Saturday Feb 14, 2026

Saturday Feb 14, 2026

Thursday, 28 July 2016 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

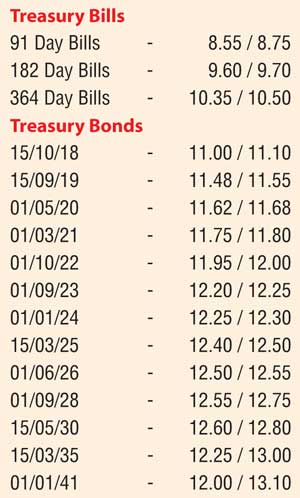

The weighted averages at yesterday’s weekly Treasury bill auction declined for a third consecutive week with the 182 day and 364 day bills recording decreases by 06 and 01 basis points respectively to 9.69% and 10.48%. However, all bids received on the 91 day were rejected. A total amount of Rs.20.15 billion was accepted against its total offered amount of Rs.19 billion.

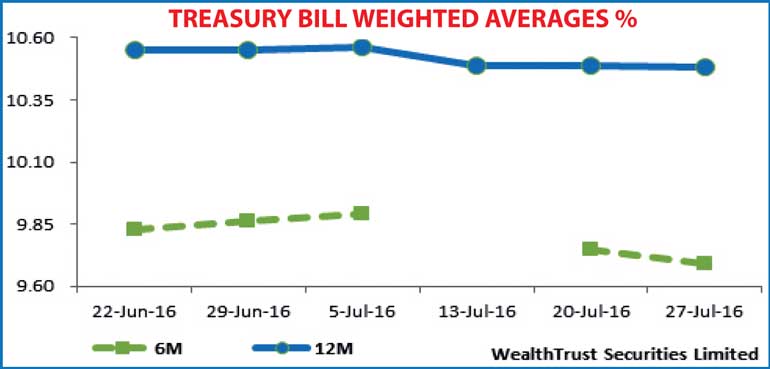

In secondary bond markets, renewed buying interest mainly on the belly end of the yield curve saw yields decrease for the first time in six days.

The liquid maturities of 01.10.22, 01.01.24, 15.03.25 and 01.06.26 saw its yields dip to intraday lows of 11.94%, 12.27%, 12.45% and 12.50% respectively against its previous day’s closing levels of 11.98/05, 12.32/39, 12.50/55 and 12.55/60.

On the short end of the curve, the 15.11.18, 15.09.19 and 01.08.20 maturities were seen changing hands within the range of 11.00% to 11.05%, 11.48% to 11.52% and 11.68% to 11.72% respectively as well.

This was ahead of today’s monetary policy announcement for the month of July 2016 due at 6.00 pm. Policy rates have been held steady at 6.50% and 8.00% for four consecutive months.

Meanwhile in money markets, the Open Market Operations (OMO) Department of Central Bank was seen injecting an amount of Rs.30.22 billion at a weighted average of 7.98% on an overnight basis as the net liquidity shortfall reduced to over a three week low of Rs.35.77 billion yesterday. The overnight call money and repo rates remained steady to average 8.24% and 8.06% respectively.

Rupee remains steady

The USD/LKR rate on the active one week forward contract remained steady to close the day at Rs.146.25/30. The total volume traded during the day of 26 July was $ 61.50 million. Given are some forward USD/LKR rates that prevailed in the market: one month – 146.95/05; three months – 148.55/65; six months – 150.85/95.