Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 21 February 2017 00:00 - - {{hitsCtrl.values.hits}}

By Joan de Zilva Moonesinghe

“Whatever ‘name’ is given to a just social system, nevertheless not its name but its content is what is important, andcalls for a ‘strong juridical framework’, that is, a legal framework, to orient the economy toward the total good of mankind.”

The eminent ex-Deputy Governor of the Central Bank of Sri Lanka, Wijewardena who believes very strongly in the ‘magic’ of the free market, has denounced government policy,embraced by the Central Bank,in mandating the banks firstly,to direct credit to identified priority sectors and secondly, to deploy a minimum amount of funds mobilised by bank branches, within the branch locations for the benefit of the branch communities.

These are, indeed, very noble principles of responsible governments to ensure that the credit demands of all sectors of society are met, if not through the banking system, through specialised credit institutions established for this purpose.The government has chosen the former, which Wijewardena says is a betrayal of, andcontrary to, the social market economic policyespoused by this Government as quoted by him, where the Government’s role is limited to facilitating the market’s development of the economy and not by Government fiat as has been done.

Mandatory/Directed Credit or Priority Sector Lending(PSL) has been commonly used by many Asian Central Banks, notably India, to ensure the efficient allocation of credit to all sectors of the economy, which is one oftheir primary functions in facilitating efficient financial intermediation.In theory,directed lending overcomes market imperfections and provides fair and efficient credit to all sectors and can take various forms through refinancing schemes, interest rate subsidies, credit guarantees and the establishment ofDevelopment Finance Institutions to provide specialised credit.

There are thus several ways the Government’s objectivescanbe achievedwithout making it mandatory, particularly where they find that the flow of credit through the banking system is skewed in favour of the urban population and to economic sectors that are attractive in terms of feasibility and of course, are profitable, but not necessarily, productive.These are business decisions that banks should have the liberty to take in an unregulated,free marketenvironment.

Productive credit and household debt

With regard to productive credit, it would be very useful if the Central Bank of Sri Lanka can provide more granular information on Household Debt Vs. Business credit.We hear so often of the concern expressed by the Authorities of the increase in private sector credit.I am not sure what this concern is as,overall,if credit is increasing, be it private or public sector, it should contribute to GDP.However, in the manner in which it is projected by the Central Bank which echoes the IMF’s concerns,it seems as if private credit is not productive and it is only public sector credit that is, hence the need to restrict its growth.A definition of what constitutes public sector and private sector credit would be useful to understand these concerns in their projected perspective.

Almost all countries in the region, notably Singapore and Malaysia, pay very close attention to the level of household debt(HD) to determine monetary and economic policy.Comprehensive data on household assets and liabilities are available and both countries take comfort in the fact that household assets are adequate to meet theveryhigh levels of household debt experienced by these countries. I fail to see why the Central Bank of Sri Lanka too cannot compute this data,or does this mean that what is referred to as private sector credit is, primarily,household debt for consumption which is unproductive and is therefore a concern.

WhilstHD can very easily be computed with the available data at its disposal, the Central Bank should endeavour tocollate household assets as well.A read of the financial stability reports of these countries will show the emphasis placed on the level of household debt and the manner in which it is being managed so as to dictate national policy to contain its growth.

So then the natural conclusion is that, where there is no efficient allocation of credit to all sectors of the economy and tosectors of the population, it becomes the prerogative of the State to intervene to see that these sectors are served and that credit reaches those who are excluded.How they do so is left to their devices without disturbing or distorting the fundamental free market principles of supply and demand, says Wijewardena.

Contradiction in world’s largest free market economy – The Community Reinvestment Act 1977 of the US

The Community Reinvestment Act of 1977,as enacted and implemented in the USA by Senator Proximire, the Head of the Senate Banking Committee at that time, was a revolutionary and, therefore controversial,piece of legislation introduced in a country which is the citadel of the free market and which was based on the principle that, ‘Economic and community development is notonly the prerogative of the State but that additionally, banks, as corporate citizens, have a societal duty to sow the seeds of prosperity in their surrounding communities from where the banks have reaped their rewards’.

