypt. Despite being a member of the exclusive BRICS club, the South African economy has slowed significantly, recording an average growth rate of 2% over the last seven years. Despite these headwinds, the seven largest African economies (Figure 3), contributed nearly 70% of Africa’s total GDP of ~$2.3T during 2016.

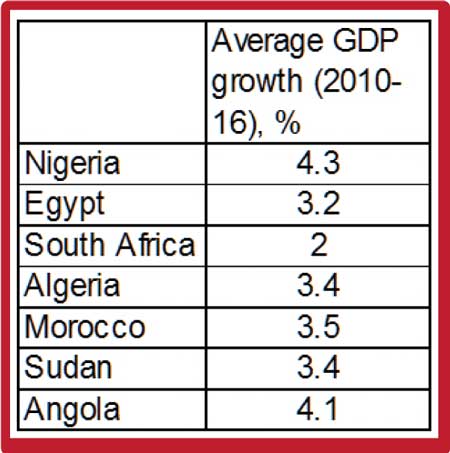

Figure 4 illustrates how the GDP share of the African economies (averaged across all 54 countries) has changed between 2008 and 2015. The share of the service sector has increased significantly at the expense of industrial output, while the contribution from agriculture has remained almost the same. A similar picture emerges amongst the 11 high growth economies shown above, where services account for ~52%, industrial output ~32% and agriculture contributes to ~16%, as per 2015 GDP data.

Most African nations have also improved their Ease of Doing Business Ranking over the last few years. As per 2016 index, Mauritius, Rwanda, Morocco, Botswana and South Africa take up the top five ranking of African nations. Out of these, Mauritius and Rwanda take up positions amongst the top 1/3 of the total 185 countries measured.

Rwanda is an example of an African nation that has made a remarkable improvement in its Ease of Doing Business Ranking. It jumped to 52nd place in 2012, from 158th in 2005 and has continued to maintain its spot amongst the top 1/3 in the world ranking and top three position amongst African countries. The Rwandan president is credited with “hacking” the Doing Business rankings in his intensely meticulous managerial style, breaking down the World Bank rating system, category by category, and taking necessary steps to improve on each criterion.

The combined population of Africa is ~1.2B today, and accounts for more than 15% of world’s population. Africa’s population is set to pass the 2B mark by 2050, doubling its population since 2010. Of the 2.37B increase in population expected worldwide by 2050, Africa alone will contribute 54%, according to United Nations projections. Nigeria is expected to add more people to the world’s population by 2050 than any other country.

Key dynamics contributing to this population growth in Africa are:

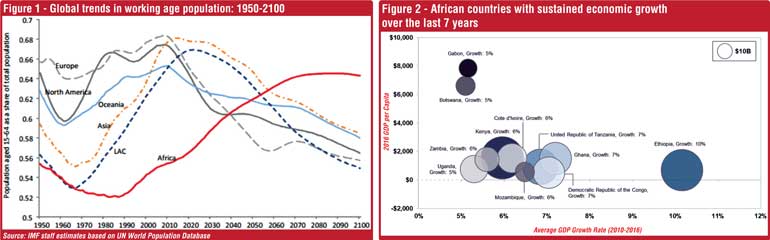

According to UN world population data, the working age population (aged between 15 to 64 years) as a share of the total population has already peaked in Europe, North America, Oceania and Asia regions. Latin America is forecasted to reach its peak by mid 2020s. However, Africa bucks this trend – its working age population as a share of the total population is set to continue to rise from its current 56%, all the way through to the next century. By 2060, Africa will have the highest share of working age population in the world – surpassing Latin America and Asia, whose working age population will continue to decline along with other continents.

French socialist thinker, Auguste Comte, stated that “Demography is destiny”. The post war baby boom helped drive growth in Europe and North America through the 1950s and 1960s. From the 1970s to 2000s, Asia enjoyed similar, population-driven gains making it the “World’s Factory”.

