Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Wednesday, 14 June 2017 00:01 - - {{hitsCtrl.values.hits}}

“I have not thought of buying an insurance policy until I listened to one of the agents who built the trust in me and impressed me with a clear explanation on the benefits it offers for different events such as illnesses, financial safeguard for retirement, non-claim bonus, etc.” – Microinsurance policy holder

“I have not thought of buying an insurance policy until I listened to one of the agents who built the trust in me and impressed me with a clear explanation on the benefits it offers for different events such as illnesses, financial safeguard for retirement, non-claim bonus, etc.” – Microinsurance policy holder

By Manoj Thibbotuwawa

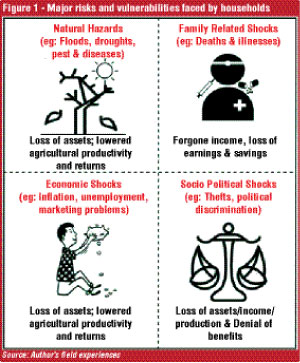

Sri Lankans living in most areas of the island are highly vulnerable to risk and uncertainty. They frequently suffer from various disasters such as floods, droughts and landslides, diseases and deaths, pest and disease outbreaks for crops, etc. Inability to effectively deal with such risks is widely accepted as a contributory factor for persistent poverty.

Insurance has evolved as an effective instrument to compensate the financial losses from such shocks affecting assets and livelihoods. In developing countries like Sri Lanka, where the formal insurance markets are inefficient in its delivery and ineffective in reaching the needy, especially in rural areas, microinsurance is often available. Hence, microinsurance has the potential to make the poor less vulnerable to such risks, by offering a convenient risk transfer mechanism for them.

Unfortunately, convincing people, especially the poor, to trust a stranger to safe-keep their hard-earned money, which they may or may not get back, is a difficult task. Therefore, the demand for microinsurance products by the rural inhabitants is very low and the outreach of microfinance institutes in the rural areas is very limited, despite the increasing need of microinsurance.

Which opportunities are available?

Rural poor households are vulnerable to various risks which exacerbate their poverty levels (Figure 1). While informal risk management mechanisms and social safety nets like Samurdhi are available, these are often insufficient, particularly when risks frequently occur over a short period of time. Further, low and volatile incomes hinder the accumulation of savings and even the available savings are exposed to high inflation in Sri Lanka.

However, the poor have been excluded from existing formal commercial insurance schemes due to various reasons. From the supply side, formal insurance products have been designed primarily for middle and high income classes, and not much has been done to reach out to the informal economy, especially in remote areas. From a demand perspective, the poor lack the capacity to access formal insurance. This supply and demand gap, along with inadequate insurance organisations, has raised the need for a micro level insurance scheme that targets low income households.

Moreover, there are certain household socio-economic and demographic characteristics that underpin the necessity of microinsurance for rural inhabitants. These include poor infrastructure, higher risk of illnesses due to poor sanitation, inadequate nutrition and access to health services, high risk occupations, volatile incomes, lack of savings and other assets, and poor interaction with formal financial institutions. Undoubtedly, this highlights significant opportunities that exist in the microinsurance industry to be harnessed by service providers.

Why are people reluctant to buy microinsurance?

Despite the many opportunities available, the demand for microinsurance and its outreach are still low in Sri Lanka due to various reasons. Even though the lack of understanding about microinsurance is often cited as the underlying reason for poor demand, better awareness and knowledge of insurance does not always translate into higher demand (except sometimes in the case of index insurance). Field level consultations in Sri Lanka reveal that trust, value proposition, irregular incomes (liquidity constraints) and awareness as the most important determinants of demand for microinsurance.

Dissatisfaction or lack of trust about insurance policies, and agents in particular, has been the biggest concern for households while renewing, purchasing or choosing to purchase an insurance policy in Sri Lanka. Insurance agents are usually not direct employers of the service provider and are paid based on the premiums collected and the number of new enrolments. Rumours or experiences of insurance scams by so-called agents have led people to mistrust insurance agents.

Dissatisfaction or lack of trust about insurance policies, and agents in particular, has been the biggest concern for households while renewing, purchasing or choosing to purchase an insurance policy in Sri Lanka. Insurance agents are usually not direct employers of the service provider and are paid based on the premiums collected and the number of new enrolments. Rumours or experiences of insurance scams by so-called agents have led people to mistrust insurance agents.

Volatility in main income flows, which makes it difficult to ensure timely payments of high premium values, also plays a key role in the lack of demand for microinsurance. Not having a continuous income stream sometimes prevents policy holders from paying the premium without defaults which then results in the automatic cancellation of insurance policies. However, people who are able to pay the premiums regularly are satisfied with their policies. Therefore, the reason for mistrust may not be necessarily misconduct of the agent, but a lack of understanding about the terms and conditions of the policy. For example, field consultations revealed that the automatic cancellation due to unpaid premiums is the reason behind certain policyholders’ mistrust.

Therefore, providing potential clients with comprehensive explanations on the policy, and continuously engaging with the clients as explained during consultations, is crucial to maintain the client base.

Coverage of insurance policies in terms of type of risk and benefits available is also an important determinant of rural people’s buying decisions. Field consultations reveal that some households have chosen not to buy owing to the inadequacy of insurance policies that addresses only specific needs such as crops or livestock, as well as the lack of benefits.

What can be done?

The real challenge microinsurance faces in Sri Lanka is making supply driven policies for insurees, but not for insurers, while focusing on improving potential clients’ affordability, accessibility and trust.

Customising the value of the premiums within the clients’ affordable range to have a proper balance between affordable premium and meaningful benefit is an important prerequisite for stimulating demand for microinsurance. Also, flexibility in the insurance policy to customise the value and allowing some leeway for clients to change their payment frequency when they are in distress will increase demand and reduce the drop outs.

The credibility of microinsurance can be improved by ensuring that as many genuine claims as possible are paid quickly without hassle. Using more reliable delivery mechanisms at the village level will also help build trust. Positive impressions and increased trust that can be generated by providing value-added services such as SMS alerts on specific information (e.g., weather) will also encourage policy renewals. Information campaigns through a trusted villager and the exploitation of peer networks within the village can build awareness.

Low income earning, rural clients face multiple risks. Therefore, composite products that cover multiple risks have the potential to attract more clients to increase demand, as well as outreach. However, since such complex schemes may be more difficult for clients to comprehend easily, starting with simple schemes that can be understood by anyone will be more appealing. Awareness creation can eventually facilitate the move towards schemes covering multiple risks.

Low income earning, rural clients face multiple risks. Therefore, composite products that cover multiple risks have the potential to attract more clients to increase demand, as well as outreach. However, since such complex schemes may be more difficult for clients to comprehend easily, starting with simple schemes that can be understood by anyone will be more appealing. Awareness creation can eventually facilitate the move towards schemes covering multiple risks.

The poor generally prefer to rely on savings and informal borrowings for emergencies due to the flexibility they offer. Therefore, bundling with savings is preferred, as it gives some assurance for premium payments. Technological advancements such as expansion of mobile phone networks in Sri Lanka can be used to make the system more efficient and to minimise operational costs.

Since microinsurance in Sri Lanka is still at the infant stage, the gestation period for the returns on investments could be bit longer for the insurance companies. The possible solution for this could be initial cooperation with non-profit-oriented government or non-government organisations in order to reduce the cost of product design and implementation. Finally, the facilitative role of government in promoting microinsurance among the poor by creating awareness and breaking the barrier of distrust and making an enabling environment through regulation is also very important.

[This article is based on a desk review and set of focus group discussions conducted by the IPS to evaluate the demand for micro-insurance in Sri Lanka. Thibbotuwawa is a Research Fellow at the Institute of Policy Studies of Sri Lanka (IPS). To view this article online and to share your comments, visit the IPS Blog ‘Talking Economics’ - http://www.ips.lk/talkingeconomics/.]