Bankers feared regulation in this area would cause a collapse of the banking industry and ‘if taken to an extreme, create a socialist-style redistribution of wealth’.However, the effects of unregulated banking practices have been too detrimental to ignore, even in the US and thus, requiring banks to assist in the redevelopment of their communities,has become a legislative priority in the US.This was in an environment in the US commonly referred to as ‘redlining’ or ‘community disinvestment’ which refers to the large-scale diversion of local community deposits to larger, more favourable money markets where the interest rates are higher.

Thus, money invested by local community residents is shipped off to other lending markets, leaving the local urban and farming communities without sufficient credit resources even though the local community generated that money.The findings of the Senate Banking Committee prior to the passage of the CRA,showed only about eleven percent of the money deposited in Brooklyn remained in the community and only ten percent of the money invested by residents of the District of Columbia was reinvested back into the district. Los Angeles, St. Louis, Indianapolis, andCleveland documented similar results.

What is important to note is thatcompliance with the CRAin the delivery of credit to the low and middle income groups of borrowers, was expected to beconsistent with safe and sound operations and does not require institutions to make high-risk loans that may bring losses to the institution.

This is precisely the principle upon which the Government of Sri Lanka too decided to mandate a minimum percentage of funds mobilised by bank branches, to be deployed within the branch location itself, for the benefit of their communities, albeitwithin safe and sound parameters.

At the same time, it is acknowledged that this is exactly how the market functions at its best,in the pursuit of profit maximisation which underpinsthe free marketmechanism and where the market cannot be held to account.

PopeJohn Paul II very lucidly dictates this accountability in his Encyclical CentesimusAnnus, “Society is not directed against the market, but demands that the market be appropriately controlled by the forces of society and by the State, so as to guarantee that the basic needs of the whole of society are satisfied.”

Governments must, perforce,intervene in the public interest for ‘there are collective and qualitative needs which cannot be satisfied by market mechanisms. There are important human needs which escape [the market’s] logic. It is a strict duty of justice and truth not to allow fundamental human needs to remain unsatisfied, and not to allow those burdened by such needs to perish’.

At the same time, economists focus on the socialist philosophy of mandatory reinvestment calling it a ‘governmentallyimposed credit allocation’ coercing ‘a private sector industry... into providing a service which contradicts the dictates of the marketplace. Forced allocation of capital . . . is at best damaging to a financial institution and at worst,a publicly mandated redistribution of wealth’.’

Senator Proximire as the Head of the Senate Banking Committee at that timefound that there was considerable urban decay as a result of the lack of efficient credit allocation by lending institutions.

Most banks in Sri Lanka show performance in community development as part of their corporate social responsibility(CSR).But they wouldn’t have to do this if,on a branch-wise or district-wise basis,they demonstrated performance in community development and upliftment in their branch locations,or on a centralised district basis.

Therefore, it would have been useful herein Sri Lanka too,to assess the situation vis-à-vis the deployment of credit within the communities in which the bank branches are located and to ensure that community development too was encouraged.A co-ordinated effort towards community development by all banks within a district,could also be encouraged to alleviate the burden that would otherwise fall on the two state banks which have a much wider branch outreach than the private sector banks.

Population per financialinstitution

Role of non-bank financial institutions

In assessing financial outreach, it is imperative that we do notconfine our studyto only bank branches, but take into accountthe important role played by non-bank financial institutions in Sri Lanka, like the licensed finance companies, the thrift and credit co-operative societies,which have a wide branch outreach and cater to a market segment which are, commonly,financiallyexcluded by the banks.They also provide the type of financial services demanded by the low and middle income groups of population, which are user friendly and which lack the deposit and lending protocols of the formalised banking sector.It is therefore important that the financial services they provide should go into the reckoning of our financial outreach survey, particularly because,given a choice,potential customerswould always prefer to stay with the non-bank institutions rather than with a bank.

Estimates of financial inclusion should, therefore,fundamentally assess the extent of financial services which are accessible to the population,regardless of the financial institution thatprovides these services, as long as these financial institutions are within the formalised, regulated financial system.

The financial services provided by the network of licensed finance companies should also be reckoned, considering that many of them are increasingly servicing the micro financing,vehicle financing and other financial needs of the population.They have a network of 1216 branches countrywide andare also deposit-taking institutions, which are often preferred over the banks by those who are financially excluded by the banking system due to their ease of access.

