Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 22 April 2016 00:00 - - {{hitsCtrl.values.hits}}

Photo-voltaic solar technology is a well-known and globally practiced technology. Roadways are readily available to be used for installing PV solar panels and they cannot be used for any other purpose

Photo-voltaic solar technology is a well-known and globally practiced technology. Roadways are readily available to be used for installing PV solar panels and they cannot be used for any other purpose

By K.C. Somaratna

When the Prime Minister of a country expresses in the Parliament that (a) the indebtedness of his Government mentioned three months ago was wrong, (b) it should be about 10% more and (iii) it could be even another 10% more, naturally the citizenry of that country would be alarmed.

But the two facts that (i) he gives the assurance that he will put all this right and (ii) he is the Prime Minister who has registered the highest year-on-year increase in GDP Growth Rate in post – independent Sri Lanka would definitely give significant consolation to all of us.

This state of affairs raises a few issues which need to be addressed: (a) why were the figures given earlier not quite right, (b) isn’t there a process responsible to ensure accuracy of these figures, (c) how can we eliminate this inaccuracy of information in future public debt pronouncements, (d) why is our public debt so high and (e) how can we reduce our indebtedness as a nation and still maintain our growth at above 5% level.

These are the issues I intend to delve into within this article.Not in way of excusing myself ofany possible mistakes to be made in this article, but in way of motivating other non-economist, non-financial professionals to study these key characteristics which would determine the type of country they would be leaving behind for their children and grandchildren, I wish to say here that I am only a physical scientist and neither an economist nor a financial professional.But I have been studying the Central Bank Annual Report from late 1960s and I found it an extremely interesting report to study.

Magnitude of this indebtedness

When I say that this public debt is almost the value of solar energy we have wastedin 2015, I intend to emphasise two things:firstly the fact that real value of what we receive free in the form of solar energyand waste in one calendar year is quite huge and secondly the fact that if this resource is appropriately utilised, settling this public debt will be much easier than it would otherwise be.

First, I will explain how I arrived at this statement.If we calculate, at the rate of Rs. 10per kilowatt hour, the value of total solar energy received on our 65,000 km2 land area of Sri Lanka at the rate of five kWhr/m2.day in 2015,that value becomes Rs. 1,186.25 trillion.

But this enormous amount of solar energy we receive carry out very important activities for us as follows:(a) keep us comfortably warm at 250C or so, (b) provide us light during the day time, (c) maintain the natural water cycle operational, (d) provide energy for photosynthesis and yield agricultural output, etc.We also use it to make salt for local consumption and export and dry coir dust for export, etc.

But a certain portion of this energy is wasted – wasted because that portion does not help in any of the above activities; but on the contrary, would only hinder them.For example it would make us warmer as we tend to feel these days or it would make drastic changes to the natural water cycle thus leading to both floods and droughts.This, the portion of solar energy that falls on approximately 50,000 km of our roadways, is wasted, because it gets absorbed by the highway to the extent of about 90% and only contributes towards climate change.If this length of roadway is on an average10m wide, the value of this wasted solar energy in 2015 is Rs. 9.125 trillion.

So this is why I said that our public debt at Rs. 9.5 trillion is nothing when compared to this precious energy base we allow to be wasted year after year. How we could harness this energy, how it becomes the most natural way of making our public debt a thing of the past will be treated at the end of this article.

I have not been in the Ministry of Finance and hence I only know of one source for this information for any outsider which is the Annual Report of the Central Bank.The figures given in these Central Bank Annual Reports would not meet the expectations of an Activist Investor base of a PLC.If one looks at Tables 108- 111 (both inclusive) in the 2014 Annual Report you will see that the total public debt is given on different bases in these tables; and these tables are not compatible with each other.

Following are a few examples:

(a)Table 109 gives project loans from nine countries – Australia, Austria, Denmark, Finland, HongKong, Korea, the Netherlands, Spain and UK – amountingto more than Rs. 150 billion; but none of these countries are identified as lenders in Table 108 and both the totals in Tables 108 and 109 add upto Rs. 3,113,116 million.Table 108 has two rows titled Other – one as bilateral and only Rs. 49,100 million and the other marked as Financial Markets amounting to Rs. 1,429,125 million and identified as outstanding defence loans and Treasury bonds, etc. held by foreign investors and the diaspora.

