Friday Feb 13, 2026

Friday Feb 13, 2026

Wednesday, 29 March 2017 01:06 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

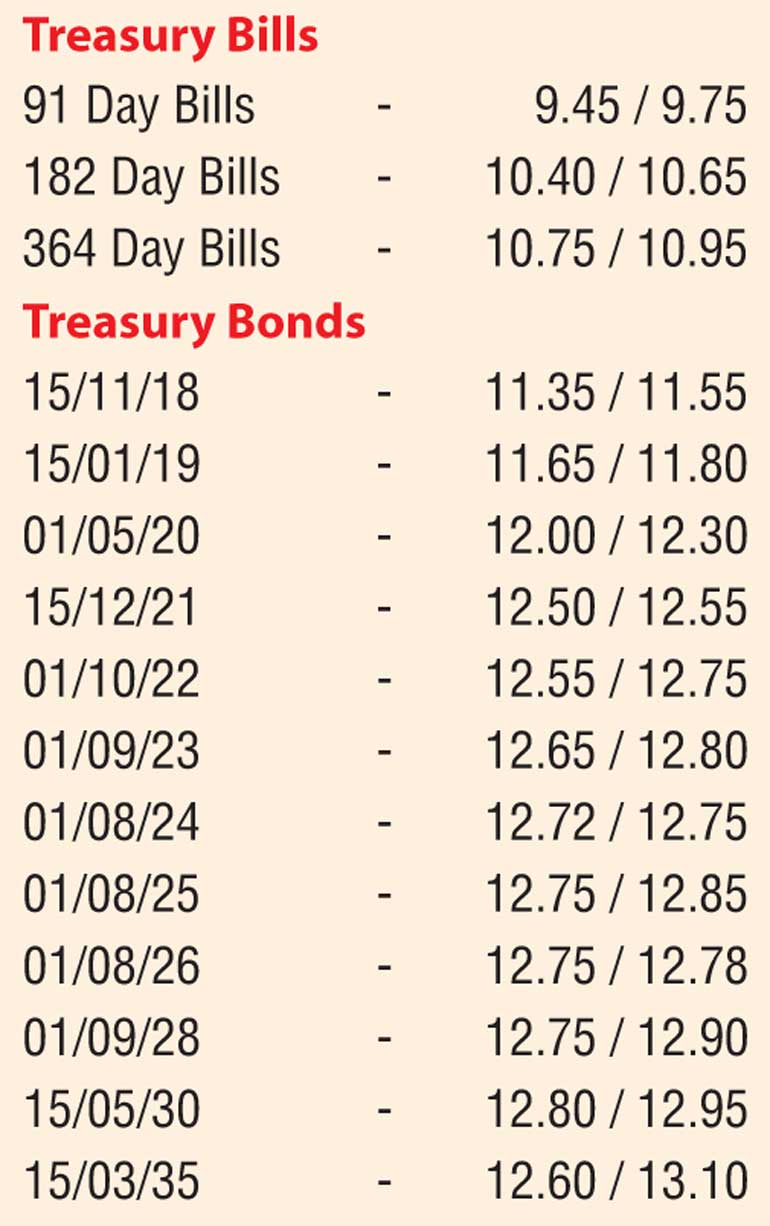

Secondary market bond yields continued to decrease for a fifth consecutive day, with buying interest of the liquid maturities of 15.12.21, 01.08.24 and 01.08.26 resulting in their yields hitting intraday lows of 12.50%, 12.70% and 12.72% respectively.

This is in comparison to the previous day’s closing levels of 12.60/70, 12.80/85 and 12.90/95. Furthermore, maturities consisting of 15.01.19, 01.07.19, 01.01.24 and 01.06.26 were seen changing hands within the range of 11.70% to 11.92%, 11.83% to 11.96%, 12.70% to 12.75% and 12.80% to 12.87%.

Today’s Treasury bill auction will have on offer a total amount of Rs. 25.5 billion, consisting of Rs. 8 billion of the 91 day, Rs. 8.5 billion of the 182 day and Rs. 9 billion of the 364 day maturities. At last week’s auction, the weighted averages continued to increase, with the 91, 182 and 364 day maturities increasing by 10, 7 and 8 basis points respectively to 9.57%, 10.46% and 10.82%.

The total secondary market Treasury bond transacted volume for 24 March 2017 was Rs. 7.00 billion.

In money markets, the overnight call money and repo rates remained mostly unchanged to average 8.75% and 8.80% respectively as the OMO Department of the Central Bank of Sri Lanka drained out an amount of Rs. 15.00 billion at a weighted average of 7.73%, by way of an overnight repo auction. The net surplus in the system stood at Rs. 13.34 billion.

Rupee dips further

The USD/LKR rate on the active two-week forward contracts dipped further yesterday to close the day at levels of Rs. 152.70/80 against its previous day’s closing level of Rs. 152.65/75 on the back of continued importer demand.

The total USD/LKR traded volume for 27 March 2017 was $ 44.44 million.

Some of the forward USD/LKR rates that prevailed in the market were three months - 155.40/60 and six months - 158.10/40.

Reuters: The rupee ended weaker on Tuesday due to dollar demand from a state bank to cover import bills.

Rupee forwards were active, with two-week forwards ending at 152.70/80 per dollar, compared with Monday’s close of 152.65/75.

“There was some selling (of dollars) by a foreign bank, but a state bank bought. They have some large import bills to cover and therefore they bought dollars from the market,” said a currency dealer, asking not to be named.

The rupee is under pressure due to the higher seasonal import demand some oil bills, dealers said.

The Central Bank on Monday raised the spot rupee reference rate by 10 cents to 151.70 after the bank raised the it by 25 cents on 20 March.

On Friday, the central bank raised interest rates for the first time in eight months, saying tighter policy was a precaution against a build-up of inflationary pressures. Analysts said the rate hike, a move aimed at easing pressure on the rupee, could help stabilise the domestic currency that is hurt by rising imports and outflows due to rupee bond sales by foreign investors.

Foreign investors net bought government securities worth Rs. 70 million ($ 461,285) in the week ended 22 March. They have net sold Rs. 63.2 billion of such instruments so far this year.