Interestingly, Asia and Latin America both witnessed a 20% increase in their working age populations between 1965 and 2010. Asia turned its population growth into a seven-fold increase in GDP per capita. However, Latin American managed only to double its GDP per capita. Recent research by the International Monetary Fund shows that poor policy and insufficient investment hindered Latin America’s ability to benefit from a growing population.

Two decades ago less than 30% of Africa’s population lived in urban areas. This has increased to ~40% today, and by 2025 the  majority of Africans will live in cities, with the urban population accounting for 52% of the total population.

majority of Africans will live in cities, with the urban population accounting for 52% of the total population.

The link between a country’s level of urbanisation and economic growth is well established. Big cities are epicentres of economic activity with large markets for businesses, and magnates for international investment and tourism from around the world. They are hubs of non-agricultural, high-paying professional jobs where per-capita income is significantly higher compared to rural populations.

According to the United Nations, in 2010 there were 50 urban clusters in Africa with a population of one million or more. Of these, three clusters had a population of five million or more. By 2025, the number of urban clusters in Africa is set to nearly double, reaching 93. Out of these, 12 clusters, are forecasted to have a population of five million or more.

According to a study carried by McKinsey Global Institute in 2012, 47% of global growth between 2010 and 2025 will come from 440 emerging cities. Out of this ‘Emerging-440”, Africa and Middle-East will contain 39 cities.

At Stax we believe ‘city strategies’ will drive future growth for both local and global companies. Therefore, a country prioritisation based on macro fundamentals, followed by a city strategy that identifies optimum entry points, are key tenets of successful market expansions.

The world’s economic power balance has started shifting eastwards over the last decade. As China emerges as an economic super power, its influence across the region also starts to grow. For example, its growing hunger to source and secure minerals and oils from Africa has seen a rapid increase in its investments and trade with the continent. China-Africa trade stood at $200B in 2015, twice as much as Africa-USA trade for the same period, and this is set to double to $400B by year 2020.

State-owned Chinese firms are venturing into Africa and other regions, building hard infrastructure such as ports, highways, railways and power stations. This enables Chinese companies to win business as local demand tapers, and exert political influence over emerging Africa.

China’s ‘no-strings attached’ investments have been labelled opportunistic and a new form of “colonialism” by some segments. Despite these accusations, China’s outbound direct investment (ODI) into Africa has remained below 5% of its overall ODI since 2012. The lion share of China’s ODI is increasingly funnelled to countries that are part of its One Belt One Road (OBOR) initiative, which includes Sri Lanka.

As Sri Lanka’s post-war economic resurgence transitions into long-term stability, local companies are increasingly looking at larger regional markets for future growth. Neighbouring South Asian nations (Bangladesh, Pakistan etc.), emerging Mekong valley economies (Cambodia, Myanmar, etc.) and African nations are popular destinations among Sri Lankan companies.

Mini-hydro power companies were among the early entrants of Sri Lankan companies into Africa as opportunities in the local market started to saturate. They were followed by construction, ICT, logistics and automotive companies.

In the ICT sector, hSenid, the largest Human Capital Management (HCM) solution in Sri Lanka, entered the African market more than 10 years ago when they successfully bid for a RFP in Tanzania with a local partner. According to Founder Chairman Dinesh Saparamadu: “Africa is a high growth market for us with clients in banking, insurance, telecom and NGO sectors. Today we have more than 60 corporate clients across 17 African countries for our HCM and mobile solutions.” hSenid opened their Africa office more than seven years ago in Nairobi, Kenya and uses that as a base to service rest of the African continent via direct and partner channels.

St. Theresa Industries (STI), a company that specialises in manufacturing of power distribution and transmission materials, is another company that has expanded into Africa over the last 4 years. In 2013, STI set up a factory with a local partner in Kenya to take advantage of the huge market potential due to limited rural electrification and distribution network.

