Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 24 June 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

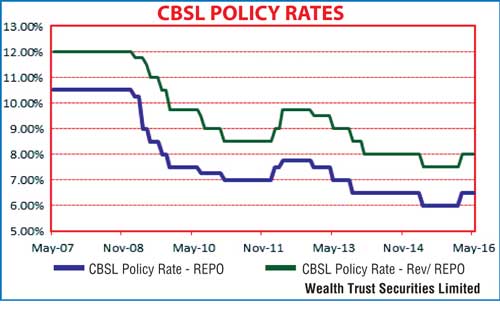

The secondary market bond yields were seen edging up yesterday as activity moderated ahead of today’s monetary policy announcement for the month of June due at 6 p.m. Policy rates have been held steady at 6.50% and 8.00% for three consecutive months since February’s hike of 50 basis points each.

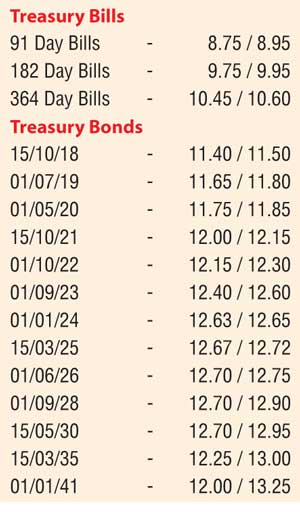

The yields on the liquid maturities of 01.01.24 and 01.06.26 were seen increasing to intraday highs of 12.65% and 12.70% respectively against its previous day’s closing levels of 12.55/60 and 12.62/70 while on the short end of the curve, the 01.05.20 was seen changing hands within the range of 11.76% to 11.78%.

Meanwhile in money markets yesterday, the Open Market Operations (OMO) department of Central Bank was seen injecting a sizeable amount of Rs. 30 billion on an overnight basis by way of a reverse repo auction for first time since 19 April 2016. The auction weighted average stood at 7.97%. This intern kept overnight call money and repo rates steady to average at 8.18% and 8.04% respectively.

Rupee appreciates marginally

In Forex markets, the USD/LKR rate on the active one week forward contract appreciated marginally yesterday to close the day at Rs.147.20/40 against its previous day’s closing levels Rs.147.40/60. The total USD/LKR traded volume for 22 June was $ 125.95 million.

Some of the forward USD/LKR rates that prevailed in the market were: one month – 147.95/05; three months – 149.50/75; and six months – 151.40/60.

Reuters: Shares fell for a fourth straight session to hit a two-month closing low on Thursday as investors turned cautious ahead of a rate announcement by the central bank.

The central bank will announce June monetary policy rates at 1230 GMT on Friday and the market broadly expects rates to be left steady for a fourth straight month, although a possible rate hike is not ruled out.

A decision by Moody’s to revise downwards Sri Lanka’s outlook on its sovereign rating and a government proposal to reintroduce capital gains tax also weighed on investor sentiment, brokers said.

The benchmark Colombo stock index ended 0.35 % lower, or down 22.74 points, at 6,398.06, its lowest close since 25 April. The index has shed 1 % so far this week.

“Market participation is very low as investors are taking a wait and see approach, especially with the Moody’s downgrade, capital gains talks, high interest rates and how government will implement reforms to retain the IMF loan,” said SC Securities Ltd head of research Yohan Samarakkody.

Sri Lanka’s cabinet on 15 June approved a proposal to reintroduce the capital gains tax, especially on land sales.

Moody’s Investors Service on Monday revised down Sri Lanka’s outlook to negative from stable, citing further weakening in some fiscal metrics in an environment of subdued GDP growth, which could lead to renewed balance of payments pressure.

Treasury bill yields rose between 1 and 3 basis points at a weekly auction on Wednesday. They have risen between 7 and 43 basis points since the central bank left the key policy rates steady on 20 May.

Overseas funds offloaded Rs. 279 million ($1.90 million) worth of equities on Thursday, extending the year to date net foreign outflow to Rs. 6.02 billion worth of shares so far this year.

Turnover stood at Rs. 822.03 million, more than this year’s daily average of around Rs. 753.1 million.

Shares in conglomerate John Keells Holdings Plc fell 1.20 %, while Lanka ORIX Leasing Company Plc dropped 4.42 %.

Reuters: Rupee one-week forwards ended firmer on Thursday due to dollar selling by exporters who were expecting further strengthening of the currency after a State-run bank sold the US currency in early trade, dealers said.

Importers were reluctant to buy dollars, expecting the currency to strengthen further on the State-run bank’s intervention, dealers said.

One-week dollar/rupee forwards, which have been acting as a proxy for the spot rupee in the absence of trade in three-day forwards, ended at 147.10/30 per dollar, higher than Wednesday’s close of 147.40/70.

“Rupee ended firmer as importers side-stepped expecting central bank to strengthen rupee further,” said a currency dealer asking not to be named. “We have seen some exporter conversions also.”

The Central Bank usually directs the market via two State-run banks, but on Thursday, it was not clear if the bank had sold dollars on behalf of the apex bank.

Dealers said the market was perplexed by the Central Bank’s intervention in both spot rupee and forwards at a time when the rupee was facing downward pressure.

Central Bank officials were not available for comment.

Moody’s Investors Service on Monday changed the country’s outlook to negative from stable, citing further weakening in some fiscal metrics in an environment of subdued GDP growth, which could lead to renewed balance of payments pressure.

The Central Bank raised the spot rupee’s peg to 145.25 per dollar from 144.50. The spot rupee was not actively traded for an eighth straight session on Thursday, dealers said.

For a sixth straight session, there was no active trading in three-day dollar/rupee forwards, known as spot next. The forwards closed at 144.85/90 per dollar on 15 June.

Spot next, which has acted as proxy for the spot currency since January, indicates the exchange rate for the day following conventional spot settlement.

For Thursday’s trade, the spot next settlement takes place five days ahead due to the intervening weekend.

Foreign investors net bought Rs. 6.67 billion ($46.06 million) worth of Government bonds in the week ended 15 June, Central Bank data showed.