Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 27 July 2016 00:00 - - {{hitsCtrl.values.hits}}

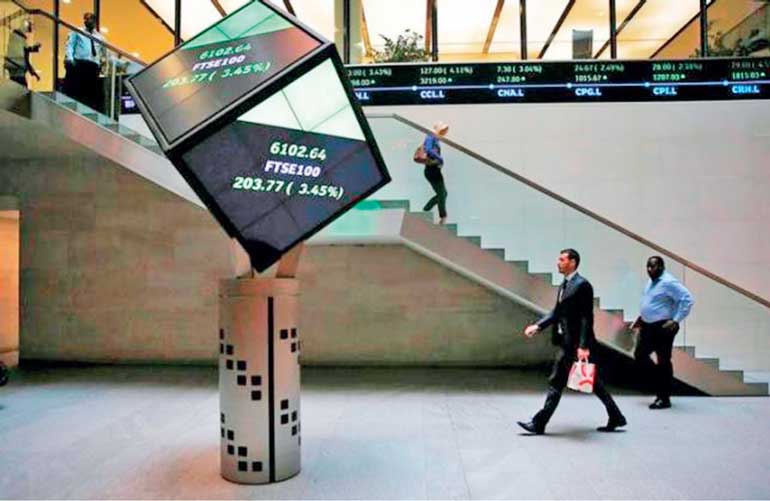

People walk through the lobby of the London Stock Exchange in London, Britain 25 August 2015

London (Reuters): A buoyant yen and a fall in oil prices to their lowest since early May put stock markets on the defensive on Tuesday, as investors position for central bank meetings in the United States and Japan.

The rise in the yen, traditionally a safe haven for capital when investors are concerned by political and economic risks, may be largely due to a recalibrating of expectations for the scale of new economic stimulus from the Bank of Japan on Friday.

Japanese officials have quelled speculation of it dropping outright “helicopter money” into the economy, but even expectations for the scale of extra buying of financial assets with newly-minted yen have cooled this week.

A Nikkei report said Japan’s government was likely to double the amount of direct fiscal outlays into the economy over the next few years to six trillion yen ($57 billion). But that figure was viewed as too modest to engender a return of inflation that would weaken the yen.

“There had been too many test balloons concerning Japan’s upcoming monetary and fiscal easing programs over recent weeks,” analysts from Morgan Stanley said in a morning note.

“While such a (six trillion yen) package would still double the (finance ministry’s) ... real fiscal spending estimates, it was far less than markets were hoping for.”

The yen rose around 1.5% to 114.88 yen per euro and 104.35 per dollar. Japan’s stock market, which tends to fall as the yen rises, fell 1.4%.

After a mixed start, Europe’s major markets were all lower, hauled down by another half percent fall in oil prices, which took Brent crude to its lowest since May 10.

MSCI’s broadest index of Asia-Pacific shares outside Japan edged up 0.7% to reach its highest in almost a year, aided by gains in China and South Korea.

Weale’s U-turn

Stock markets have recovered well from the shock of Britain’s vote last month to leave the European Union, largely on the presumption that central banks would wade in with more stimulus to offset any blow to still meager global growth.

While the doubts over the Bank of Japan may undermine that, Bank of England policymaker Martin Weale – last week an opponent of cutting interest rates – said his view had changed on the back of a poor batch of purchasing managers surveys.

That strengthened expectations of easing of UK monetary policy next month and sent the pound to a two-week low against the euro.

By contrast, Wednesday’s June rate decision by the Federal Reserve is expected to provide a slightly more optimistic message that will support expectations of a rise in U.S. rates by the end of the year.

Such a message from the Fed would be likely to support the dollar – already trading close to four-month highs against a basket of currencies – while cooling appetite for stocks and other higher-risk investments.

“There seems to be an expectation that perhaps this week’s Federal Reserve rate meeting could well come across as slightly more hawkish than markets were pricing a week ago,” CMC Markets analyst Michael Hewson said.

“This may help explain the slow rise of the dollar not only against its main counterparts but also against commodity prices.”