Madusanka Fernando, Director of STI, said: “We were able to take advantage of the 2030 vision of the Kenyan government which promotes local manufacturing by providing exclusive rights to government contracts. To date, we have been successful in securing over $ 15 million worth of contracts from the public and private sector and are already looking to increase our footprint to Tanzania and Rwanda by the end of this year.”

He added: “It must be noted that Africa is a very challenging market to operate which requires a pragmatic approach with an appetite for risk.”

During 2017, apparel manufacturers Hela clothing and Hirdaramani group also established their manufacturing presence in Africa. As African economies continue to grow, more opportunities will open up in areas such as tourism, hospitality education and green energy. Service industries such as retail, banking and healthcare can also expand into Africa to take advantage of the growth in the services sector.

Despite the positive tailwinds blowing across the continent, a sound country and city strategy are a pre-requisite for success in Africa. Local nuances, infrastructure limitations, corruption, small wallet size of the consumer and loosely defined legal frameworks, are some of the challenges we have experienced working with our clients.

According to a Harvard Business Review (HBR) contributor, leapfrogging is rooted in the notion that infrastructure can be ‘hacked’. In other words, leapfrogging takes effect when entrepreneurial optimists spring into action, convinced that conventional infrastructure inadequacies won’t be addressed sufficiently in the near to mid-term.

For example, Africa’s lack of fixed telecom infrastructure was a boon for the growth of mobile telephony. As per ITU sources, Africa’s fixed line penetration in 2015 was a mere 2.2 per 100 inhabitants. In contrast, mobile subscriber penetration was as high as 83.3 per 100 inhabitants.

Sub-Saharan Africa is by far the least electrified continent, with half the continents population (estimated at 632 million people as per International Energy Agency) without basic energy. To put it into perspective, more than half the global population without electricity is in Africa, and Spain alone generates about as much electricity as the region’s 54 countries put together. After all, Africa is known as ‘the continent that has more mobile phones than light bulbs’.

In much the same way as in telecoms, Africa can jump straight into renewables and off-grid technologies, rather than developing more traditional fossil fuel based on-grid forms of power generation. For example, Trine, a Swedish energy company, has tried to make this a reality. Under its model, customers get use of solar kits to generate electricity, paying for the equipment in monthly instalments. Already, nearly 100,000 people across Kenya, Tanzania, Zambia, Senegal and Uganda have signed up.

The advent of mobile banking, led by Kenya and other East African nations over the last decade, is a homegrown invention that epitomises how Africa is leapfrogging the lack of physical infrastructure. Indeed, it demonstrates how advances in technology emanating from emerging markets actually find their way to advanced country markets later on.

There are several other leapfrog innovations emerging from Africa—examples include “ReadySet’, a portable solar-powered mobile phone charger invented by a venture backed startup, a triple-layered air- and water-tight crop storage bag (which provides extreme protection from moisture, pests, and high temperatures for a variety of crops) and the use of drones for the transportation of transfusion blood to overcome poor road and rail infrastructure.

Much is going right for Africa: increased peace and stability, a burgeoning population, the emergence of urban agglomerations, a  young workforce in an aging world, and the rising powers of the East that are keen to do business with the continent. Far sighted companies, that are prepared to take a calculated risk on the window of opportunity that is opening up in Africa, are set to reap the most benefits in the years to come.

young workforce in an aging world, and the rising powers of the East that are keen to do business with the continent. Far sighted companies, that are prepared to take a calculated risk on the window of opportunity that is opening up in Africa, are set to reap the most benefits in the years to come.

(The writer is Business Development Lead at STAX and can be reached via [email protected].)

(Stax Inc, Sri Lanka’s largest strategy consultancy, has its headquarters in Boston, and branch offices across Chicago, New York, Colombo and Singapore. In Sri Lanka, Stax advises four of the Top 10 conglomerates, blue chip industry leaders and large family businesses on areas such as strategy planning, market assessment, data analytics and investor facilitation.)