Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 24 May 2016 00:33 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

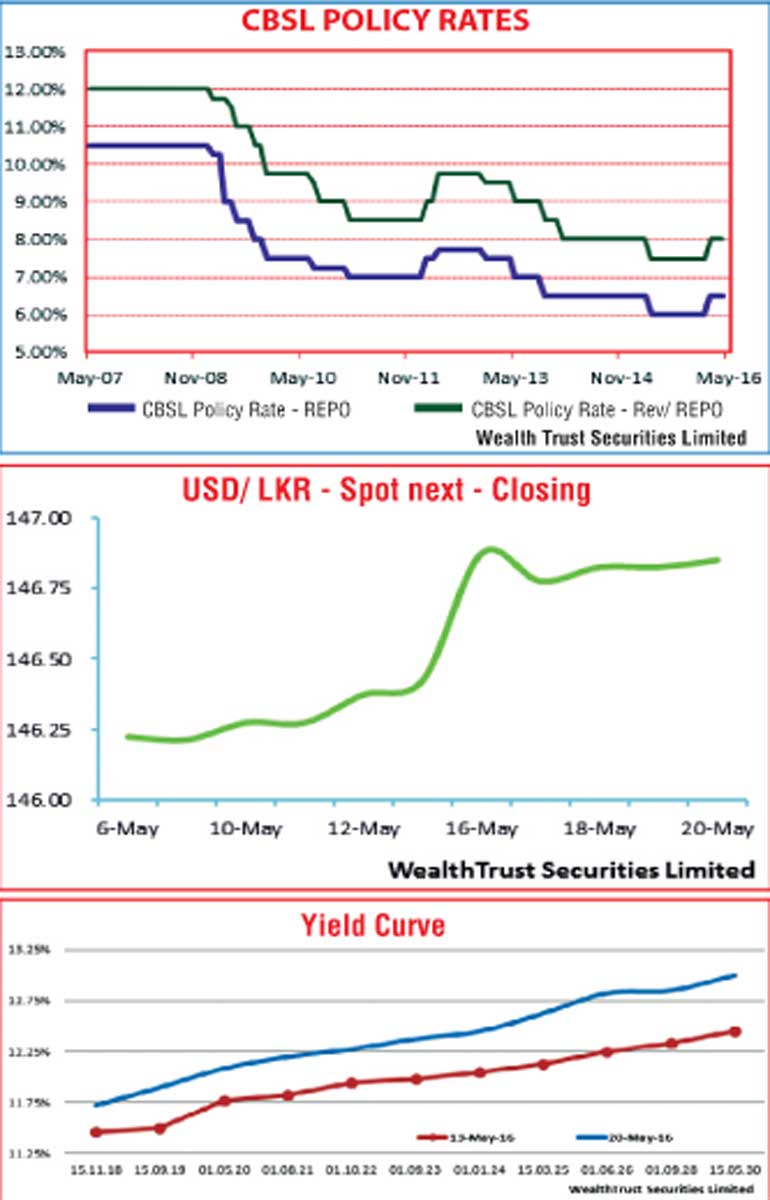

The secondary bond market remained active during the week ending 20 May, as yields were seen increasing gradually throughout the week, leading to the monetary policy announcement on Friday for the month of May. At its announcement, policy rates were held steady for a third consecutive month at 6.50% and 8.00% respectively.

The upward momentum was driven by the outcome of the primary auctions as weighted averages were seen increasing. The overall yield curve witnessed a parallel shift upwards for a second consecutive week, with the liquid maturities of 15.11.2018, 01.05.2020, 01.06.2026 and 15.05.2030 increasing by 24, 34, 55 and 45 basis points respectively week on week to hit weekly highs of 11.70%, 12.10%, 12.80% and 12.90% against its previous weeks closing levels.

The upward momentum was driven by the outcome of the primary auctions as weighted averages were seen increasing. The overall yield curve witnessed a parallel shift upwards for a second consecutive week, with the liquid maturities of 15.11.2018, 01.05.2020, 01.06.2026 and 15.05.2030 increasing by 24, 34, 55 and 45 basis points respectively week on week to hit weekly highs of 11.70%, 12.10%, 12.80% and 12.90% against its previous weeks closing levels.

Furthermore two way quotes on the rest of the yield curve was seen increasing as well. In secondary bill markets, October 2016 maturities changed hands at levels of 9.60% to 9.70% and April 2017 within a range of 10.40% to 10.45%. Meanwhile the foreign holding in rupee bonds was seen increasing further for a second consecutive week to record an inflow of Rs. 1.35 billion for the week ending 18 May, while the accumulated inflow for the past two weeks stood at Rs. 12.45 billion.

Meanwhile in money markets, overnight call money and repo rates remained mostly unchanged to average at 8.15% and 8.00% respectively for the week as average net surplus liquidity stood at Rs. 6.21 billion. Nevertheless the Standing Lending Facility Rate (SLFR) of Central Bank at 8.00% was accessed throughout the week for an eleventh consecutive week.

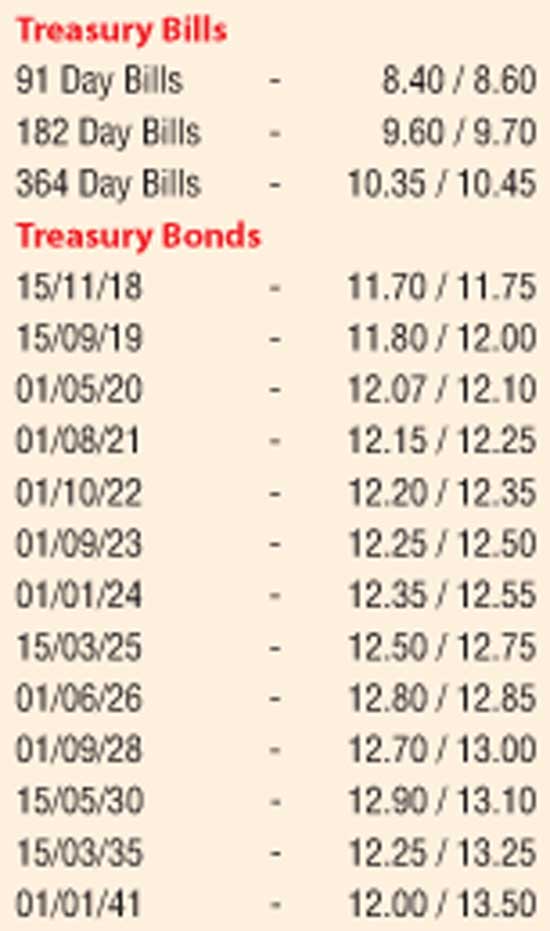

Rupee dips further

The rupee on its spot next contract was seen depreciating during the week to close the week at Rs. 146.80/95 against its previous weeks closing of Rs. 146.40/45 as importer demand outpaced foreign buying in Rupee bonds. The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 52.49 million.

Some of the forward dollar rates that prevailed in the market were one month – 147.70/00; three months – 149.20/60 and six months – 151.50/00.