Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 20 May 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

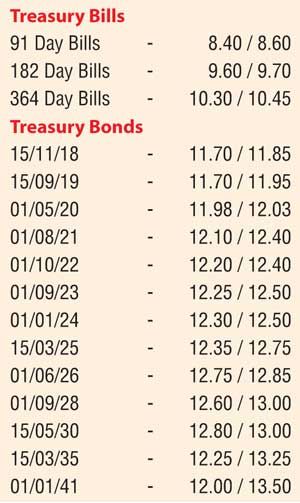

The weighted averages on the Treasury bond maturities of 15.11.2018, 01.05.2020 and 01.01.2024 were seen increasing by 24, 36 and 33 basis points respectievly to 11.75%, 12.11% and 12.40% against its previous weighted avaerges, at its auctions conducted yesterday. Menwhile the 01.06.2026 maturity recorded a weighted averge of 12.82%, significantly below its average of 13.93% recorded on the 29th of March 2016. A total amount of Rs.44.5 billion was accepted at the auctions against its total offered amount of Rs.45 billion.

The outcome of the Treasury bond auctions saw yields in the secondary bond market increase further yesterday. Activity centered on the liquid maturities of 01.05.2020, 01.06.26 and 15.05.2030 as its yields were seen increasing to a highs of 12.00%, 12.80% and 12.90% respectively against its previous day’s closing levels of 11.90/93, 12.30/55 and 12.60/70. In addition, two way quotes on the 15.11.2018, 01.10.2022 and 01.01.2024 maturities were seen increasing as well. On the very short end of the yield curve, January 2017 maturities were seen changing hands within the range of 10.10% to 10.15%.

Meanwhile the Central Bank of Sri Lanka’s monitory policy announcement for the month of May 2016 is due today at 5.00 pm. At its last month’s monetary policy review, rates were kept steady for a second consecutive month.

Meanwhile in money markets, the net surplus liquidity of Rs.5.83 billion saw overnight call money and repo rates remain steady to average 8.15% and 8.02% respectively yesterday.

Two-way quotes on the Rupee narrows

The USD/LKR rate on the active spot next contract was seen closing the day at Rs.146.80/85. The total USD/LKR traded volume 18 May was US $ 20.07 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 147.60/75; 3 Months - 149.20/40 and 6 Months - 151.70/90.