Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 11 January 2017 00:00 - - {{hitsCtrl.values.hits}}

By Lasintha Ferdinando

By Lasintha Ferdinando

This article was the result of preparing for a few public engagements which led the writer to research into some areas of concern. And we believe many will benefit from this experience.

Background

As the world struggles to pump up domestic consumption, boost economic growth while having interest rates as low as possible, here in Sri Lanka we are struggling with high interest rates even though inflation is somewhat under control, with mediocre economic growth in spite of a peaceful environment but with an unstable Government to execute plans.

As the world struggles to pump up domestic consumption, boost economic growth while having interest rates as low as possible, here in Sri Lanka we are struggling with high interest rates even though inflation is somewhat under control, with mediocre economic growth in spite of a peaceful environment but with an unstable Government to execute plans.

As a country we must compete in the world market to bring in much needed foreign reserves to boost our ability to invest and consume. Where are we on this aspect? Whilst the trade deficit is almost 50% of imports, the Balance of Payment is managed thanks to the labour exports (remittances) and the fragile tourism sector (first thing that drops out when an economic downturn occurs) and ICT income, which is still 80% and is repatriated as hardware, licenses, consultancies, etc.

Currently, Sri Lanka is similar to a group of companies which is dealing within itself while the focus of dealing with the external customers is limited or uncompetitive. The Irony is whatever the economic condition of the country, one particular industry thrives and this is the backbone of all other industries. It is none other than the financial sector. How can this happen?

Let’s focus on one aspect of the main factors of an economy- capital, for which interest is paid. This parasite which we try to put into perspective is the Excess T1 capital in LCBs and as a result its impact on the interest rate in Sri Lanka.

Based on a large set of data which was analysed as of 31 December 2015, a few anomalies caught our attention.

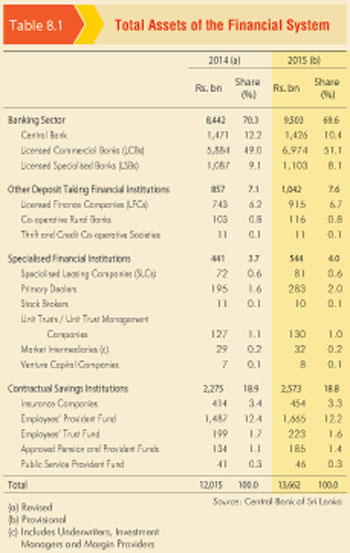

51% of assets held by LCBs as the most prominent composition of the financial system

Let us see what influences the interest rate at high level (not in the priority of importance).

1.Exchange Rate

2.Inflation/Opportunity cost

3.SRR (Statutory Reserve Requirement)

4.Cost Structure of the players in the market (Intermediation cost)

5.Investment or consumption drive/policies

6.Demand and Supply

7.Liquidity in the marketplace/time preference

8.Government borrowings

It is evident that 51% of the financial system in Sri Lanka is concentrated in the License Commercial Banking (LCBs) sector. Surely they are a key influencer of the interest rates in the economy of Sri Lanka. Let us analyse what goes in to determine the lending rate by a LCB.

Leding Rate = cost of funds + SRR + Operational Cost + B&D Provisions (general, specific, impairment + Risk Premium) + Inflation + Profit Margin + Liquidity Premium + Taxes (VAT, Corp Tax, VAT on personnel cost, etc.).

We are more interested in the Profit Margin and the Taxes components in the pricing mechanism. Cost of funds is a determinant of the consumer preference of postponing their purchasing power. All what they look for is a positive return on the investment with liquidity and the risk factor considered.

Real Rate of Return = Nominal Interest Rate – Inflation

5.5% Real Rate of Return (as of now) = (1 Yr) AWFDR 10.25% - 4.7% inflation (Nov YOY)

Savers are happy at the moment but is this what Sri Lanka wants? Is it more saving that we need and not employment generation investments? Entrepreneurs or Investors are more interested in the credit creation or as borrowers to create more enterprises or wealth.

In this background, let’s look deep into the Lending Rate and two other components - Profit Margin and Taxes. What harm or benefits do they bring to the economy.

Putting this into perspective let us look at how strictly regulated the LCBs are and what prompts LCBs to collect Tier 1 capital more and more.

Current regulations or risk management strategies for banks

The following are the present regulations or risk management strategies for banks

These regulations bring more inefficiency to the Industry. But the systemic risk is not managed under the current context. It has been eliminated.

The last Budget, introduced a minimum of Rs. 20 billion Tier 1 capital. This feeds the parasite even more. But instead of forced consolidation in the industry, these types of regulations may influence banks which are lagging behind to consolidate voluntarily.

But what if they also meet the minimum Tier 1 capital requirement? The parasite that we are going to reveal gets even bigger. Through the financial intermediation, LCBs try to achieve an acceptable ROE (Return on Equity) for shareholders. In this context industry average ROE for 2015 was 16.1%, with some LCBs getting closer to 24% ROE at the high end.

But in reality, according to BASEL requirements, the Tier 1 capital buffer should be kept in relation to the Risk Weighted Assets (RWA) held by a LCB. RWA are far lower than Total Assets owned by the LCBs.

