Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 27 February 2017 00:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

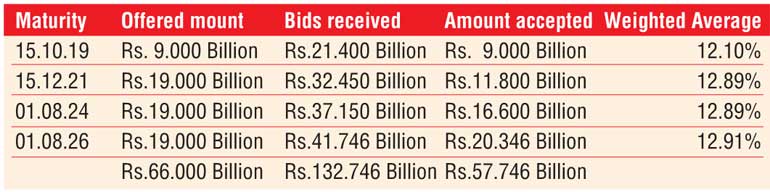

The shortened trading week ending 23rd February 2017 saw primary market weighted averages on Treasury bonds increase to eleven (11) month highs at its auctions conducted on the 23rd of February to levels last seen in March 2016.

The yields increased significantly by 69 basis points on the 1.11 year maturity of 15.01.2019, 70 basis points on the 4.10 year maturity 15.12.2021, 50 basis points on the 7.05 year maturity of 01.08.2024 and 70 basis points on the 9.05 year maturity of 01.08.2026 resulting in weighted averages of 12.10%, 12.89% each and 12.91% respectively in comparison to its previous weighted averages. The total successful bids were seen totaling Rs.57.75 billion against its total offered amount of Rs.66 billion.

Activity in secondary bond markets slowed down considerably during the week with most market participants seen on the sidelines on the back of foreign activity slowing down. The foreign component in Rupee bonds was seen declining for a seventh consecutive week to record an outflow of Rs.15.3 billion for the week ending 22nd February.

In money markets, the OMO (Open Market Operation) Department of Central Bank was seen infusing liquidity throughout the week on an overnight basis at weighted averages of 8.47% and 8.48% as the average net liquidity shortfall increased to Rs.42.62 billion for the week against its previous week’s average of Rs.14.09 billion. This in turn resulted in overnight call money and repo rates averaging at 8.49% and 8.81% respectively.

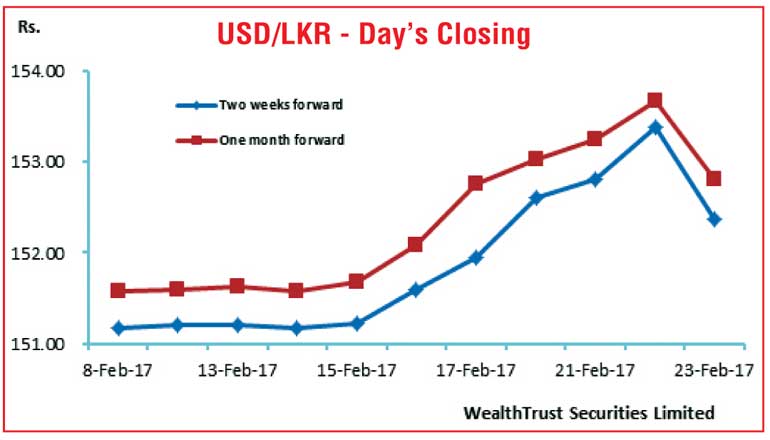

Rupee dips during the week

The USD/LKR rate on active two weeks and one month forward contracts depreciated considerably during the week to lows of Rs.153.70/85 and Rs.154.65/75 respectively against its previous weeks closing of Rs.151.80/10 and Rs.152.60/90 on the back of importer demand and foreign selling in rupee bonds. However, it was seen bouncing back from its weekly lows to close the week at levels of Rs.152.30/45 and Rs.152.75/90 respectively on the back of selling interest from banks.

The daily USD/LKR average traded volume for the first three days of the week stood at US $ 87.89 million.

Some of forward dollar rates that prevailed in the market were 3 Months - 154.70/00 and 6 Months - 157.35/50.