A maze of crude oil pipes and valves is pictured during a tour by the Department of Energy at the Strategic Petroleum Reserve in Freeport, Texas, US 9 June

A maze of crude oil pipes and valves is pictured during a tour by the Department of Energy at the Strategic Petroleum Reserve in Freeport, Texas, US 9 June

London (Reuters): Oil on Tuesday hit its lowest since May, falling towards $44 a barrel, pressured by concerns that a long-awaited rebalancing of the market would be delayed due to excess supply.

Brent crude is still up more than 60% from a 12-year low near $27 in January, but the rally has petered out on signs that the supply glut will persist and as economic jitters raised concern about the strength of oil demand.

Global benchmark Brent was trading at $44.44 a barrel at 1007 GMT, down 28 cents. It fell to $44.28 intraday, the lowest since May 10. US crude was down 43 cents at $42.70, having fallen to its lowest since April earlier.

“Right now, there is not much to be optimistic about,” said Olivier Jakob, oil analyst at Petromatrix, citing weak refining margins that will probably weigh on crude demand. “We have to wait a little bit longer for the rebalancing.”

Britain’s BP, the first oil major to report second-quarter results, on Tuesday reported lower-than-expected profit and said its refining margins were the weakest for a second quarter in six years.

Record crude output from the Organization of the Petroleum Exporting Countries, a glut of refined products and signs of more drilling activity in the United States in the face of low oil prices have added to concern about excess supply.

US drillers added oil rigs for a fourth consecutive week. The decline in U.S. output has been key to balancing a market weighed by excess supply for two years.

BP Chief Executive Bob Dudley was upbeat on the oil price outlook, saying the market would start to recover towards the end of the year and into 2017, although excess inventories would take longer to get rid of.

“We do see the market coming into balance, it may already be there,” he told Reuters. “There’s a lot of stocks. It will take some time to work its way off, 18 months or so.”

Also dampening sentiment, many traders are reducing their bets on rising prices.

Hedge funds and other money managers cut their net long position – bets on rising prices – in Brent and U.S. crude futures and options by 31 million barrels to 453 million in the week ending on July 19. U.S. inventory reports from industry group the American Petroleum Institute and the U.S. Department of Energy due this week are expected by analysts to show a fall in crude stocks but a rise in gasoline supplies.

London (Reuters): Gold rose on Tuesday as the dollar slipped ahead of a two-day Federal Reserve policy meeting this week, which will be closely watched for clues on the outlook for U.S. interest rates.

The Fed is expected to leave policy unchanged at its meeting starting later in the day, but investors are watching for any signs that the U.S. central bank may move back to tightening later this year.

Spot gold was up 0.5% at $1.321.57 an ounce at 0930 GMT, while U.S. gold futures for August delivery were up $1.90 an ounce at $1,321.40. “Looking at Fed funds futures, no one is really expecting a move this week, but what the meeting may do is give us more of a clue as to what might happen in September, and perhaps in November and December,” Mitsubishi analyst Jonathan Butler said.

“It does still look like there could be a rate rise before the end of the year,” he said. “That is consistent with the improving economic situation, particularly the strong employment data for June, and there are also sighs that inflation is starting to pick up as well.” Gold is highly sensitive to rising U.S. interest rates, which lift the opportunity cost of holding non-yielding bullion, while boosting the dollar, in which it is priced.

A scaling back of expectations for further increases in U.S. interest rates, which rose for the first time in nearly a decade in December, has helped push gold up 24% this year.

The dollar fell a quarter of a percent against a currency basket, largely due to a bounce in the yen after traders dialled back expectations of how much new stimulus Japanese authorities will inject into an ailing economy.

Holdings of the world’s largest gold-backed exchange-traded fund, SPDR Gold Shares, fell 0.46% to 958.69 tonnes on Monday.

A surge in Western investment helped offset sliding Asian demand in the second quarter, GFMS analysts at Thomson Reuters said on Tuesday, as they hiked their gold price forecast for the year in response to jitters over the economic outlook.

Top consumer China’s net gold imports via main conduit Hong Kong fell 38.5% in June, data showed on Tuesday.

“Gold exports from China to Hong Kong reached a 6-month high of 12.2 tons in June, which contributed to lower net imports,” Commerzbank analyst Carsten Fritsch said.

Palladium was down 0.2% at $683 after touching a nine-month high of $688 in Asian trading hours. Silver was up 0.8% at $19.68 an ounce, while platinum was 0.7% higher at $1,085.20 an ounce.