(b)Table 109 identifies an outstanding Project Loan from China to the value of Rs. 229,882 million; but Table 108 identifies only a Bilateral Loan from China to the value of Rs. 87,743 million with a note that this amount excludes loans of projects under state owned business enterprises.This note is not clear for three reasons:(1) whether these enterprises are ones in China or in Sri Lanka.If in Sri Lanka these figures should not come into the realm of public debt or may be the Government has given guarantees on these. (2)It is not mentioned where the balance amount of Rs. 147,139 million is included.(3) Only other place where it could be accommodated i.e. other Financial Markets amount does not include any project loans; but only Treasury bonds, bills and defence loans.Although I have quoted these disparities from 2014 Annual Report, they were present in 2013 Report as well and even in 2009 although the figures are different.

These issues amounting to more than Rs. 100 billion should have got noticed during the report reviewing process within the bank and should not have come into the domain of public knowledge and embarrass the Prime Minister and relevant Ministers.Yes, I agree that this is only about 1% of the publicdebt or 3% of foreign debt, we are talking about; but it should not appear year after year and we should be able to rectify it after the first appearance.

Reviewing process for Central Bank Annual Report

I am sure there is a reasonably detailed reviewing process for this annual report in place and I would imagine three departments who need to be involved in respect of these public debt figures.They are as mentioned in the Annual Report itself, the Public Debt Department, Internal Audit Department and of course, the Auditor General’s Department.I am sure that the responsible personnel in these sections would have gone through these tables and would have understood these properly to be accurate; but it may be that some aspects which they would have known are not explicitly given in the published report thus leading to these confusions.

I believe the Central Bank is currently preparing its report for 2015 which is due to be presented to the Minister of Finance within four months after the end of each financial year.I would imagine that these unclear aspects of the Report for 2014 would have goteliminated in the 2015 Report in view of this public debt attracting the attention of all Sri Lankansand the information thus presented should not embarrass the relevant ministers.

Three large organisations – Public Listed Companies – have been quoted in the Financial Times during the month of March which have grown significantly during the last 18-20 years and there had been more than one common aspect about these three companies – Dialog, Colombo Dockyard and Nawaloka Hospitals.All these three companies are ISO 9001 certified companies and after they got certified they grew significantly with this system.In fact it is for this reason that Tom Peters named Chapter 8 of his book ‘Circle of Innovation’ as ‘System is the Solution’.

All these three companies do have a process called Corrective Action Process within that ISO 9001 system through which they take adequate and appropriate corrective action in respect of any non-conformity identified – pronouncement of wrong public debt figures for public consumption is a serious non-conformity for a central bank of a country –which will consist of (a) the correction of the non-conforming product or service – value of public debt in this case and (b) corrective action – some process either new or revised which will ensure that a similar non-conformity would not happen in the future.Most importantly that corrective action should ensure elimination of a similar future occurrence irrespective of who would beoccupying the respective seats in that future setup.

If we can activate such a corrective action for this non-conformity I believe our grand-children would not face this sort of a shockand if we don’t identify such a corrective action, but just rectify the current non-conformity only, the chances are very high that it would happen again and again with different tables and data and different individuals making the pronouncements.

This report need to be studied and debated

A public quoted company puts out the Annual Report and makes it available to the shareholders; then there will be the Annual General Meeting at which the shareholders can raise any issues in respect of this Annual Report.Similarly the Central Bank’s Annual Report should also be discussed in the parliament in reasonable detail.Generally companies do not make all their plans known to the shareholders, but their outcomes will be.In the public sector the Parliamentarians debate the plans, the budgets; but not the outcomes.

I am sure that there are enough andmore members in our Parliament who could make a significant contribution towards improving the accuracy of data in this report and direct this in the right direction.Such a process of overseeing the report would also be helpful in improving the quality of the report.I know that the Central Bank adopts certain templates prescribed by international public finance monitoring agencies; but such adaptations need to provide more overly acceptable data for the public.

Is our public debt too high and if so, why?

