Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Tuesday, 6 December 2016 00:03 - - {{hitsCtrl.values.hits}}

Investing is serious business and you’d think making an investment in a Unit Trust Fund involves a lengthy and tedious documentation process, however investing in a fund by licensed Unit Trust Management firm Guardian Acuity Asset Management (GAAM) is hassle free and convenient.

Unit Trust management companies are licensed and regulated financial service providers andUnit Trusts are pooled investment vehicles, where money collected from a number of investors(could be individuals or institutions) is invested in different financial instruments, such as stocks, fixed deposits, bonds etc.

They are called Unit Trusts because money contributed by each investor is translated into units (I.e. if you invest Rs. 100,000, and if the per unit price on the date of investment is Rs. 10, that means you have essentially invested in 10,000 Units).

The return to investors is based on the change in per Unit Value from the point of investment. The Unit Value in turn is computed based on the returns generated by the respective financial instruments the fund is invested in. (For example, if it is a fixed income fund invested in Fixed Deposits and Debentures, the unit value represents the interest returns from fixed deposits and debentures.)

Guardian Acuity Asset Management is a joint venture between Ceylon Guardian Investment Trust PLC (Subsidiary of local conglomerate Carson Cumberbatch PLC) and Acuity Partners (a joint venture between DFCC and Hatton National Banks).

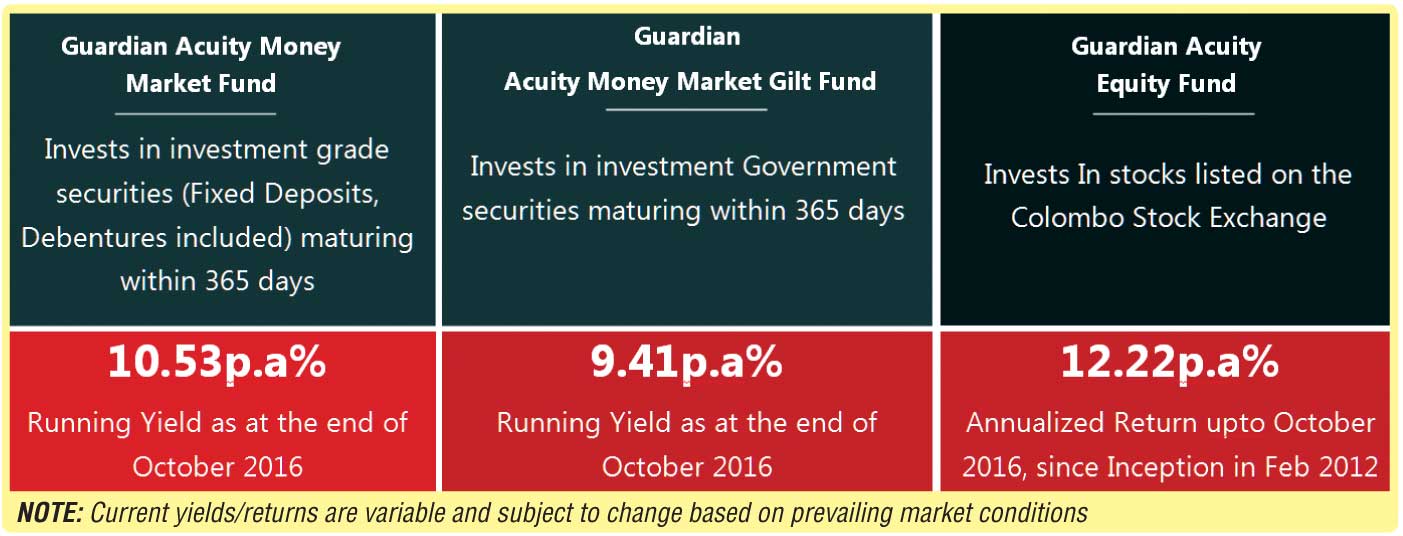

The company offers three types of open ended Unit Trust Funds for investors and has been recognized for its performance and sound operations in various platforms.

According to Mohandas Thangarajah, General Manager of GAAM, a first time investor with GAAM can open an account with the company in no time, using the GAAM investor portal. Describing the process further, Manager Operations, Champa Perera stated “All you have to do is visit our website www.guardianacuity.com, click on ‘Check Your Investment Balances’ in the homepage, enter your NIC or Passport number and submit the online subscription form which includes the KYC details. Subsequently, if you are an individual investor E-mail us a scanned copy of your NIC (signed by the investor), a Utility Bill (for proof of address), and the deposit slip of your initial investment. Also, corporate investors need to submit their respective KYC documents as instructed in the subscription form.”

Thangarajah went on to say that investing in GAAM funds is also easy due to the fact that the Company has collection accounts with multiple banks in the country, namely; HNB, DFCC, Deutsche Bank and Commercial Bank. “Consequently, investors can make their deposit in any of the aforementioned bank branches located anywhere in the country, while you can also use the online transaction system of HNB to deposit your funds”.

Thangarajah added that investors could use the online portal to check their fund investment balance, monitor movement in fund unit prices, monitor movement in fund investments, switch between funds and make subsequent investments as well.

For more information on Unit Trusts, visit the Unit Trust Association of Sri Lanka website www.utasl.lk.