Thursday Feb 26, 2026

Thursday Feb 26, 2026

Monday, 27 June 2016 00:00 - - {{hitsCtrl.values.hits}}

Major surprise as vote tallies point to Brexit

Based on 92% of constituencies declared at 05:20am, we believe that the “Leave” vote has won, with around 52% of the vote. Turn-out was very high, around 72%, but much higher in many Leave areas. As it stands, Scotland (62% Remain) and Northern Ireland  (54%) voted to Remain, but Wales (53% Leave) and England (54%) to Leave.

(54%) voted to Remain, but Wales (53% Leave) and England (54%) to Leave.

Within England, inner London showed strong support for “Remain”. Final results are expected later in Manchester Town Hall. If confirmed, it would be an unprecedented event for the EU, and the most destabilising instance of Vox Populi Risk globally to date. This Brexit vote goes against our base case for a “Close Remain” outcome, even if we had argued that the risk of a “Leave” win was high (40%). This represents a major surprise as predictions markets had been assigning a 25% likelihood to a “Leave” win on the morning of June 23, and risk assets had rallied noticeably up until polls closed.

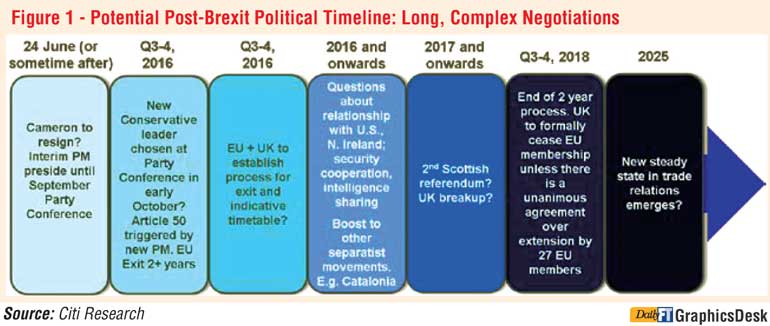

Far-reaching potential political consequences of Brexit

These include possibly a 2nd Scottish independence referendum (leading to UK break-up) and the potential collapse of the Good Friday agreement in Northern Ireland. Sinn Fein has called for a re-unification referendum in Ireland.

A Brexit result will also boost other nationalist and separatist parties/movements — in Europe and possibly beyond — likely leading to more opposition and challenger parties campaigning on the basis of a reformed deal with the EU and offering copycat referendums, while a new “steady state” in relations with the EU and other trading partners is unlikely to emerge before 2025, after a prolonged period of uncertainty.

What happens now in the UK

The UK’s position in the EU is unchanged until exit procedures are completed, which are likely to take two years once Article 50 of the EU Treaty is triggered. We expect PM Cameron to resign although there will be calls for him to stay on and preside over the transition. We also expect a new Conservative Party leader and PM to be chosen before starting exit negotiations, though Brussels may push for this to happen sooner. Following the resignation of the PM, we would expect an interim PM such as Home Secretary Theresa May to take over until a new Conservative leader is chosen at the 2-5 October party conference.

The EU is bracing for the aftermath

We do not expect a post-Referendum compromise or prospect for a counter-offer from the EU that would reverse the result of the referendum. We expect EU Heads of States and Governments to meet perhaps as early as Saturday and issue a statement respecting the result, while reassuring the rest of the EU that contingency plans are in place.

Risk of lasting uncertainty

The Brexit vote creates: i) lasting uncertainty about the future relationship of the UK with the EU, ii) a trade-off for the BoE between stabilising growth and dealing with the probable surge in inflation, and iii) a trade-off for the UK Treasury between stabilising growth and the protection of its sovereign credit rating at a time of large current account and fiscal deficits. At the EU level, it will likely freeze EU integration and increase the risk of copycat referendums, among other political risks.

