Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 5 January 2017 00:00 - - {{hitsCtrl.values.hits}}

Central Bank Governor Dr. Indrajit Coomaraswamy

Central Bank Governor Dr. Indrajit Coomaraswamy

Central Bank Governor Dr. Indrajit Coomaraswamy on Tuesday declared that the stability in the economy was broadly on track given the improved macro fundamentals but emphasised a great deal of work was due to ensure more rapid yet inclusive growth in the country. This key observation as well as several other useful insights and recommendations were shared by Dr. Coomaraswamy during his speech at the presentation of Central Bank’s Road Map for 2017 and beyond. Here are excerpts of the CB Chief’s speech:

The presentation of the Road Map is a very important tradition that was initiated by the Central Bank in 2007 and this is the 10th statement in that tradition that we are presenting today. It is our belief that sharing our policy direction would make our policies for the medium- term more predictable and transparent, and would help you in shaping your own plans and operational modalities in the future. It will also ensure greater clarity regarding our policies and actions.

In this context, we believe that harmonisation of purpose and better coordination among private sector and public sector operations would enhance the effective implementation of our policies and measures, thereby helping to achieve our common development goals.

So, let me warmly welcome you to the presentation of this year’s Road Map.

Core objectives of the Central Bank

Ladies and gentlemen, as you aware, the core objectives of the Central Bank are the attainment of economic and price stability and the maintenance of financial system stability with a view to encouraging and promoting the development of productive resources of Sri Lanka. We attach the highest priority to delivering collectively on the mandates given to us. The considerable resources of the Central Bank of Sri Lanka are focused on achieving these objectives on a sustained basis and on performing the important agency and ancillary functions bestowed upon us effectively.

During 2016, we have implemented several proactive policy measures in order to ensure economic and price stability. These policies have helped curb demand pressures in the economy and maintain inflation at a low level. At the same time, we have introduced several policies related to the financial sector with the view of strengthening institutions and ensuring effective and active markets as well as safe and sound payment mechanisms.

In addition to our core functions related to the key objectives I have just outlined, we have performed a number of agency and ancillary functions, thus contributing to enhance the overall performance of the economy.

The Central Bank manages the Public Debt to ensure that the Government’s financing needs and its payment obligations are met at the lowest possible cost over the medium- to long- term, consistent with a prudent degree of risk. The Exchange Control Department also initiated a number of measures in order to create a more conducive environment for both local and foreign investors. The new Foreign Exchange Act is designed to effect further improvements in this regard. A number of measures will be taken in the medium term to further relax foreign exchange transactions.

The Central Bank is also the manager of the Employees’ Provident Fund, which is the largest superannuation fund in the country. Through the activities of the Regional Development Department and the provincial offices, the Central Bank seeks to strengthen the delivery of credit to the agriculture sector and to small and medium scale enterprises as well as the microfinance sector, thus facilitating greater financial inclusion. Also, as the sole authority for issuing currency, the Bank has continued to ensure that all cash transactions take place smoothly.

We consider that communication is an integral part in pursuing policy actions and discharging our responsibilities. Considering the utmost importance of clear communication and enhanced transparency, we attach priority to formulating our policies in a forward looking manner, which will help economic agents to make their economic decisions in a more informed manner.

We are living in a challenging world

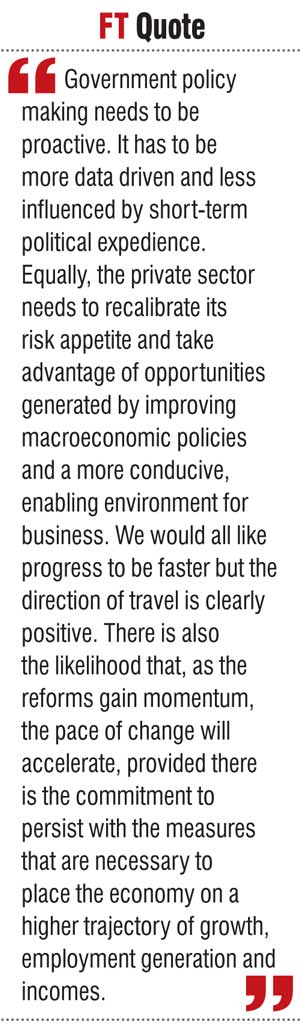

Ladies and gentlemen, today, we are living in a challenging world. Sri Lanka is gradually transforming to an upper middle income economy. However, the objectives of the Government and the aspirations of the people cannot be met through “business as usual” on the part of the public and private sectors. Government policy making needs to be proactive. It has to be more data driven and less influenced by short-term political expedience.

Equally, the private sector needs to recalibrate its risk appetite and take advantage of opportunities generated by improving macroeconomic policies and a more conducive, enabling environment for business. We would all like progress to be faster but the direction of travel is clearly positive. There is also the likelihood that, as the reforms gain momentum, the pace of change will accelerate, provided there is the commitment to persist with the measures that are necessary to place the economy on a higher trajectory of growth, employment generation and incomes.

