Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 24 May 2016 00:06 - - {{hitsCtrl.values.hits}}

GIH Capital, in association with RIU has introduced the Islamic Finance Country Report 2016. The interest shown by a multitude of stakeholders towards this comprehensive report highlights the need for relevant, accurate and updated information on the Sri Lankan Islamic Finance industry. While the industry has been growing in double digits over the last few years, there have been many more prospects for growth along the way. Below are a couple of interesting insights from the report that have been summarised for the readership.

Introduction

The Islamic Finance industry has grown globally at an annual rate of 10-12% over the past 10 years with Shariah compliant financial assets estimated at approximately $ 2 trillion in 2015. A pivotal point to note is that the interest in Islamic Finance among non-Muslim countries such as the UK, Luxembourg, South Africa and Hong Kong, have been quite progressive.

Similarly, the local industry has seen significant growth over the last few years. Since the amendment to the Banking Act in 2005 (Act No. 2 of 2005), more than a dozen banks and financial institutions now offer Shariah compliant products. There are several large professional service firms that have specialist Islamic Finance teams. With the advent of the new Government under Maithripala Sirisena (President) and Ranil Wickremesinghe (Prime Minister), and the subsequent budget, Islamic Finance has now been recognised as an integral part of the country’s financial system.

As a result of these developments, the players in the Islamic Finance industry have come together to form the Association of Alternative Financial Intuitions (AAFI), headed by Ravi Abeysuriya.

Industry overview

Key personalities in the sector believe that the local Islamic Finance industry, as of June 2015, amounts to about Rs. 60 billion. Based on our analysis, we find that the total number of players in the industry in 2016 has grown to 43 players from 37 players in 2012.

The banking and finance industry still continues to dominate the landscape in terms of the number of players, with a cross-border player entering the banking space in 2015. This being said, there have also been new entrants into the Islamic Insurance and Microfinance space.

Microfinance, especially, is growing as it upholds many of the principles advocated in traditional Islamic Finance such as equal opportunity, advocacy of entrepreneurship, risk sharing, disbursement of collateral free loans, and participation of the poor. A comprehensive case study on Islamic Microfinance is available in the Islamic Finance Country Report 2016.

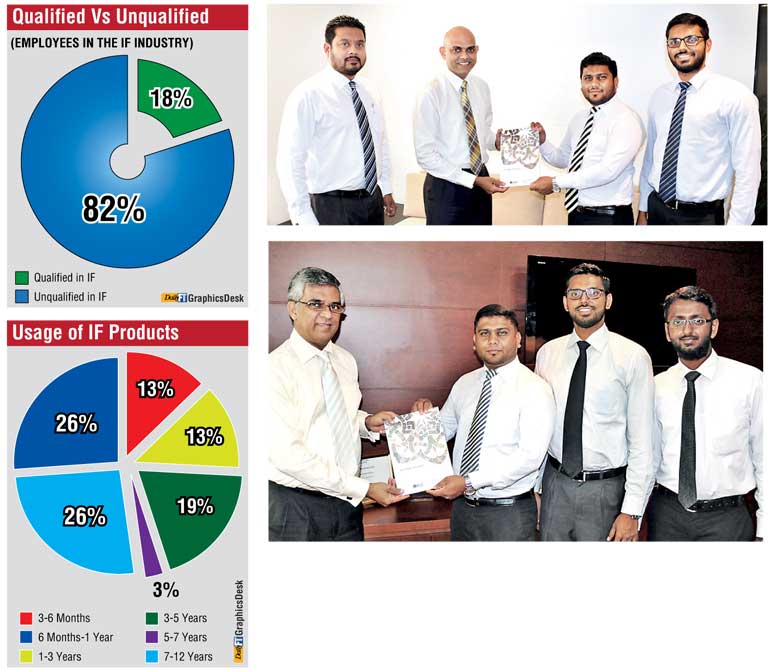

Despite the growth in the number of players, however, not a great deal of progress has been made in terms of the numbers of qualified staff who are working in the industry. Currently, only 18% of all full-time employees have a formal Islamic Finance qualification as compared with 13.4% in 2012.

Products offered

In terms of products, Diminishing Musharakah has seen significant growth in the banking space over the years, whereas on the liability side, Mudharabah stills hold strong. This being said, Wadiah Yad Dhamanah has been introduced to the market on a very small scale to structure current accounts. Certain microfinance providers have, as of 2015, begun offering products structured upon Qard-ul-Hasan (a benevolent loan) as well.

Capital market instruments such as Sukuk have also been gaining steamwith the ongoing search for less expensive, new sources of capital to fund local development and infrastructure expansion. Several key personalities in the industry believe Sukuk can play a significant role in financing major infrastructure projects – like the envisioned Megapolis Project.

Customer base

The overall findings would indicate that the customer profile is moving towards a younger average age over recent years. There are also positive implications of customer retention with more than half the customer sample using Islamic Finance products for more than five years.

However, the non-Muslim customers, as a percentage, have declined overall with some variation between the dedicated players and the window operators where the latter have a slightly higher percentage of non-Muslim customers. Several industry players have sighted recent political tensions as the reason for the drop in non-Muslim customers. As penetration of the market beyond the Muslim community is both necessary and vital to ensure continued growth in a multi-cultural country like Sri Lanka, many of the larger banking, finance and insurance service providers have initiated efforts to move away from Arabic names for products and use more indigenous terms instead.

Challenges and outlook

Despite the great strides that have been made in recent years, there are still several issues that the recently formed Association of Alternative Financial Institutions (AAFI) in particular is trying to iron out. For instance, the removal of the double stamp duty on Islamic mortgages will be paramount; not to mention, the need for conducive securitisation laws in order to issue Sukuk as well as modifying the existing exchange rules to facilitate foreign investment. Players are also pushing to introduce Shariah compliant real estate investment trusts (REITs) and Shariah compliant treasury bills.

For further details on the Islamic Finance industry and how you could obtain the report please contact: [email protected] or [email protected].