Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 3 April 2017 00:03 - - {{hitsCtrl.values.hits}}

Massive losses at EPF through imprudent bond deals

Media reports last week had referred to an alleged loss of Rs 9.5 billion at the Employees Provident Fund or EPF when it had made some scandalous deals with a primary dealer company now under investigations (available at: https://www.colombotelegraph.com/index.php/epf-scam-caused-a-loss-of-rs-9-5-billion-governor-indrajit-protects-scammers/).

The reports had disclosed the findings of a special investigating team appointed by the Monetary Board, on the losses that had been incurred by EPF when it had refrained itself from bidding at the primary auctions of Treasury bonds but buying them from the alleged primary dealer or from those who had bought from him at significantly higher prices.

It had been revealed that the Monetary Board had not taken firm action against those who had been responsible for those colossal losses. Instead, it had been reported that the Board had decided to call for explanations from them as a preliminary step towards a subsequent full -scale inquiry.

Brief response by Monetary Board

The not-so-good media reports prompted the Monetary Board to issue a very brief – in fact, it had only three sentences in all – statement of clarification disclosing its own side on the issue in question (available at: http://www.cbsl.gov.lk/pics_n_docs/latest_news/press_20170327ex.pdf).

The statement has not denied the incurrence of a loss of Rs. 9.5 billion by EPF as alleged in the media reports. It has simply clarified that the Board considered the report in question and decided to take disciplinary action against “any officials where there is evidence of wrongdoing” under the bank’s internal disciplinary procedures.

Losses should be investigated by law enforcement agency

It appears that the Board is still waiting for evidence to take action. Evidence will not be forthcoming on its own accord. It will surface only if the scandalous bond transactions are investigated by a law enforcement agency like the CID or FCID which could examine the telephone conversations which the alleged officers had had with outside parties during that period and compare their actual assets with those reported in the assets and liabilities statements filed by them.

This is costly, but the extent of the loss merits incurring such a high cost.

Monetary Board eroding its reputation deliberately

What it reveals is that the Board has failed once again to fulfil its obligations as the country’s prime banking institution, in general, and as the trustee of EPF, in particular. Such a callous approach by the Board to serious scandals in the Central Bank does not augur well for its reputation. It also dents the reputation of the Prime Minister under whose care the Central Bank has now been listed as per the Government’s work allocations. The longer the Monetary Board or the Prime Minister keeps a blind eye on those losses, the bigger would be the problem that would hit them on their head later.

This happened in the case of the scandalous bond issue that took place on 27 February 2015. Had the Monetary Board or the government taken corrective action then and there, it would not have blown into a series of massive scandals in the next 14 month period tarnishing the good name of the Central Bank, on one hand, and making a mockery of the good governance being preached by the present government, on the other.

Legal Eye: Justice Minister or trade unions should take the Board to courts

The alleged losses in EPF are in fact a product of this series of bond scandals, tolerated by the Monetary Board despite many warnings by market participants. Now that it has come to light through an internal investigation, the Board should take immediate action to douse the fire. If it does not do so, it will blow into a major fire soon.

Sensing this ominous eventuality, the writer Legal Eye has warned of the possibility of the Monetary Board being taken to courts by the Minister of Justice or trade unions for the breach of trust reposed on it under the Trust Ordinance (available at: http://www.ft.lk/article/606419/Loss-to-EPF-in-Treasury-bond-investments--applicability-of-Trust-Ordinance-provisions-and-Justice-Minister%E2%80%99s-role).

A trustee should protect trust money as if he protects his own money

In economics as well as in law, a trustee has the obligation to protect the assets belonging to a trust-beneficiary as if he would protect his own assets. Accordingly, since he does not allow his assets to go waste, he should not allow the assets of the trust also to go waste. A Monetary Board with foresight cannot ignore the warning by Legal Eye.

Monetary Board ignoring numerous warnings

In fact, the Monetary Board was warned of a series of major scandals in the issue of Treasury bonds involving losses to the Government as well as to EPF on a number of occasions. However, the Board not only turned a deaf ear to them but also was offensive to those who had pointed them out.