As the Central Bank, we have a pivotal role to play while being at the heart of this much needed transformation. The Government is putting forward many new initiatives to develop the country. This is happening at a time when the global economy is undergoing yet another transitional period. Hence, this is truly a challenging time, which calls us to be proactive and focused on clear outcomes.

At this juncture, I would like to share some of my thoughts on the Sri Lankan economy in a broader perspective.

Sri Lanka poised for a fresh leap of development

When we review Sri Lanka’s post-independence economic performance, it is clear we could have done better. In the Central Bank’s context, the perennial excess aggregate demand in the economy, created by large fiscal deficits, has complicated monetary and exchange rate policies.

However, I believe Sri Lanka now faces one of its best chances since independence, to correct this situation. In particular, the country does not have a drag in terms of an internal conflict or regressive policies.

Today, Sri Lanka is poised for a fresh leap of development. In that context, it is the responsibility of the Central Bank to provide a stable foundation to leverage the country’s excellent geographical location and favourable international relations to attract investment to foster more robust and sustainable growth and employment generation. Sri Lanka is twenty miles from the fastest growing large economy, India; in the middle of China’s Maritime Silk Route; and fortunate to have excellent relations with a number of capital surplus countries in the world.

As I have repeatedly emphasised, sustained growth requires strengthening macroeconomic fundamentals, implementing structural reforms that increase the competitiveness of the economy, and improving the business environment.

The challenge that we are having right now is to put in place policies that give us sustained stabilisation of macroeconomic fundamentals in the country, amidst uncertain global conditions.

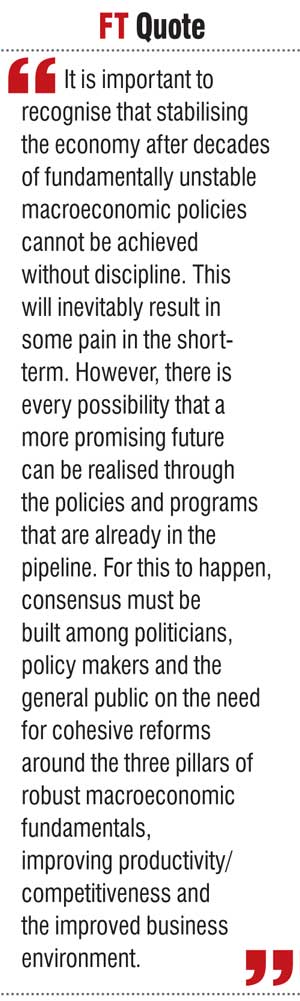

It is important to recognise that stabilising the economy after decades of fundamentally unstable macroeconomic policies cannot be achieved without discipline. This will inevitably result in some pain in the short-term. However, there is every possibility that a more promising future can be realised through the policies and programs that are already in the pipeline. For this to happen, consensus must be built among politicians, policy makers and the general public on the need for cohesive reforms around the three pillars of robust macroeconomic fundamentals, improving productivity/competitiveness and the improved business environment. We have to establish a solid foundation for the nation to meet the imperatives of a new economic growth model, built on the core tenets of high value-added entrepreneurship, creativity and innovation to generate benefits for all Sri Lankans.

The country has a number of structural problems that have been amplified over the years by the large fiscal and trade deficits, which are the core weaknesses of the Sri Lankan economy. Being a twin deficit country increases vulnerability in an uncertain and volatile global economic environment.

Unsustainable budget deficits boost excess and untenable demand in the economy. When there is excess demand, it leads to inflationary pressures and higher nominal interest rates in the economy and there is also a higher propensity to import, given the limitations in domestic supply. That in turn, exerts pressure on the balance of payments and the exchange rate.

This has been the Sri Lankan experience over several decades, which stands in marked contrast to the policies of the successful East and South East Asian countries. Those countries achieved robust fiscal outcomes, low inflation, low interest rates and competitive exchange rates.

We cannot continue with repeating stop-go cycles, with each successive trough becoming more dangerous. We have to change with vigour in order to achieve our objectives. We have missed enough opportunities and we cannot afford to miss them repeatedly. We need decisive policy initiatives implemented with commitment. More importantly, we need to take a longer term view and act accordingly.

We are not in the ICU but clearly in hospital

It is naïve to believe economics can be separated from politics. No country, no society has been able to achieve this. However, we need to ask why Sri Lanka, which was second to Japan in Asia, on most socio-economic indicators, has slipped so far behind today.

We need to ask why this is. In what is often termed the Asian century, Sri Lanka is the only country, other than Afghanistan, in the Asia/Pacific region with an IMF program – having an IMF program is the economic equivalent to being in hospital. We are not in the ICU but clearly in hospital. The remedial treatment is known and it is encouraging that it has commenced. The International Monetary Fund (IMF) itself has recognised that progress has been made in stabilising the economy. Improved fiscal performance has been at the heart of this improvement. Honourable Finance Minister and his team deserve credit for this. However, the continuing challenge is to have the clarity of purpose, focus and determination to implement the necessary changes. It has to be a national effort.