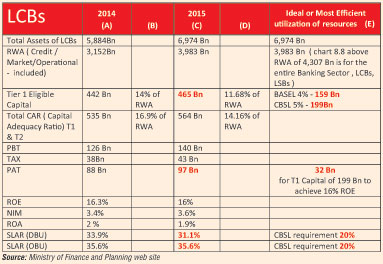

Do you know that the current asset (RWA) book of all LCBs can be run with just 43% of the Tier 1 capital available in the LCB Sector? In other words if the LCB Sector generated a PAT (Profit after tax) of say Rs. 97 billion as per the Table 8.6 above, but to meet the ROE of 16% for 43% of Tier 1 capital, based on RWA, LCBs would have been happy with Rs. 32 billion as PAT. The table highlights this phenomenon further.

Parasite Description

If we interpret the above table data further, we see that the country’s LCBs have an asset base of Rs. 6.9 trillion, but the RWA are only Rs. 3.9 trillion. In order to run a business of this nature as a Sub Sector of Financial System LCBs require only Rs. 199 billion of Tier 1 Core Capital, but LCBs have a collective T1 of Rs. 465 billion. If we reverse engineer the RWA based on the available T1 capital, the country would have a RWA base 2.33 times more than what it is at the moment, which is Rs. 9 trillion at the same level of risk.

In this context to satisfy the shareholders of all LCBs, they should have earned only a PAT of Rs. 32 billion, but LCBs earned Rs. 97 billion during the financial year ended 2015. This difference of Rs. 65 billion should have been in the hands of entrepreneurs (ideal scenario) so that they could be competitive in the world market and generate more employment opportunities by way of reinvesting. NIM had been moving up and the RAO is deteriorating, clear signs of inefficiencies.

On the other hand, what is the point of taxing the banking system? Is it a mechanism to collect tax due to the inefficiency of the IRD (Inland Revenue Department). Taxing the LCBs or any organisation in the financial system makes the nominal rate higher and higher, since this cost is passed on to the consumer. In the end if the Government factors its revenue (tax collection) through these channels and the interest incremental cost due to market rate increase on its borrowings will outweigh the tax revenue tremendously. This means the interest serving cost (due to the above market forces) is far greater than the tax collected. This is another topic by itself.

Furthermore, whilst the regulator states 20% of SLAR as the minimum requirement, LCBs are holding 30% +, which means the liquidity in the money market is mopped up and held under LCBs on low-yielding assets such as government securities or the CBSL SDFR.

Whilst it is one the Primary Tasks of the Central Bank to maintain price stability and maintain systemic risk, it appears that their actions by itself bring the whole country into an uncompetitive market status through unwanted/above global standard regulations. The Central Bank must adopt a calculated Risk Model for LCBs instead of one rule for all method. ( for further reading: http://www.ft.lk/article/496729/Imperative-reforms-to-the-financial-system-especially-in-the-banking-sector).

Gone are the days when monetary policy decisions alone could control price stability. One classic example is the foreign reserves drain off during the last two years, due to a lack of coordination and coherent decision-making in relation to duty structures and concessions. Hence, better coordination between and amongst the Ministry of Finance (Budget decisions), Monetary Board, Central Bank, Customs practices and IRD decisions must be made to make Sri Lanka a sustainable country.

A positive note

It was found that the CAGR (Compound Annual Growth Rate) of RWA of LCBs (comparing Q3 of 2010 and Q3 of 2016) grew by 20.15% whilst the Regulatory Capital (T1 & T2) of LCBs grew only by CAGR 19.15%, which means at some point in the future the lending portfolio will outweigh the minimum capital requirement of the LCBs. Sadly at this level of credit demand and the economic growth, the above scenario will not happen in the coming decade from now.

What should happen is that the debt market needs to be aggressively developed, which will facilitate the long-term funding requirement of LCBs and take away the idle T1 capital from the LCBs. This will bring about a reduction in the interest rate in the marketplace. On that note it was witnessed that the T2 capital formation has grown at CAGR of 19.36% (comparing Q3 of 2010 and Q3 of 2016) compared to the increase in T1 Capital CAGR by 18.82%.

The parasite

A million dollar question is should we keep this idle T1 capital in LCBs and suffer (higher Interests) for the rest of the years to come? (Qualification – Considering the overall LCB Sector, but individual LCBs may have their own limitations and constraints)

So what can be done by the LCB sector to arrest the situation? The following are suggestions.

From the entrepreneurs’ point of view, the Chamber of Commerce and other similar organisations should take this idea forward and make our country’s Financial System much more efficient than what it is now. We at JKSE Consultants Ltd. would be pleased to work with such interested organisations.

(The author has been a Joint Managing Director of boutique consultancy firm JKSE Consultants Ltd. since 2012. He is a Fellow of The Chartered Institute of Management Accountants, UK and The Institute of Bankers of Sri Lanka. He obtained his Master’s degree from the University of Colombo and is a Certified Investment Advisor in Debt and Equity Markets as well as being a Chartered Global Management Accountant. He can be reached on [email protected]. Website www.jkseconsultants.com)