Cornering the bond market by a primary dealer

For instance, just six days after the scandalous bond issue of 29 March 2016, this writer warned the Board of another bond scam that had taken place  in an article in this series published on 4 April 2016 (available at: http://www.ft.lk/article/534654/Dilemma-in-monetary-policy--Monetary-Board-being-caught-in--The-Devil-s-Alternative--). This was the transaction that had led to alleged losses in EPF. This is what this writer said in the article under reference: “In the recent past (that is, mid-March 2016), the Central Bank, presumably with the approval of the Monetary Board, tried to suppress the interest rates in the market by rejecting all the bids at successive Treasury bill and bond auctions. But this is not a strategy which the bank can follow continuously since it requires the bank to compromise its monetary policy by financing the Government through newly printed money. Hence, on occasions, it has to allow the auctions to determine the rates as well as the quantum of funds to be raised. In those auctions, rates invariably go up forcing the bank to sell bonds below their face value causing a loss to the Government.”

in an article in this series published on 4 April 2016 (available at: http://www.ft.lk/article/534654/Dilemma-in-monetary-policy--Monetary-Board-being-caught-in--The-Devil-s-Alternative--). This was the transaction that had led to alleged losses in EPF. This is what this writer said in the article under reference: “In the recent past (that is, mid-March 2016), the Central Bank, presumably with the approval of the Monetary Board, tried to suppress the interest rates in the market by rejecting all the bids at successive Treasury bill and bond auctions. But this is not a strategy which the bank can follow continuously since it requires the bank to compromise its monetary policy by financing the Government through newly printed money. Hence, on occasions, it has to allow the auctions to determine the rates as well as the quantum of funds to be raised. In those auctions, rates invariably go up forcing the bank to sell bonds below their face value causing a loss to the Government.”

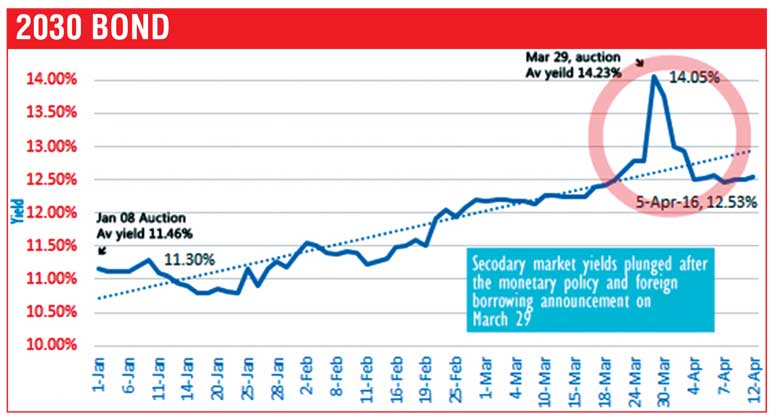

“In a recent such auction, as reported by the financial website ‘EconomyNext’ (available at: http://www.economynext.com/Sri_Lanka_long_bond_yields_plunge-3-4641-3.html ), a 15-year bond carrying a fixed rate of 11% and maturing in 2030 has been sold at a rate of 14.23% or below its face value. Within three days the yield rates pertaining to these bonds, according to the web, have plunged by about 2%, increasing their market prices significantly. It has allowed the original bond investors to earn a massive capital gain which could have been earned by the Treasury had the bonds in question been issued at the prevailing secondary market yields.”