The potential for accelerated development is clearly evident. The Government’s plans, programs and projects, as set out in the Honourable Prime Minister’s Statement and the Budget Speech have sign-posted the way ahead. However, the task now is to continue to turn the good intentions into reality. This journey ahead also requires a rebalancing of economics and politics in economic decision-making, if we are to stay on course.

The Government has commenced a strong revenue-based fiscal consolidation program.

Trade and investment policies are also being changed to harness our untapped potential.

We at the Central Bank, are changing and upgrading many of our processes and policies.

Frameworks are being developed for proactive monetary and exchange rate policymaking on a data driven basis.

In this context, the Road Map 2017 reviews developments in the economy and the policy actions that have been pursued during the past year. More importantly, it seeks to enunciate policies and programs for the forthcoming period.

I hope the policies and the outlook unveiled in this Road Map will be a catalyst in planning your activities and formulating relevant policies in the period ahead. At the same time, I would like to mention that we would not be hesitant to introduce new policies and plans depending on the requirements of the economy and as contingencies arise. Such initiatives would be adopted with necessary consultation and will be clearly communicated to the stakeholders.

Some important points

Now, let me conclude this statement by emphasising some important points.

It is clear that stability in the economy is broadly on track as evident in the improving macro-fundamentals. As the monetary authority and the apex regulator of the financial system of Sri Lanka, we are making our best efforts to ensure stable economic conditions on a sustainable basis.

Some of these policies may be perceived as painful in the short run, but they are meant to strengthen medium-term stability of the economy. This is crucial for the long-term prosperity of all Sri Lankans.

As an agent for stability, the Central Bank would continue to play its role through clear and consistent policies to ensure overall macroeconomic stability in the country. The frameworks that are being developed are intended to support this.

Our role in relation to the country’s economic performance is primarily as a facilitator. As a facilitator, we would continue to support the new growth model of the Government, which focuses on the central role of the private sector.

Our policies aim at supporting the overall thrust of the Government to promote investments, domestic and foreign, and enhance exports. To this end, we would be contributing through our efforts to improving the investment climate and facilitating trade, thereby creating the conditions to harness the benefits of the investment-trade nexus.

In this context, I believe the initial impetus to harness the country’s considerable potential must come from the domestic private sector, particularly in the next year or two. The Megapolis Development Project as well as Master Plans, that have been drawn up by the Government for the development of Hambantota, Trincomalee and Kandy, and various regional development programs will open up tremendous investment opportunities for both domestic and foreign investors.

We are also mindful that while the overall development thrust is on track, there exists disparity in the incidence of poverty across the provinces and districts, despite the progress that has so far been made in reducing overall poverty in the country. Recognising the urgent need to pay attention to this, the Government has declared 2017 as the “Year of Alleviating Poverty” to eradicate poverty in all its forms from Sri Lanka in line with the Sustainable Development Goals (SDGs).

Priority needs to be attached to equitable and inclusive growth, which is key to achieving this objective. Hence, the Central Bank will continue its role in regional development to complement these efforts. Special attention will be paid to enhancing financial literacy as a means of promoting inclusion.

I should also mention that the Government has announced its intention to restructure the Central Bank. We would very much welcome a constructive restructuring process, which would upgrade processes and result in the reform of the Monetary Law and Banking Acts, particularly to give greater powers to the Central Bank to regulate the financial system. We are confident that such moves would be instrumental in enhancing the credibility of the Central Bank, while preserving the independence it needs to perform its roles effectively.

Before concluding, let me express my sincere gratitude to a number of people who are instrumental in supporting our efforts to achieve economic and price stability and financial system stability as well as to deliver our agency and ancillary functions. I am grateful, to His Excellency the President Maithripala Sirisena, and Honourable Prime Minister Ranil Wickremesinghe for their leadership and guidance, and Honourable Finance Minister Ravi Karunanayake for his support, as close coordination between the Ministry of Finance and the Central Bank is essential for sound economic management.

I am privileged to have unstinted support and prudent inputs from the Members of the Monetary Board. Therefore, my deep gratitude is due to Secretary to the Treasury, Dr. R.H.S. Samaratunga, Mrs. Manohari Ramanathan, Mr. Chrisantha Perera and Mr. Nihal Fonseka. They have been giving up an enormous amount of their time to address the challenging issues of the day. I am also thankful to Deputy Governors Dr. Nandalal Weerasinghe, Mr. P. Samarasiri and Mr. S. Lankathilake for their continuous support and excellent and highly professional advice.

Last but not least, let me commend and congratulate the Assistant Governors, Heads of Departments, particularly the Director of Economic Research and the Staff of the Economic Research Department for today’s effort in formulating the policy document, as well as all Staff of the Central Bank who are committed to fulfilling the key objectives of the Central Bank with utmost diligence, proficiency and professionalism. On my first day in office, I said that professionalism, technical excellence and integrity are crucial guiding principles for any institution and its staff. I am very pleased to say I have seen plenty of these characteristics among the staff of the Central Bank of Sri Lanka.

Thank you and I wish you all a Happy and Prosperous New Year 2017.