Expect shockwaves through markets and economies

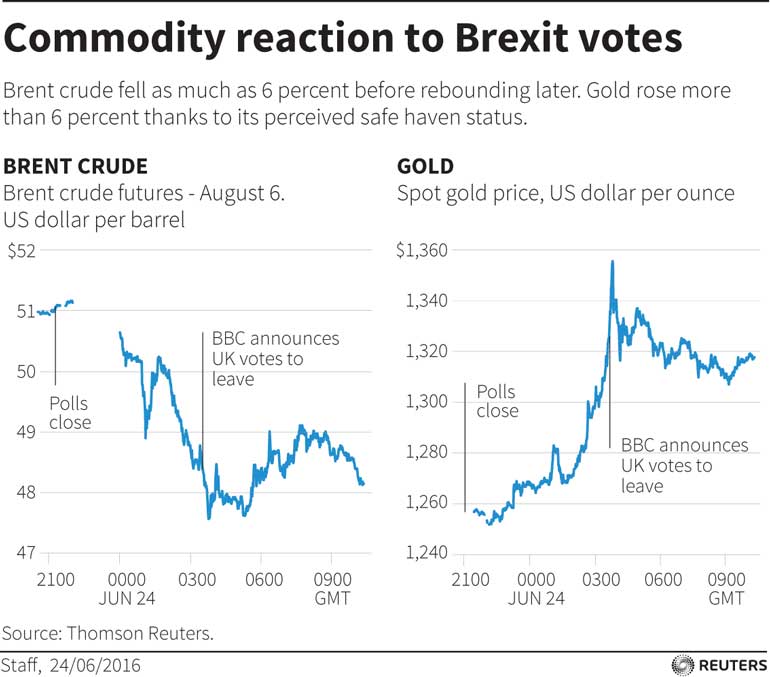

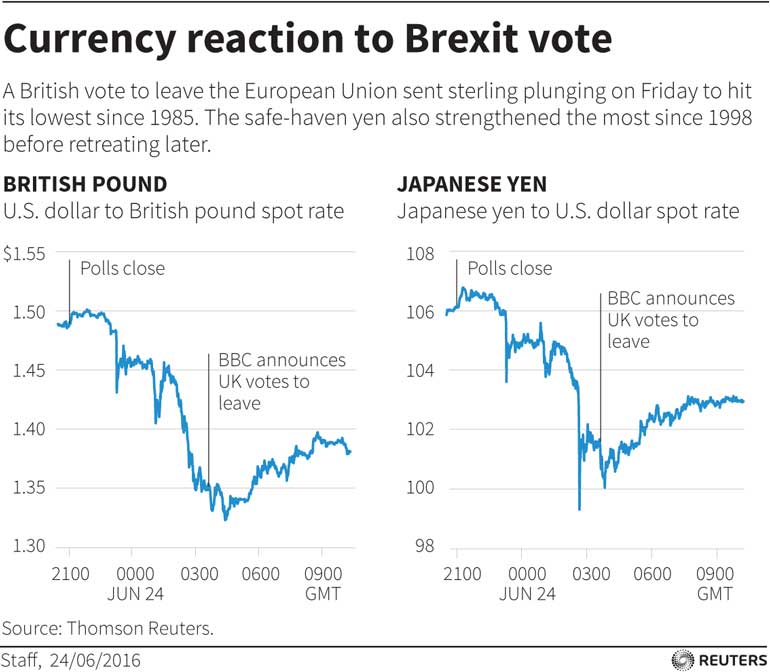

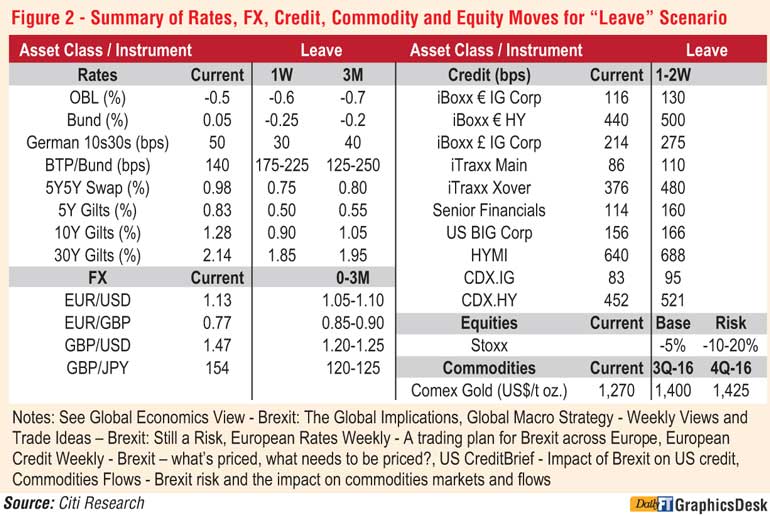

Large swings overnight, aggravated by previous moves in the opposite direction, give a clear indication of likely moves. Sterling has recorded a 16% drop against JPY, 10% against USD and 7% against EUR so far today. Treasury yields dropped by >20bp and stock markets in Asia posted sharp losses (-6% in Tokyo). We had expected sterling to fall by up to 15% on a trade-weighted basis, alongside a 30bp drop in long-term Gilt yields, while equities may sell-off by up to 20% and credit spreads widen.

Along with major uncertainty about the future relationship between the UK and EU, we expect this to translate into lower real GDP forecasts. The likely economic cooling is estimated to be biggest in the UK, where our Leave scenario suggested we would lower our real GDP forecasts by 3-4pp versus our baseline in the next three years. In the euro area, it could shave 1-1.5pp off our GDP growth baseline. Elsewhere, the impact is likely to be more modest, but negative as well.

Most likely policy responses

In the short term, we expect major central banks and regulators to take steps in case of excessive market turbulence and to launch liquidity support measures. In the following days and weeks, we would look for the BoE to cut the Bank Rate by 25bp (at least by 14 July) and perhaps restart additional asset purchases. The ECB (21 July) and other European central banks will likely envisage a cut in their policy rate if FX strengthens or inflation weakens, resulting in an unwanted tightening of financial conditions. For the Fed, a delay in the next rate hike to Dec-16 or beyond is likely, in our view. Focus will be on the BoJ given the recent currency moves. In the event of disorderly currency moves, G7 central banks could launch coordinated FX interventions.