Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 27 June 2016 00:00 - - {{hitsCtrl.values.hits}}

HSBC Global Research Pan Asia Equity Strategy has come out with its initial assessment on what Britain’s “Leave” vote means to Asian equities.

While this may have many (unintended) near- and long-term consequences for broader economic growth, corporate financials, and asset allocation, including equity performance, in this report HSBC focuses on one more immediate factor: GBP volatility.

Generally speaking, volatility in currency markets impacts the discount rate. It also shifts profits between countries and sectors. It can also create translation effects – assets (or debt) in USD will now translate into higher local currency assets (or debt).

Using regression analysis, HSBC identifies which markets, sectors and stocks are most and least sensitive to these factors. These are primarily found in ASEAN – given changes in the discount rate – and in Hong Kong – due to translation effects and operations run by Hong Kong companies in the UK. Here are excerpts:

Sensitivities to the UK

This summer is turning out to be an eventful one1, especially as Britain has now voted to leave the European Union.

Below, we look at the impact on Asian equities. We believe that there are various channels through which this decision could impact Asian equities in both the near and longer term:

1. FX volatility and spill-over effects to Asian FX and equities. This will have an immediate impact on Asian markets, but longer-term contagion effects cannot be ruled out, especially if the level of volatility is higher than anticipated. Furthermore, it is unclear how or whether central banks and other policymakers will react to these risks.

2. Increased uncertainty undermines business confidence. While businesses wait to see how the mechanics of exiting the EU will actually be implemented, they may hold off on new investment, especially if that new investment is contingent on Europe’s economic outlook and if European aggregate demand is negatively impacted. There may be longer-term consequences for the location of business activity within the EU, but the bigger near-term risk for Asian corporates is the extent to which European demand is impacted.

3. Question regarding the rise of protectionism. It is possible that the UK’s exit from the European Union could be seen as a broad response to free markets, across trade, capital and labour. If so, this development could raise questions around higher barriers to trade and a potential shift to greater market protectionism.

Exposure to GBP volatility

In this report, we focus on the first factor: the impact that FX (GBP) volatility has on Asian equities. We calculated the sensitivity of equity prices across Asia to the GBP using multiple regression equations2. The regression results are presented below. In the charts and tables, the adjusted R-squared measures the overall sensitivity/defensiveness of the EM equities to the various factors under discussion.

Currency movements impact equity markets in a variety of ways. Here we look at the three major channels.

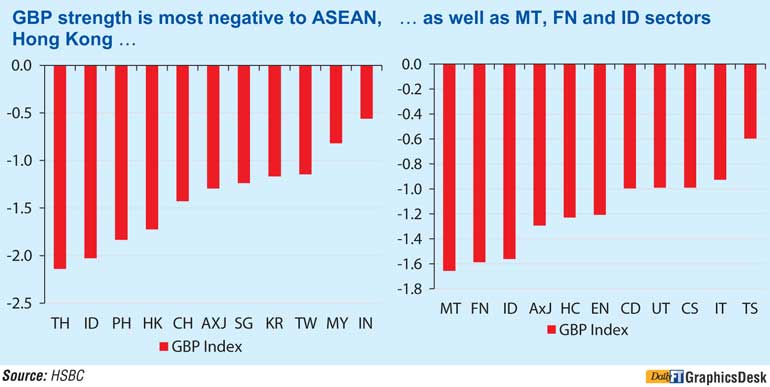

The charts below show the result of the regression analysis.

In general, we believe ASEAN is sensitive because of the impact changes in the GBP have on the discount rate. For Hong Kong, it is the translation effects of operations in the UK of selected large-cap companies that are of importance, in our view.

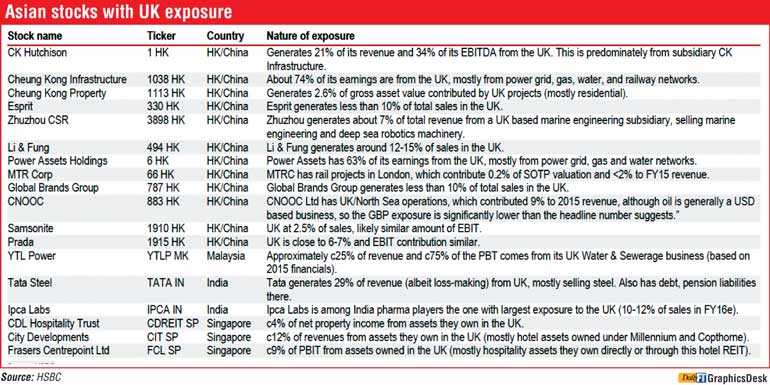

This is illustrated in the table. We asked our analysts to identify companies across the region that are particularly sensitive to movements in currencies, and the nature of their exposure. In this way, we can examine sensitivities across Asia on a regional, country, sector and stock level. This is summarized in the accompanying table.

Generally speaking, Indian companies have more exposure to Europe while Hong Kong companies have relatively high exposure to the UK. It is interesting to note that quite a few Asian utility companies operate water, gas or power networks across Europe or the UK.

Also, while there are quite a few companies with substantial operations in these territories, the overall impact on Asian profits is small. This suggests that the impact of changes in Europe and Japan is probably stronger through the FX markets, with spill-over effects into Asian currencies, than the impact on Asian earnings directly.

Footnotes

1 There appears a high correlation between the timing of our holidays and large swings in Asian equities. Last year we left for a holiday on the day the Chinese market peaked and came back when it was 30% lower. This year we are gone the second half of July. So brace yourself.

2 We use the log changes in the variables – dependent (MSCI indices in USD) and independent (China PMI, Brent crude oil prices USD/b, redemption yield on US 10Y sovereign bonds and USD, EUR, JPY and GBP indices) – using data over the last three years (at weekly frequency) so that the regression coefficients can be aptly considered as sensitivities.