Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 27 October 2016 00:00 - - {{hitsCtrl.values.hits}}

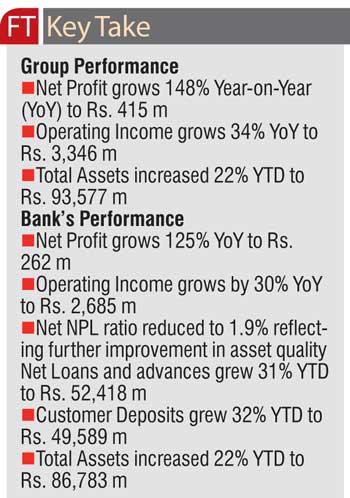

Union Bank of Colombo Plc (the bank) and its subsidiaries UB Finance Ltd and National Asset Management Ltd (the group) have recorded a combined Group Profit after Tax (PAT) of Rs. 415 m, reporting a notable increase of 148% Year-on-Year (YoY) during the first nine months of 2016.

Core banking growth and profitability

The bank’s post-tax profit for the period was Rs. 262 m, a 125% increase YoY.

Reflecting steady progress, total operating income of the bank grew by 30% YoY to Rs. 2,685 m. Reflecting a strong Core Banking performance, Interest Income grew by 66% YoY to Rs. 4,951 m.

Interest Expense grew by 128% YoY to Rs. 3,301 m. As a result, NII grew by 7% YoY to Rs. 1,651 m. The bank’s fee and commission income of Rs. 239 m is an increase of 57% over the comparative period with fee income from business lending, cards and trade transactions being the primary contributors of the said impressive growth. Other income grew significantly by 104% to Rs. 846 m. The bank does not have any exposure to the equity market.

Reflecting a significant improvement in the quality of the portfolio, the Net NPL ratio improved to 1.9% from 2.7% in December 2015 with a corresponding reduction in impairment charges from the comparative period. Total Impairment charge for the period is Rs. 38 m and reflected a 72% reduction YoY.

The bank’s total operating expenses increased by 31% to Rs. 2,226 m primarily due to investment spending on new branches, ATMs, staff and technology in line with the strategic plan.

The bank remains well capitalised with a strong core capital adequacy ratio of 23% and a total capital adequacy ratio of 22%.

The bank’s balance sheet expanded by 22% YTD to reach Rs. 86,783 m. Loans and advances grew by 31% to Rs. 52,418 m during the period under review, while customer deposits reflected a growth of 32% to Rs. 49,589 m.

Operational performance

The continuous improvement of the bank’s financial performance affirms the success of the concerted efforts of Union Bank in its new strategic focus following the landmark investment from TPG - one of the largest global private investment firms.

Key operational and business performance enhancers implemented up to the third quarter of 2016 have contributed to the continuous growth of Union Bank’s financial performance, while strengthening its new position as a fully-fledged commercial bank serving a diverse clientele including the Retail, SME and Corporate segments. Such crucial strategic steps implemented by the bank include efficiency enhancements, channel development and portfolio diversification.

In line with Union Bank’s mandate to deliver greater banking convenience, the bank extended its reach within the Western Province with the opening of its 65th branch in Borella in July 2016. The branch, located at No. 40, Gnanartha Pradeepa Mawatha in Colombo 8, offers a comprehensive portfolio of products and services including Retail, Corporate and SME banking solutions, delivered in an open, customer-centric and welcoming ambience that provides a redefined banking experience with greater convenience and better engagement of customers.

Facilitating further convenience and ease of access, Union Bank expanded its offsite ATM network to 53 ATMs by the end of the third quarter of 2016, increasing its overall ATM network to 119. Union Bank’s island-wide network expansion will continue to support its business growth while the sizing up of its network of offsite ATMs and entering into strategic partnerships that deliver enhanced convenience will continue to add value to the customer experience.

Adding more versatility to its Retail Banking portfolio, in September 2016 Union Bank announced the launch of Union Bank Invest Plus - a systematic investment plan designed to reward the commitment of prudent savers who are willing to save on a continuous basis.This pragmatic addition to the range of Retail Banking solutions offered by the bank is expected to help clients to follow a disciplined savings routine to enjoy a guaranteed return on their savings. The new product, which aims to build long-term relationships with clients while channeling continued deposit inflows, is expected to make significant contributions to the bank’s deposit portfolio.

The bank continued strong growth across the SME, Corporate and Retail Banking segments in the third quarter of 2016. The innovative cash management solution, which was launched within the second quarter of the year, showed increased customer uptake, contributing to portfolio expansion.

Commenting on the performance of the bank, Union Bank Director/Chief Executive Officer Indrajit Wickramasinghe said: “Union Bank’s first nine months’ results are impressive, given the changes taking place in the market space. The growth achieved despite macroeconomic challenges can be attributed to the operational excellence and renewed strategic business focus of the bank. In a bid to continue this growth momentum for the remainder of the year, Union Bank will continue to harness the benefits of its operational efficiencies while continuing to diversify our product portfolio and delivery channels to cater to the growing customer bases. With the backing of a strong capital base, a focused business plan and a dynamic team geared for performance, Union Bank will continue to build on this success, while taking on the challenges and opportunities that will emerge within the final quarter of 2016 and beyond.”