Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 29 June 2016 00:00 - - {{hitsCtrl.values.hits}}

The UK’s withdrawal from the European Union (EU) following the referendum of Brexit – abbreviation of British exit – last Friday has created ripples in global markets. The British Pound fell to its lowest level since 1985. In the circumstances, investors flee risky assets and take refuge to the dollar and yen. Brexit is a blow to emerging market economies such as Sri Lanka which are already hit by the global financial turmoil and the economic setback in the aftermath of the US rate hike in last December.

Sri Lanka is exposed to Brexit as she has fairly significant trade, investment and financial links with the UK and the EU. Brexit came at a time when Sri Lanka is under severe balance of payments pressures with heavy external debt payments amid credit rating downgrades.

Market reactions

In 1973, the UK joined the European Economic Community (EEC), which was the precursor of the EU. The UK decided to remain as a member of the (later known as EU) in 1975, based on the results of a referendum favouring the continuation of the membership. Since joining the community, however, the UK appeared to have resistance towards Europe.

The Brexit sent shock waves to capital markets. Stocks tumbled sharply on Friday across global equity markets. US shares were down by 3.6%. The Dow Jones industrial average declined by 611 points, its biggest drop since last August.

The Brexit is predicted to result in economic setbacks in the UK as well as in the EU. Its impact would spill over to the emerging Asian economies through multiple channels including currency swings, trade exposure, bank lending, equity capital flows, inward remittances, and tourism. The scenario may change in the long run depending on the future relationship between the UK and the EU.

Currency swings

Currency swings

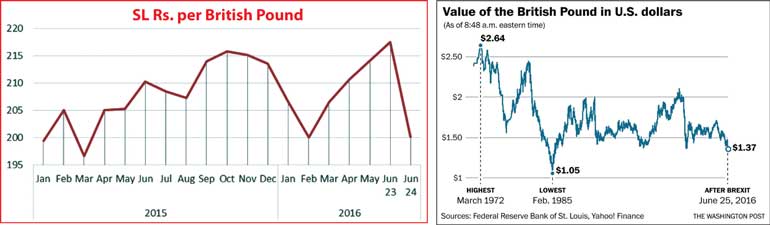

Wild currency fluctuations were evident immediately after the Brexit. The British Pound, which was trading at 1.50 against the US dollar hours before the Brexit, hit 1.33 dollars as the “Leave” campaign gathered momentum, depreciating around 10% and reaching a low not seen since 1985. Later, it reached 1.37 and remained at the same level till Saturday morning. The euro too depreciated against the dollar by nearly 8%.

The depreciation of the pound and the euro tends to discourage imports to Europe, and therefore, exports from emerging market economies are likely to suffer. However, these effects would taper off over time with the anticipated lesser currency fluctuations.

Following the Brexit, SL rupee appreciated against the pound by 9% from Rs. 217.53 on 23 June to Rs. 200.10 on 24 June. Thus, the rupee appreciated to the peak level prevailed in last February before it depreciated in subsequent months against the pound. The rupee was up against the euro by about 3% on 24 June compared with the previous day.

This single-day appreciation of the rupee partly nullified the export competitiveness gained by Sri Lanka through rupee depreciation during the last few months. Since the EU as well as the UK are major trading partners of Sri Lanka, the rupee appreciation vis-à-vis their currencies has adverse effects on the export sector. This calls for a further depreciation of the rupee on top of the current rupee weakening.

Sri Lanka’s trade exposure to EU and UK high

Sri Lanka’s exports to EU account for about 30% of the country’s total exports. Hence, developments in the EU have a significant bearing on the Sri Lankan economy. The depreciation of the euro coupled with the anticipated economic setback in the Euro region will diminish the demand for Sri Lanka’s exports.

Being the second largest destination for Sri Lanka’s exports, the UK accounts for about 10% of total exports. As in the case of EU, the developments emerged in the UK after the Brexit will have adverse consequences on our exports. Specifically, the fact that the UK is no more a partner with EU in offering GSP Plus facility is a major policy concern for the government.

Imports from EU to Sri Lanka account for about 9% of total imports and imports from UK account for 2%. Given the depreciation of the euro and the pound, imports from Europe would be cheaper unless the SL rupee weakens adequately to offset the effect.

Inward remittances and tourism

The amount of annual inward remittances received from the EU region is around $ 1.2 billion accounting for 18% of total remittances. A setback in these remittances could be expected due to the depreciation of the euro and the envisaged economic setback in the region.

Around 30% of the total number of tourists are coming from Western Europe. The depreciation in their currencies makes outward tourism more expensive for the Europeans. On the contrary, Sri Lankans will find it cheaper to travel in Europe, particularly in the UK.

Brexit amid sovereign outlook downgrade

The capital markets which are already hit by the US rate hike a few months ago will have fresh shocks with uncertainties surrounding Brexit. Sri Lanka’s dependence on foreign borrowings have risen in recent times due to heavy debt service commitments. While export earnings being sufficient to finance only around one half of import outlays, commercial borrowing to bridge the external gap has become the order of the day. As investors would prefer safe instruments such as US bonds and gold in the midst of uncertainty, lending to vulnerable emerging market economies like Sri Lanka will diminish.

The external pressures are exacerbated by the recent downgrading of Sri Lanka’s sovereign outlook. Moody’s investor service downgraded Sri Lanka’s sovereign rating to negative from stable on 20 June. The weakening fiscal outlook and renewed liquidity and external pressures are the key drivers that underpinned Moody’s downgrade.

In March, the Fitch Rating agency downgraded Sri Lanka’s sovereign credit rating to negative from stable indicating a significantly weak credit risk. The negative outlook means more downgrades are on the cards.

The rating downgrades have adverse implications for Sri Lanka’s foreign finance which already in poor shape providing itself the basis for the downgrade, and thereby creating a vicious circle of forex shortages. The rating cut will add pressure to the Government in its efforts to seek sovereign borrowings abroad. The Government will not only have difficulties in raising more funds but it will also have to bear high borrowing costs for new loans to cover the risk premium as reflected in the rating downgrade.

Call for tighter policy measures

The current monetary policy stance with market-responsive exchange rate and interest rate systems began to act as counter-cyclical measures to curb demand-driven inflation and surge in consumer goods imports, as pointed out in my previous articles in this paper. However, the emerging developments in the global markets following the Brexit, a much faster depreciation of the rupee and further tightening of monetary policy seem inevitable.

The Extended Fund Facility (EFF) agreed upon with the IMF early this month lays down the policy agenda for the medium-term to deal with the fiscal and external imbalances. Unless this stabilisation program is reinforced by fiscal consolidation with strong political commitment, the country’s resilience to external shocks is going to be extremely weak in the coming months.

(Prof. Sirimevan Colombage, an economist, academic and former central banker, can be reached at [email protected].)