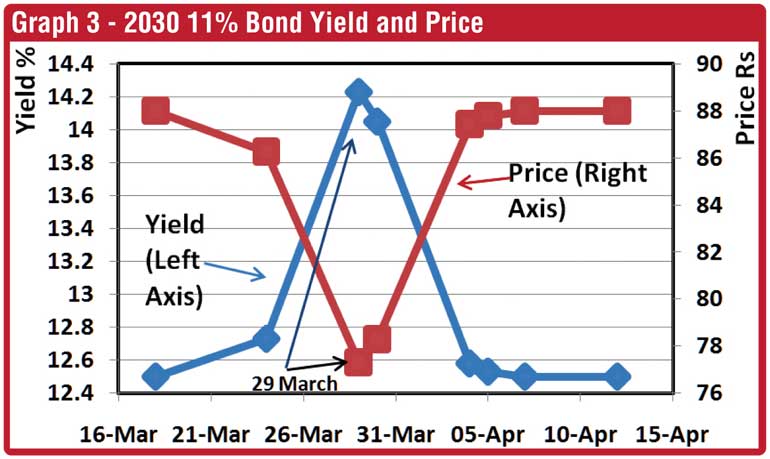

The price movement of the bond in question is presented in chart 3. It is a deep well around 29 March enabling the buyers to buy the bond at bargain prices and sell back at higher prices to state agencies which also had a collusive role in the affair. The Monetary Board should not have approved of this transaction without even winking an eyelid. Now that the scandal has come to light, it has to bite the bullet.

Monetary Board becomes offensive

Instead of taking this warning in its true spirit and taking action against wrongdoers, the Central Bank went on an all-out offensive against this writer. In its response, it had tried to decry the warning by projecting it as one made by a mere ‘retired employee’ of the bank (available at: http://www.ft.lk/article/536676/Central-Bank-responds-to--Dilemma-in-Monetary-Policy--Monetary-Board-caught-in--The-Devil-s-Alternative-?-).

But the board was warned once again by this writer on 25 April 2016 that EPF too had had a collusive hand in the scandalous transaction. The article said that the board itself had created arbitraging profit opportunities for predatory primary dealers.

Pumping bond prices and dumping on EPF

This is what the article under reference said: “When the Board cancels all the bids at the primary auctions for government securities, it disseminates information across the market that in the forthcoming auctions, the Board would accept a higher volume of funds than the one announced to the market. Then there is a pressure for bidding at low prices which mean at high interest rates. The Board before 2014 prevented such practices by primary dealers by getting EPF to come to the primary market at appropriate yields.”

The market was at that time abuzz with stories that EPF had refrained itself from bidding at the primary auction but buying at high prices from those who had bought those bonds in the primary market. It had paved the way for the predatory primary dealers to corner the market and make massive profits. In fact the subsequent events proved that it was true. The leaked onsite examination report on Perpetual Treasuries had corroborated this market story.

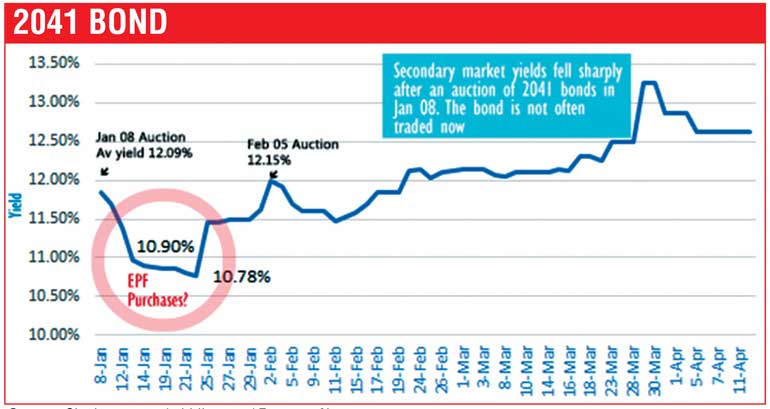

The analyst commenting in EconomyNext has documented the interest rate developments in the Treasury bond market prior to and before the Treasury bond issue in question in late March 2016. The results are shown in Graph 1.

He also had graphically presented how EPF had been manipulated, perhaps without the Board’s knowledge, to permit some predatory primary dealers to dump their pumped-up bonds on EPF. This is shown in Graph 2.

These two graphs reproduced by this writer alone on 25 April 2016 would have been sufficient for the Board to spring itself into prompt action, but it did not choose to do so.

Graph 3 shows the bond yield and price relating to this bond a week prior to and after the auction date, namely, 29 March 2016. The buyers have bought the bond on 29 March by driving the price to a level of Rs. 77 per 100 rupee bond. Within days, the price has moved up to its original level allowing the initial buyers to make a big killing on the market. The victims have been EPF and other State-controlled funds.