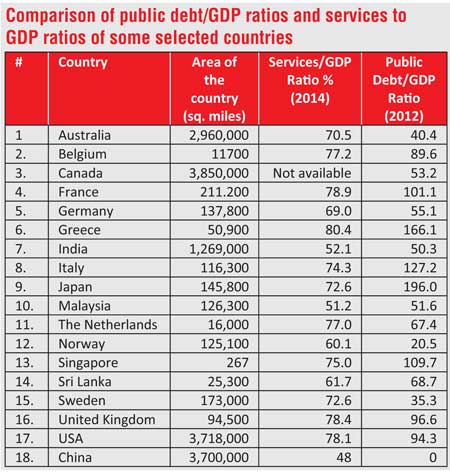

Public debt cannot be gauged high or low by merely looking at the absolute value alone; we need to look at it relative to the country’s GDP and it is for this reason Public Debt to GDP Ratio is used.The table contains Debt to GDP Ratio, Services to GDP Ratio and the land area for a selected set of countries.Two former Central Bank personnel – W.A. Wijewardena, a former Deputy Governor, and Prof. Sirimevan Colombage – have written to the papers regarding this issue of public debt looking at it from economists’ point of view and my objective is to look at it from a different – the non-economists’ – viewpoint.

Prof.Colombage stresses a few key points about this debt position as follows:(a) Our growth in the recent past has been due to private consumption and debt funded infrastructure and he says that debt-dependent growth is unsustainable.(b) The current crisis was partly triggered by threats to and subsequent action to increase the US interest rates which contributed to significant net outflow of foreign investment.(c) The significant contributions of (i) $ 8430 million trade deficit and (ii) worker remittances which acted in opposite directions.(d) Growth due to non-tradable service sector by locally rendered services in construction, transport, trade and banking services.

Wijewardena’s comments go as follows: (i) An artificial reduction in budget deficit to GDP ratio was achieved by curtailing capital expenditure, (ii) Central Bank failed to explain the real picture in its annual report for 2014, (iii) The excess money created leaked out to fund imports, (iv) Growth of services with no corresponding increase in agriculture and manufacture makes an economy vulnerable.Of course, Wijewardena went into great length in an article only a fortnight earlier to emphasise the virtue of having a high services to GDP ratio in the region of 75% while our ratio is only 62% in 2014.

All these are very valid statements but only within certain limitations.In respect of private consumption, the Central Bank shows an increasing trend in the percentage of savings while the private consumption in rupee terms also has increased.Out of private consumption, only 30% has gone in for food and beverages, etc.,20% has gone for transportation and 10%is spent overseas.

Whenever I think of debt-funded infrastructure, I always think about what happened to Golden Key.The finance industry is very good as long as you don’t indulge in projects with money deposited with you.Under normal circumstances, in the finance industry you pay the interest to the depositors, long after you have earned several times the interest to be paid and your cash-to-cash cycle time is negative.But the moment you start investing in projects like a hospital, all of a sudden the cash-to-cash cycle time becomes positive and long and you lose control.

Similarly, when you invest debt money in infrastructure projects, you would have difficulties in servicing the debt unless there is revenue to pay back the loan.When the investment is in non-tradable service sector, the pay back becomes a burden and later in the article we address this as well.

The issues with the trade deficit is at a low value to-day due to the low prices of oil and I dread to think of a situation when the oil prices would be in the region og $ 70 or 80 a barrel and drastic weather – either a drought or floods – affects our agricultural production.It is during times like this when the oil prices are low and weather has been kind to us that we should start settling our debts.

I have dealt trade deficit issues in detail some time back in one complete article with all relevant figures and I don’t intend to talk about it in absolute terms now.In situations like this our biggest challenge is to convert these non-tradable service sector investments arising from debt driven infrastructure into productive enterprises which will yield tradable products.This is the challenge facing all professionals today.Towards the end of this article I will show how this could be done in a fashion that we could reduce the trade deficit as well in the process.

Since we have already spoken about private consumption, capital expenditure and the impact of imports on the debt situation, I will now touch upon the contribution of service sector on indebtedness.Although Wijewardena has been lamenting about Sri Lanka’s backwardness in going in for service-driven developmentor at least comparing our service to GDP ratio to those in so-called developed countries like USA, UK andJapan – a few weeks earlier, in his new article he talks about the vulnerability of growth based on services without fostering growth in agriculture or industry.Of course, if one desires agriculture and manufacture to grow faster than services, the service to GDP ratio will only decrease from its value of 62% in 2014 and will not reach the values of USA/Japan in 70s range.

The table shows how Services to GDP ratio and Public Debt to GDP ratios are related, for a set of countries with different land areas.If one looks at how these values vary, one would think that for smaller countries higher Service to GDPratios not necessarily lead to lower Public Debt/GDP ratios; but when countries are larger in area, there would be a greater need for services – transportation, communication, trade, banking, etc., than when a country is small.This also implies that the land area of a country is a parameter worth taking note of when one is planning out economic strategies for a country or comparing related strategies.

Please note that each of the eight countries which have a Public Debt/GDP ratio above 85% has a Service/GDP ratio above 70% and out of the three countries which (a) have a Service/GDP ratio above 70% (b) but do not have a Public Debt/GDP ratio above 85%, Australia is a very large country, the Netherlands has been an industrial country earning money on fossil fuels and Sweden is also a comparatively large country.

This relative significance of services vis-à-vis manufacturing demands closer scrutiny.We tend to disagree with Wijewardena regarding the relatively larger importance of service aspects even in respect of a manufactured product.It may be that there are 20 related servicing steps in the process of putting out a product to the market place; but I believe it is that manufacturing –nuts and bolts – phase which really yields a product which would fetch a price.

An eye opener for this significance is the recent crisis situation in pharmaceutical companies which is a clear indication of the irrelevance/uselessness of all the servicing steps when there is no product to be presented in the market place.Or take the case of the apparel industry where about 30 to 35 service steps would be involved in putting out a product in the market place; but the actual price the customer would pay for the item would depend only on the cost of the material used, the number of standard minutes required, the cost of a standardminute and the confidence the customer has in the quality of the product to be delivered.

How can wasted solar energy end our public debt?

Now let us get to the most important aspect of all this discussion.It revolves around how we could make use of this wasted solar energy to end our public debt.This solution revolves around converting this wasted solar energy falling on our roadways – the debt funded infrastructure not yielding a tradable product –intoelectricity either to be used in charging Battery Electric Vehicles (BEVs)or supplying to the main grid or both – either of which will be a tradable product.

The way to do this is to lay photo-voltaic solar panels above the roadways as a roof and connect these either to BEV battery charging stations or to the grid.Photo-voltaic solar technology is a well-known and globally practiced technology.Roadways are readily available to be used for installing PV solar panels and they cannot be used for any other purpose.It is these roadways – out of all manmade structures – which will absorb and waste the highest percentage of solar radiation therebycontributing to global warming.When we build more of them, we will experience more of global warming as we experience these days.

What are the other specific advantages of installing these PV solar panels above these highways? (a) They are readily available, (b) No deforestation and associated long procedures are needed, (c) This would prevent roadways cracking due to sunlight and rainwater falling on them and as a result the maintenance cost of roadways will be greatly reduced. (d) We could also harvest rainwater without contamination with pollutants on the ground, (e) The projects could be implemented very fast, (f) The roadways will be where the energy will be needed for charging BEVs and as such the transmission losses will be greatly reduced, (g) Roadways are been built in developing countries all the time, (h)If the roadway is being used by pedestrians and motorcyclists, this would provide the roadway users shelter from both the sun and the rain.

Why should we use the electrical energy thus generated to power battery electric vehicles?Because it is then that we could settle the highest percentage of foreign debt using a given amount of energy thus generated.To put it in rupee terms we could say like this.If we solarise (the word we use for installing PV solarpanels above and along the roadways. Highway solarisation is the term coined by us and extensively used in our 25 plus newspaper articles which are available on the internet.)

From a one km long road 10m wide, we could generate about 2075 MWhrs/year.If we use this energy to replace main grid electricity, as per CEB energy usage figures, we could save Rs. 11 million in foreign exchange if the electricity would have otherwise been generated using coal or we could save Rs. 19 million in foreign exchangeif the electricity would have otherwise been generated using liquid fuels.But on the other hand if we use this energy for charging BEVs to replace petrol being otherwise used by a petrol vehicle the foreign exchange to be saved even at today’s oil prices would be Rs. 55million. As such the obvious use of any electricity generated using PV solarpanels installed above a roadway will be to charge BEVs and for each one km of 10m width roadway we have solarised we could save Rs. 55 million of foreign exchange per year.

When one looks at highway solarisation in this fashion, it automatically becomes the ideal way to (a) convert the purely service-oriented infrastructure built with debt funding to yield a tradable product and eliminate the concern of Prof. Colombage, (b) enhance industry component of the GDP to fulfil Wijewardena’s expectation and (c) in the process save enough foreign exchange to pay the cost not only of highway solarisation but even of the highway itself.

It had been mentioned in media that one km of a highway about 30m wide will cost about Rs. 1.4 billion, solarising this highway will cost about Rs. 1.14billion, the foreign exchange saving from this solarisation will be about Rs. 165 million per annum, this will pay back the solarisation cost in about seven years and the highway construction cost in another say 10 years (including interest, etc.). The other beauty of this is that electricity will be generated and available for sale from about the first year onwards.

Then the problem arises as to how much of electricity we could generate to be productively used.For vehicle electrification in the next 10 years we might need about 1,350 GWhrs/year for about 600,000 Battery Electric Vehicles.One might wonder where these BEVs are and our answer would be that if there is a tax regime conducive to their imports they will come in very large numbers.Please note that the new Tesla 3 vehicle which was announced in early April brought in 270,000 new orders within the first 36 hoursalthough the car would be available for delivery only in December2017.Then there is a day time demand of about 2m555 GWhrs/annum from about 08.30 hrs to 18.30hrs, above the base load of 1,000+ MW powerand this could consume about 1,231kms of solarisation of roadways.These two would project to 1,900 kms of roadways of 10m width being solarised, saving about Rs. 59billion of foreign exchange every year.

Then there are plans to expand our exports to $ 50 billionin 2050 – I would rather it to be in 2035 –fromits current value of $ 12.5 billion and this would necessitate another 22,400GWhrs in 2035 which will demand solarisation of yet another 5,000 kms of 22m width roadway.As such the total saving that could be realised in 2035 would amount to about Rs. 264 billion of foreign exchange per year and if everything elseremainsrelatively static, we could settle our total foreign debt within the fourth decade of this century.If we don’t do this now andoil prices go up, no politician of whatever credentials would be able to save Sri Lanka.One only need to recollect how USA was struggling, with their borrowing limits being raised almost yearly, until they started reducing their oil imports. During the last five years their oil imports have come down by one billion barrels a year.

Does anybody else have a better solution?

It was mentioned in a recent cricket commentary that when Tillakaratne Dilshan got out for a low score and was coming towards the pavilion, somebody in the pavilion had shouted,“Why don’t you retire and go home?” to which Dilshan responded by offering his bat to anybody in the pavilion to take and go and score.Similarly I would like to know whether anybody else has a better solution to reduce our foreign debt situation.

We have heard politicians – of almost all colours and political convictions – talking about how much an average Sri Lankan owes foreign countries to emphasise the fact that the other party has not managed the economy well.If anybody wants to take the Sri Lankan economy on a path of his or her own design, he or she needs to take control of this behemoth of fossil fuel imports.Unless and until this is done, it would always be a case of we, Sri Lankans, being dragged towards greater and greater debt and you would be blaming the other party for all the mess and the debt created.

So let us take control of our destiny by taking control of our energy cost and start an era of reducing foreign debt and there would never come a better time to do this than now and today when oil prices are low, the weather is being decently kind to us, the EU or even Japan is talking about zero or negative interest rates and China is generous in helping others,of course including Sri Lanka,with its own reserves.

Tomorrow – when the weather becomes correspondingly unkind and unpredictable, full of fluctuations and uncertainties as forecasted by climate change scientists on one hand and oil producing and exporting countries can no longer sustain the low prices of today due to their savings becoming exhausted and citizens, unable to enjoy the luxuries of today (having domestic aids is one such luxury which is connected to the remittances we receive ), becoming restless – we would get trapped in a vicious circle of no money to invest in renewable energy projects, leading to no renewable energy to save to invest and a future prime minister will pronounce in Parliament to everybody’s surprise, followed by applause, that Sri Lankan public debt has become Rs. 15 trillion and that he/she is going to put it right.

(The writer is Managing Director of Somaratna Consultants.)