Thus together with the CRBs and the finance companies, the number of branches of financial institutions for every 100,000 persons would stand at33.5.If the Thrift and Credit Co-operative Societies are also added it would increase to 74 based on the CBSL’s statistical website.

Whilst it is evident thereforethat Sri Lanka provides a very wide branch and financial servicesoutreach to its population,theextent to which these services meet the credit needs of the communities in these locations,would be the true measure of the usage of financial services and how financially included they are.

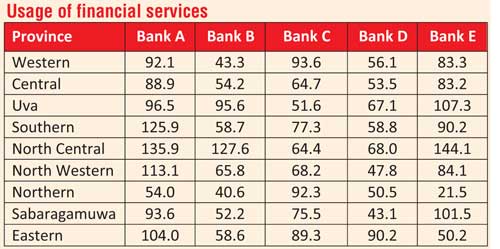

Quite contrary to the general perception that credit is concentrated in the Western province at the expense of lower credit activity in the outlier provinces, the statistical data available on the Central Bank’s website and from the published annual accounts of the banks, particularly of the systematically important banks (SIBs), illustrate a very wide dispersion of credit activity across all provinces, particularly in the Sabaragamuwa, North Central, Northern and Uva provinces outside the Western province.

Since all these institutions mobilise public deposits and grant loans, the credit to deposit ratios of the provinces in which these branches are located,would illustrate the extent to which the credit needs of these communities are served.All the SIBs had CD ratios in excess of 75% in all provinces, sometimes even in excess of 100%,with the Co-operative Rural Banks on the other hand paling in comparison,which mobilised more deposits than they were granting credit.The Northern Province was slowly gathering momentum with branch representation per 100,000 persons being the second highest after Colombo.There was much more deployment of funds in all other provinces than there was in the Western Province.

This is thus far in excess of the mandatory limit to be imposed of 15% which seems to assume that absolutely no credit is granted by some branches.To be able to contribute effectively to the branch communitiesfrom whom the branches source their funds, a minimum of at least 40% should be deployed within the branches and it is recommended that the limit be revised upwards accordingly.More granular data on each branch within the provinces might show a lower ratio,but from the data available on a few banks, it is definitely far higher than the mandatory limit of 15% per branch.

There may be a few instances where Branch Managers prefer to lend their branch deposits to Head Office rather than take credit decisions that might result in default and losses for the branch.It is therefore important that Branch performance,or their contribution to the bank’s profits,shouldalso take into the reckoning how these profits are generated and the level of financial intermediation engaged in by the branch, through the identification of the credit needs of the community.

To be able to deploy at least 40% of branch deposits mobilised, within the branch community is definitely not beyond the capacity of Branch Managers to achieve, given the proper incentives to do so, although it might result in taking them out of their comfort zones and mobilising them into delivering dynamic bankable propositions.

Priority sector lending/directed credit

As for priority sector lending, a Committee appointed to deliberate thiskeypolicy decision could have examined the best way in which the government’s desire to boost certain economic sectors, should be implemented in collaboration with the stakeholders which, areprimarily the banks.

Dr. RaghuramRajan, the eminent economist and ex Governor of the Reserve Bank of India, in his report, A Hundred Small Steps: Report of the Committee on Financial Sector Reforms said:

“Priority sector norms will expand access only if they make banks do what they would otherwise not do, which almost by definition is unprofitable. There is therefore a delicate balance in setting priority sector norms and eligible categories. High priority requirements and narrow eligible categories targeted at those who truly do not have access,could lead to greater access to credit, but could reduce bank profitability considerably.”

The question that looms large,therefore, particularly in the context of the Sri Lankan banks is,to what extent can bank profitability be compromised for the sake of the development of the macro-economy?Almost all the banks in Sri Lanka have shown extremely good results by way of 20-30% growth in profitability in 2015.When you look at the press reports on bank performance this is all you see, how much their profits have increased!

In 2015 this was despite a low interest rate environment,but a high credit turnover,where credit growth and low interest expense on the cost of deposits,fuelled the significant increase in profits across the sector.However the sustainability of such profit growth, given the volatility of market conditions in the industry, is worthy of consideration.Over the last decade, however, a simple annual average growth of profits of the systematically important banks(SIBs),ranging from 15-40%,is evident.