Whistleblower gives a wake-up call to Monetary Board

The Monetary Board, assisted by the bank’s senior management, was still adamant and did not take any corrective measure. Thus, the robbing of EPF by predatory market participants continued unabated. But the Board could not keep its silence any more after a whistleblower blew the fuse by releasing to the public domain in October 2016 an internal onsite examination report prepared by the staff of the Department of the Supervision of Non-Bank Financial Institutions or DSNBFI on primary dealer Perpetual Treasuries.

The report alleged that Perpetual Treasuries had preyed on EPF by dumping Treasury bonds which it had bought at low prices through three intermediary financial institutions. The report had suggested to the Monetary Board that a full-scale inquiry should be made on the alleged losses to EPF.

Leaked onsite examination paper provides sufficient evidence for Board to act

This writer drew the attention of the Board to the emerging reputation risk arising from the shoddy deals which EPF had made with the primary dealer in question in an article in this series (available at: http://www.ft.lk/article/572608/Whistle-blowing-on-Perpetual-Treasuries--Embarrassing-but-vindication-of-CB-s-supervisory-staff ). This is what this writer said about the whole scandalous deal.

Using Central Bank’s money to do bond business

“According to the leaked onsite examination report, Perpetual Treasuries had even made use of the interest rate anomaly created by the Monetary Board headed by Governor Mahendran. Despite the pressure for market interest rates to rise, the Monetary Board sought to swim upstream by reducing the Central Bank’s lending rates from 8% to 7.5% in April 2015. This was done by the Board when the interest rates in all government securities had gone up by about 2% or 200 basis points in March 2015 due to the high rates of the scandalous 30-year Treasury bonds issued by the bank in end-February, referred to above.

“Naturally, when the Central Bank cuts interest rates, the market rates should come down, but as the leaked onsite examination report has shown, they have moved in the opposite direction increasing interest rates by about 5% or 500 basis points to about 13% in the case of 10-year bonds for example by March 2016. Yet the bank maintained its low lending rate of 7.5% throughout.”

Board’s anomalous interest rate policy has helped primary dealer in question

This writer warned the Monetary Board in an article published in April 2016 in this series that its anomalous interest rate policy would breed opportunities for market participants to borrow at low rates from the Central Bank and lend at high rates to the Government, a process known as ‘arbitraging’ (available at: http://www.ft.lk/article/534654/Dilemma-in-monetary-policy--Monetary-Board-being-caught-in--The-Devil-s-Alternative-?).

The Board turned a blind eye to this warning. But the leaked examination report says that that was exactly what Perpetual Treasuries had been doing in order to make super profits. In April and May, 2016, according to the report, Perpetual Treasuries had used the intra-day liquidity facility and Reverse REPO facility of the Central Bank available at 7.5% to borrow cheap money from the Central Bank and lend to the Government at high interest rates prevailing in the market. It had made capital gains of Rs 4.7 billion out of these transactions in just two months. Thus, the Monetary Board, through its naivety, immaturity and irresponsibility, had permitted one primary dealer to make super profits by taking advantage of its lack of supervision and anomalous interest rate policy.

Finance Minister and EPF had borne the costs?

Who had borne the costs? In the first place, it is Finance Minister Ravi Karunanayake who had been forced to borrow at high interest rates. Then, it is the investors who have bought these Treasury bonds from ‘the chain of market transactions’ created by Perpetual Treasuries at higher prices than those prevailing at the primary market.

The supervision team has not identified these secondary losers, but it has pointed its fingers at EPF which is also functioning under the management of the Monetary Board. The supervision team has recommended that an inquiry should be conducted into the investment pattern of EPF to ascertain whether it was also a collaborating party to these scandalous bond deals.

Opening a can of worms?

The alleged loss to EPF is massive and should not be tolerated. If the Board fails to take necessary corrective action to rebuild its lost reputation, it opens itself to another outside inquiry. Such an inquiry, opening up a can of worms within the Central Bank, will be embarrassing to the Board as it has already happened by the revelations at the Presidential Commission on bond issues.

(W.A. Wijewardena, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected])