Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 14 March 2016 00:07 - - {{hitsCtrl.values.hits}}

By Charumini de Silva

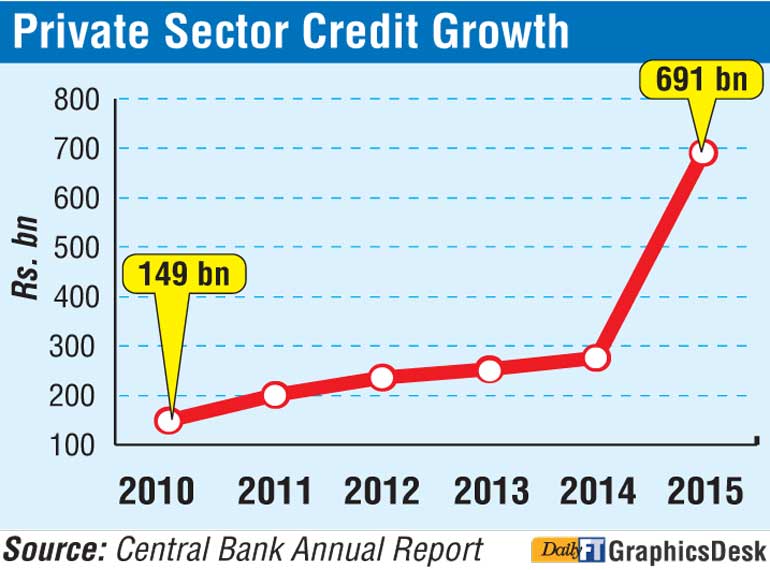

Private sector credit grew threefold in 2015 to Rs. 691.4 billion from Rs. 223.9 billion in the previous year, with vehicle imports, IT, agriculture, tourism and construction sectors drawing the most cash, said Central Bank Governor Arjuna Mahendran.

“Private sector credit grew across the board. One sector that grew very rapidly was vehicle imports, which helped the economy almost offset the reduction in what we spent on petroleum. Agriculture was another sector which revived strongly during last year,” Mahendran told the Daily FT.

He also said that credit expansion was notable in construction and IT as well as in tourism sectors owing to credit available at low interest rates.

“The whole economy was gathering steam during last year and this year we tightened interest rates because we don’t want to get ahead of it and cause inflation. We do not want to get entangled in supply constraints, which is the very reason why we have tightened the interest rates. Let’s see how it will work. The next few months are critical,” Mahendran opined.

Funds for credit expansion were generated by a combination of resources from remittances, borrowings, foreign inflows as well as domestic savings.

“There was a notable increase in the domestic savings which we were pleasantly surprised by. In addition, people who held money overseas are bringing back those monies as they are getting a decent return here in Sri Lanka now,” he added.

Analysts have pointed out the private sector also borrowed heavily to pay the one-off Super Gains Tax, which is estimated to have raked in around Rs. 80 billion last year.

The Governor also pointed out that it was important to have a floating exchange rate decided by the market to create a stable inflow of funds into the economy, adding that there was no market previously as the exchange rate and interest rates were fixed by the former administration of the Central Bank.

“The availability of money is not the problem, but the issue is how to attract it. In my view, to grab the attention of investors, consistent policies and proper markets are key factors we need to focus on — and that is what we are adopting at present,” he explained.

Commenting on the external turbulence, Mahendran noted that it was something that they had to combat since last year, noting that there were direct impacts from the sudden devaluation of Chinese Yuan and the rate hike by the US Federal Reserve.

In addition he pointed out that Middle Eastern fronts were liquidating their investments in equities and the bond markets as revenues generated via oil were declining at a considerable rate. Hence, the Governor asserted all these activities had resulted in outflows from Sri Lanka’s bond and equity markets.

Mahendran opined the dollar had peaked while the Euro had started to appreciate against the dollar. “This shows the flow towards the US is now starting to stabilise and hopefully we won’t see much more outflows, but the Middle Eastern funds are a key element we have to watch in the months ahead,” he stressed.