Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 26 October 2016 00:01 - - {{hitsCtrl.values.hits}}

The secondary bond market yield curve continued to witnesses the rare phenomenon of a flattening effect, as a result of continuous foreign selling on the short end to the belly end of the curve and moderate buying interest on the long end.

The secondary bond market yield curve continued to witnesses the rare phenomenon of a flattening effect, as a result of continuous foreign selling on the short end to the belly end of the curve and moderate buying interest on the long end.

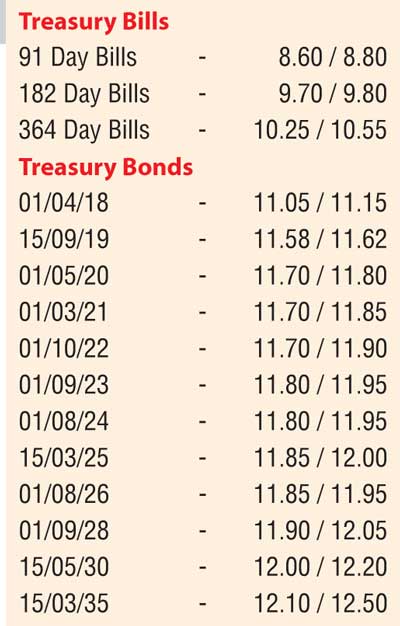

The early 2018 maturity of 01.04.2018 saw its yield increase to 11.06% against its yesterday’s closing of 10.80/00 while the 15.09.2019 moved up to 11.60% against its closing of 11.46/50. In addition, the yield on the 01.05.2020 and the 01.08.2020 maturities increased to daily highs of 11.70% and 11.90% as well against its day’s opening low of 11.65% and 11.85%. However, buying interest on the 01.08.2026 maturity saw it change hands at 11.85% to close the day at 11.85/95.

In the secondary bill market, August 2017 maturities were seen changing hands within the range of 10.40% to 10.50%. This was ahead of today’s weekly Treasury bill auction, where a total amount of Rs. 25 billion will be on offer consisting of Rs. 6 billion on the 91 day, Rs. 7 billion on the 182 day and a further Rs. 12 billion on the 364 day maturity. At last week’s auction, weighted averages were seen increasing across the board by 05, 07 and 08 basis points respectively to 8.60%, 9.46% and 10.19%. Given below are the closing, secondary market yields for the most frequently traded maturities.

In money markets, overnight call money and repo rates were seen holding steady to average 8.42% and 8.73% respectively as the net liquidity shortfall was at Rs. 29.409 billion yesterday. An amount of Rs. 30 billion was injected into the system by the OMO department of Central Bank at a weighted average of 8.50%.

Rupee holds steady

The USD/LKR rate on the spot next contract closed the day broadly steady yesterday at Rs. 147.90/05, subsequent to dipping to an intraday low of Rs. 148.10.The total USD/LKR traded volume for the 24 October 2016 was $ 41.21 million. Given below are some forward USD/LKR rates that prevailed in the market.