Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 21 June 2016 00:29 - - {{hitsCtrl.values.hits}}

Gross Written Premium

The Sri Lankan insurance industry sustained its growth during the year 2015. The insurance industry recorded growth in Gross Written Premium (GWP) of both Long Term and General Insurance business sectors.

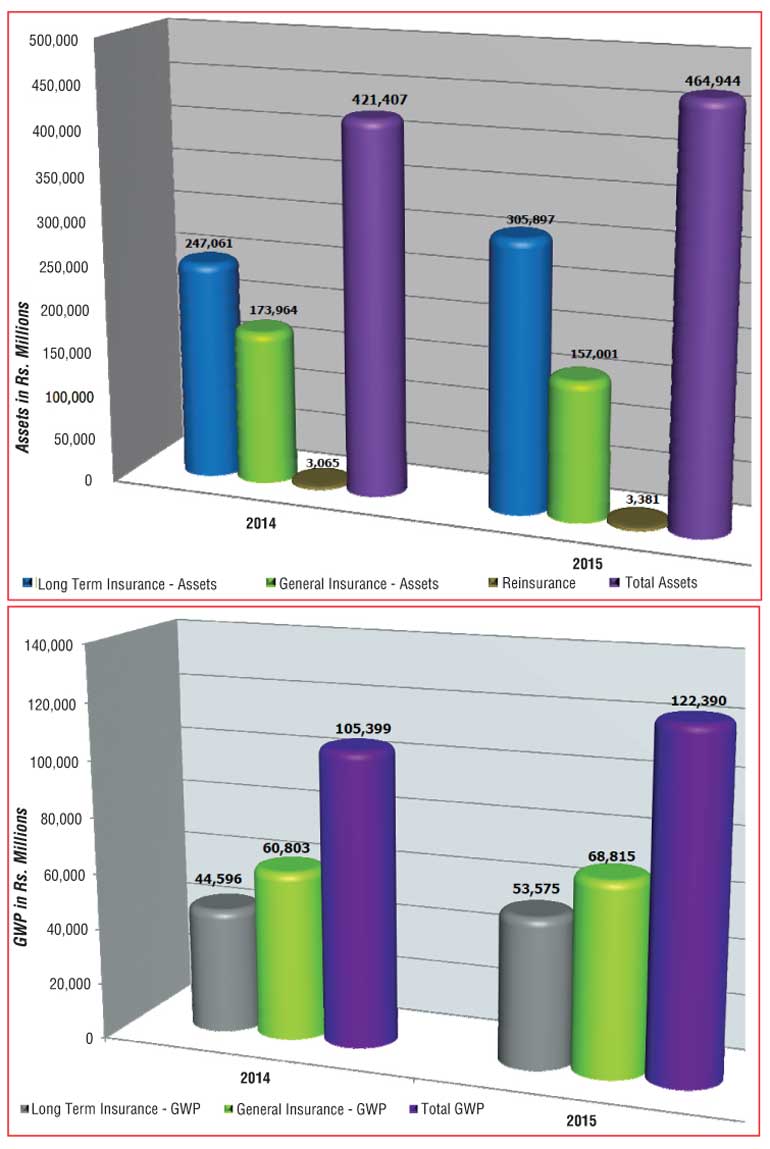

The total GWP Income for Long Term Insurance and General Insurance businesses in 2015 was Rs. 122,390 million compared to 2014 amounting to Rs. 105,399 million which reflected a growth of 16.12%. The Long Term Insurance Business recorded premium income of Rs. 53,575 million (2014: Rs. 44,596 million) while the General Insurance Business recorded a premium income of Rs. 68,815 million during 2015 (2014: Rs. 60,803 million). Thus, Long Term Insurance Business and General Insurance Business witnessed a growth of 20.13% and 13.18% respectively in GWP Income during 2015 when compared to 2014.

Total assets

Total assets

The total assets held by insurance companies amounted to Rs. 464,944 million as at 31st December 2015 when compared to Rs. 421,407 million recorded as at the end of 2014, reflecting a growth of 10.33%. The assets of Long Term Insurance Business amounted to Rs. 305,897 million (2014: Rs. 247,061 million), indicating a significant growth rate of 23.81%. The assets of General Insurance Business amounted to Rs. 157,001 million (2014: Rs. 173,964 million) depicting a decline in growth rate by 9.75%.

Investment in Government securities

At the end of 2015, the investment of total assets of Long Term Insurance Business in Government Debt Securities amounted to Rs. 136,832 million representing 44.73% (2014: Rs. 111,153 million; 44.99%), while the investment of the total assets of General Insurance Business amounted to Rs. 38,042 million representing 24.23% (2014: Rs. 31,770 million; 18.26%). Accordingly, the total investment of both Long Term Insurance Business and General Insurance Business in Government Debt Securities amounted to Rs. 174,874 million (2014: Rs. 142,923 million) as at 31st December 2015.

Dispute resolution and investigations

IBSL, under its overall objective of safeguarding the interests of policyholders, inquires into policyholders’ grievances in connection with insurance claims pertaining to life and general insurance policies. IBSL also investigates into any other complaint referred to it against any insurer, broker or agent. During the year 2015, 266 new matters were referred to the Board. A total of 274 matters were settled/closed during the year. Out of the matters settled, 54 claims were honored by insurers upon the intervention of the Board. Aggregate value of the claims settled during the year 2015, due to the intervention of the Board, is around Rs. 28.3 million.

Insurers

Out of 30 insurance companies (insurers) operating as at 31December 2015, 12 companies carry on only long-term insurance business, 15companies carry on general insurance business and three are composite companies (dealing in both general and long term insurance businesses). During year 2016, two general insurance companies merged and now there are 14companies carrying out general insurance business.

Insurance brokers

During the year 2015, 57insurance brokering companies operated in the market. Insurance brokering companies are registered with IBSL in terms of Section 82 of the Act in order to engage in insurance brokering business. Out of 57 brokers, 39 companies were registered in both long term and general insurance brokering business, while 18 companies were registered only in general insurance brokering business.

Insurance brokers’ contribution towards long term insurance business was insignificant in 2015 as witnessed in previous years. However, the premium income generated through general insurance business indicates the importance of brokers as an intermediary in the general insurance market. The premium income generated through insurance brokering companies with respect to general insurance business amounted to Rs. 16,124 million (2014: Rs. 14,559 million) while the premium income generated with respect to long term insurance business amounted to Rs. 206 million (2014: Rs. 158 million).

The total premium income from both general insurance business and long term insurance business generated through insurance brokering companies amounted to Rs. 16,330 million during 2015, compared to Rs. 14,717 million during the previous year. Thus, the total premium income generated through insurance brokering business witnessed a growth of 10.96% during the year 2015 when compared to 2014.

A detailed analysis could be viewed at http://www.ibsl.gov.lk/images/ibsl_statistical_review_2015.pdf

Note:

2015 - Provisional Figures.

2014 - Reinstated Audited Figures (Except NITF).

Assets - Inter segment transactions (i.e. transactions between Long Term and General Insurance segments) have been eliminated.