Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Friday, 16 December 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Activity in secondary bond markets remained rather dull yesterday with two way quotes widening, as the U.S. Federal Reserve increased interest rates by 25 basis points on Wednesday.

This coupled with the expectation of a primary Treasury bond auction in lieu of the maturity coming up on 01.01.2017, amounting to Rs.72.8 billion, prompted most market participants to continue to remain on the sidelines.

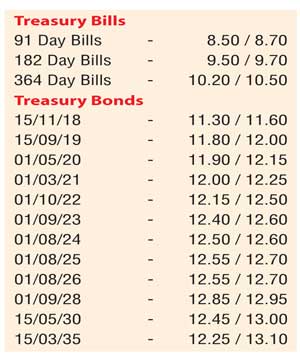

A limited amount of trades were witnessed of the two 2018 maturities (i.e. 15.07.18 and 15.11.18), 01.08.25, 01.08.26 and 01.09.28 maturities at highs of 11.30%, 11.40%, 12.65% each and 12.91% respectively.

In money markets, the overnight repo rate increased further to average 8.73% as the net liquidity shortfall increased to Rs.22.186 billion. The OMO Department of the Central Bank, injected a total amount of Rs.5.60 billion, by way of five outright purchases of Treasury bills, at weighted average rates of 9.66%, 9.70%, 9.71%, 9.75% and 9.90% for durations of 238, 245, 259, 273 and 287 days respectively, valued today. The overnight call money rate remained steady at 8.42%.

Rupee depreciates

The Rupee on the active spot next contracts was seen depreciating once again yesterday to close the day at Rs.149.50/65 against its previous day’s closing level of Rs.148.95/05 on the back of the FED rate hike.

The total USD/LKR traded volume for 14 November was $ 28.00 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 150.15/35; three months – 151.75/85; six months – 154.10/20.