One could thus argue that the banks can therefore very well afford to meet the mandatory PSL requirements and still be profitable.However, in a free market environment which was the mandate of this Government that was certainly not the expectation.It would therefore be more prudent to incentivise the banks to perform in these sectors, than mandate them to,which will certainly bring the desired results and also be in line with the Government’s mandate for a social market economic policy.

Overcoming the costs of PSL

A committee appointed to see how best this can be administered even at this late stage, would be a wise measure if indeed the Government is firmly committed to increase resource allocation to the sectors identified and boost their productivity.Some of the measures that could be considered are:

nStrengthening the peripheral financial institutions like theCooperative Banks, Regional Rural Banks, and Microfinance Institutions for last-mile connectivity and encouraging opening of ‘small’ banks with a specific mandate to boost these sectors.

Collaboration between mainstream institutions and the grass roots entities

The mainstream bank and non-bank institutions could be encouraged to meet their mandatory targets through the grant of credit to theseperipheralinstitutions,for on-lending to these sectors, resulting in a mutually beneficial,collaborative, program of financial inclusion.This will also result in these grass roots institutions, which are currently under little or no supervisory or monitoring mechanism, being progressively drawn into a more organised ‘internal systems and control’ mechanism,which is critical to the success of the national program and of these institutions themselves.

This is the experience of Bangladesh and India which often use MFIs,through which the mainstream banks are encouraged todemonstrate performance to the financially excluded and other targeted sectors.Leveraging onand uplifting the existing peripheral financial institutions’infrastructure

National initiatives disseminated through these institutions will help to uplift these institutions as well, especially the CRBs and the TCCSs, from their current,very basic, physical presence in the remotest corners of the country,to more acceptable, modern,institutions. This,in turn, would attract the calibre of staff resources which are an essential pre-requisiteto the implementation and success of these initiatives.Most of these entities are currently just holes in the wall offering little or no business stimulus or a proper working environment, even though they are an important conduit in last-mile connectivity with thegrass roots population.

Any national policy should recognise the importance of building upon this existing infrastructure, instead of duplicating it, at the expense of the financial resources needed for the grant of financial services to the targeted sectors.It will also help to eradicate wasteful expenditure on infrastructure costs.

Role of peripheral financial institutions

The vast outreach provided by the CRBs, the TCCSs and the RDBs(through the SanwardhanaDevelopment Bank), and the Samurdhi banking societies, which operate at the grass roots level, are a vital infrastructure which should be leveraged uponas a conduit for theenhancement offinancial inclusion through which the micro and SME financing initiatives could also flow.A healthy collaboration between these peripheral institutions and the other, stronger, public sector banks such as the Bank of Ceylon and the People’s Bank, would be an excellent platform for the development of productive finance through micro and SME financing for the benefit of the macro-economy.

Enhancing private sector participation

Whilst driving the national initiatives for financing the targeted sectors,primarily through the public sector financial institutions, it is important that the private sector banks and non-banks too should be incentivised to participate,outside the mandatory targets set by the national policy.Appropriate tax and regulatory concessionsmay be considered for this purpose, in the recognition that the private sector culture and expertise will complement the targeted outcomes of the national policy.

An unbridled, free market, economy is a luxury less developed economies like Sri Lanka can ill afford, particularly where there exists significant information asymmetries which give rise to imperfect markets.It is therefore imperative that in the true spirit of the principles of the social market economy propounded by government, immediate action is taken to facilitate the optimum functioning of this mechanism and in the interim, the banks are incentivised to participate in community and economic development to be able to win their support and carry them along on the Government’s economic development agenda.

This would be a much more acceptable approach,rather than wielding the big stick which mandatory targets seem to represent and which would be counter to espoused government policy as emphasised byWijewardena.More profoundly, it woulduphold the fundamental principle and objective of the efficient allocation of credit and the upliftmentand development ofall sectors of the economy.This would, however, entail the demonstration by the banks of theirperformance in this regard to the satisfaction of the authorities.Credit/Deposit ratios by themselves would not be adequate as the credit granted may be more consumption-based particularly in the provinces and thus not productive.

Therefore to demonstrate performance in community and economic development of the branch communities, on the lines of the practice in the US, would be the key tothe success of government policy and would be in the true spirit of its initiatives in this regard.

(The writer is former Director of Bank Supervision at the Central Bank of Sri Lanka and Consultantto the Governor on financial regulation).