Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 30 January 2017 00:34 - - {{hitsCtrl.values.hits}}

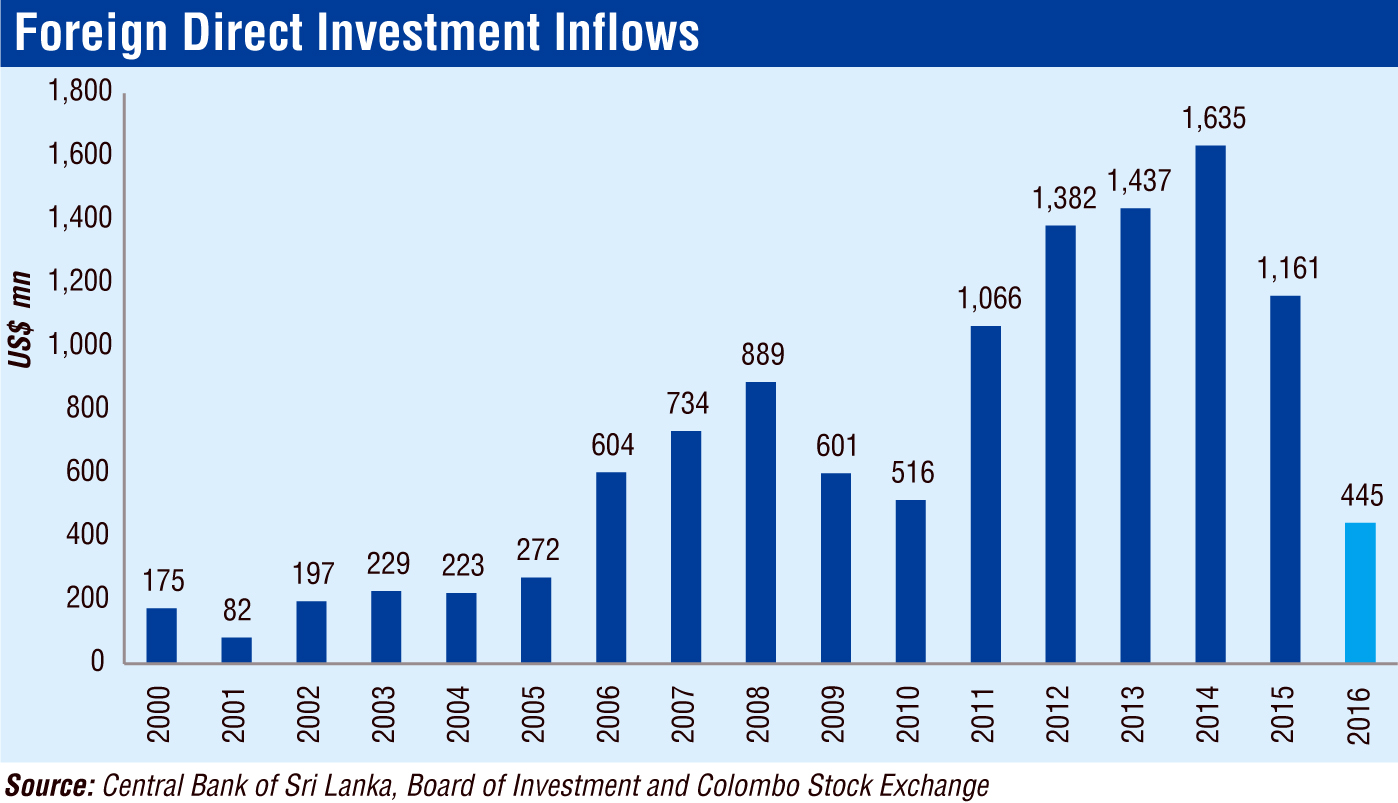

Reuters: Sri Lanka’s foreign direct investment (FDI) slumped 54% to reach an ‘extremely low by any standard’ level last year, the Government said on Friday as inconsistent tax and economic policies weighed on offshore investments.

The FDI dived 54% to $ 450 million in 2016 year-on-year, compared with $ 970 million in the previous year, which International Trade Minister Malik Samarawickreme stated was, “Extremely low by any standard”.

He said the State-run Board of Investment (BOI) should promote investment, and if necessary, regulations and rules need to be changed to attract investments “As the current regulations have failed to bring in investors”.

Prime Minister Ranil Wickremesinghe-led centre-right United National Party (UNP), which is in a coalition with President Maithripala Sirisena’s centre-left Sri Lanka Freedom Party (SLFP) promised to revive the economy with major FDIs.

Last year, the Government faced a debt and balance-of-payments’ crisis, and it also had to change its tax policies announced in the 2016 budget due to protests.

“It is a lot to do with policy inconsistency on some of the key criteria like taxes and land ownership,” Shiran Fernando, an analyst at Colombo-based Frontier Research.

“Still we see some uncertainty, in particular in the financial sector, due to the proposals outlined in the budget for 2017 in November.”

The Government also faced legal battles in raising the value added tax (VAT) by 4% to 15%, resulting in a loss of Rs. 100 billion due to a six-month delay in the implementation of the new tax.

The Government agreed for an economic reform agenda with the International Monetary Fund (IMF) for a $ 1.5 billion loan in June last year. That includes reducing budget deficit, allowing rupee flexibility, and reviving loss-making State-owned enterprises.

The IMF in November said Sri Lanka’s macro-economic and financial conditions have begun to stabilise and that the island nation’s performance under its $ 1.5-billion loan program was satisfactory.