Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 14 March 2016 00:00 - - {{hitsCtrl.values.hits}}

Critics say that ILFTA has favoured India and not Sri Lanka. This is a misconception and a conclusion arrived at by glancing at the information available on the surface

The best economic policy doesn’t guarantee its success

A country may have the best economists who could come up with a set of best economic policies. Simply because a ‘policy is the best’ does not mean that it would be a success. That is because policies are implemented in the field among people of diverse interests, tastes and ambitions. The list of such people is long. But the key characters, loosely called ‘stakeholders’, include the people at large, critics, Parliamentarians, bureaucrats and foreigners. A policy becomes successful only when it is managed properly among its stakeholders.

Getting support of the people for policies without tears and pains

Economic policies in the past, specifically those intending to introduce market reforms, budgetary discipline, stability in the domestic prices and the exchange rate, have been failures mainly because of the bad policy management. These policies become necessary when a country has ‘lived beyond its means’ creating vast holes within the economy which cannot be filled with available resources. The inevitable corollary is the ballooning of the country’s indebtedness to its own citizens in the case of domestic debt and to foreigners in the case of foreign debt. This, however, worsens the country’s ailments because, now, more and more resources have to be utilised to service the creditors.

The reversal of the trend calls upon people to sacrifice the wellbeing which they have been enjoying unabashedly. But when the situation becomes chronic and acute, as was the case with Greece in the recent past, there is no alternative except getting people to tighten their belts. But, how to get the people to tighten the belts without ‘tears’ and ‘pains’ is the challenge before governments that are required to introduce such painful economic reforms.

The reversal of the trend calls upon people to sacrifice the wellbeing which they have been enjoying unabashedly. But when the situation becomes chronic and acute, as was the case with Greece in the recent past, there is no alternative except getting people to tighten their belts. But, how to get the people to tighten the belts without ‘tears’ and ‘pains’ is the challenge before governments that are required to introduce such painful economic reforms.

Critical economic crisis faced by Sri Lanka

Sri Lanka today is exactly in such an economic mess. Its debt levels have grown beyond its ability to service them without tightening the belts of the Government. In the recent past, the money spent by the Government for repaying debt and paying interest has been more than the Government revenue. Hence, without funds for maintaining the normal services, the Government had to incur more debt not only to repay the principal but also to pay interest on the past borrowings.

This is a critically vulnerable situation for Sri Lanka. Despite the growth in the economy, the Government revenue had fallen as a ratio of the country’s total output, known as the Gross Domestic Product or GDP. Since there was no corresponding cut in the expenditure, the deficit in the budget remained stubbornly high. An artificial reduction in the budget deficit as a ratio of GDP was attained not by cutting the Government’s consumption expenditure, but by curtailing its capital expenditure. The result was the slow growth of the country’s capital stock stunting its future growth potential.

Central Bank making losses partly due to interest outpayments

Since actual growth was below expectation, the Central Bank sought to address the issue by loosening the monetary policy. Interest rates were kept deliberately at low levels, while banks were compelled to extend credit. A part of the Government’s financing requirements were met by resorting to a process known to ordinary laymen as ‘printing of money’. It increased the liquid cash levels among the people compelling the Central Bank to take it away from them by paying interest creating new money in a second cycle when commercial banks chose to park such excess liquidity with the Bank. The result was a net interest out-payment. In 2014, the year in which the new system was introduced, they amounted to Rs. 18 billion in comparison to Rs. 3 billion in 2013. Such interest out-payments not only added further liquidity to the existing excess liquidity but also caused the Central Bank to incur losses in its overall operations.

Excess money leaking out of Sri Lanka via imports

The excess money in the hands of the people forced them to spend more on imported products since the low interest rates which the Central Bank had introduced to stimulate the economy had discouraged savings. The corollary was the increase in the import bill, on the one hand, and creation of a deficit in the trade account of the country, on the other. The country was fortunate because it could temporarily part-finance the deficit out of the remittances received from Sri Lanka’s workers labouring abroad. However, there was still a deficit in the current account of the balance of payments and therefore, the country had to borrow more to finance the deficit in its external sector. This put pressure on Sri Lanka’s exchange rate to depreciate in the market.

Vulnerability of growth based on services without faster growth in real agriculture or industry

Economic growth in the past had basically been attained by allowing the services sector to grow faster. This was specifically manifested by a fast growth in trading activities, telecommunication and banking services. However, in the absence of a corresponding growth in the real agriculture and manufacturing, the services sector soon reached its saturated point. The result was the failure of the services sector to generate a continuously high economic growth as it had done before. Hence, the growth rate in Sri Lanka is now slowing down.

Failure to inform people has been costly for the present Government

This situation was well known when the new Government came to power in January, 2015. Hence, what the Government would have done was to conduct a quick survey to assess the country’s true position and alert the people. This was not done. Instead, the Central Bank in its Annual Report for 2014, issued in April, 2015, had continued to hide the true situation from the public as it had done during the reign of the previous Government. Hence, lulled by the rosy picture painted by the Central Bank, in the eyes of the public, the current economic crisis has been an ailment created by the present Government.

This would have been avoided had the Government disclosed the full facts to the people right at the formation of the new Government in January 2015. Such a disclosure would have prepared the people to face the hard economic realities that are to come in their way in the attempt of the Government to rescue the economy. Such a disclosure policy would have enabled the Government to marshal the support of the people to introduce the painful policy action which it is required to take now to put the economy on a sustainable growth path.

Outside ‘auditors’ reading the Sri Lanka economy correctly

Though the true picture relating to the economy has been kept secret to the people, it has been known to the outside auditors of the country all throughout. Such auditors consist of the rating agencies which have to rate the country’s creditworthiness, IMF and the World Bank which have to provide balance of payments and development support, respectively, to the country.

Having dug into the hard economic data of the country and having made a realistic risk assessment regarding the country’s future debt servicing capabilities, the Fitch Ratings has downgraded Sri Lanka international credit standing from -BB to +B and changed the country’s future economic outlook from stable to negative. Though the Moody’s Rating Services did not downgrade Sri Lanka’s international credit rating, the report it has submitted had warned about the possibility of Sri Lanka’s defaulting its external debt.

The Standards and Poor’s Rating Agency had earlier downgraded Sri Lanka from -BB to +B while assigning stable status to the country’s economic outlook. However, going by the Fitch Ratings, S & P has changed its opinion on the economic outlook of the country from stable to negative. In addition, it has placed Sri Lanka on the watch list and warned that, if the country did not put its house in order within the next 12-month period, even the current rating at +B would be changed by the agency for the worse in the future. What this means is that hiding economic facts does not serve the long-term interest of the new Government.

Anyone who is interested in knowing the true position of the country can do so by referring to the alternative publications done by numerous independent think-tanks. The Institute of Policy Studies and Verite Research are two such independent think-tanks that have realistically analysed the country’s true economic picture.

ETCA has been badly managed

The inaction of the Government has been seen in the management of the opposition to the proposed ETCA to be signed by Sri Lanka with India. As this writer had argued in the previous articles in this series, the secrecy maintained by the Governmental authorities on ETCA had allowed critics to label it as an outright sell-out of the country to India. The critics have become popular among professionals because they have highlighted certain issues directly relevant to them. The arguments presented by these critics seem to be plausible but cannot hold water when a thorough analytical study is done on the issue.

Misconceived failure of ILFTA

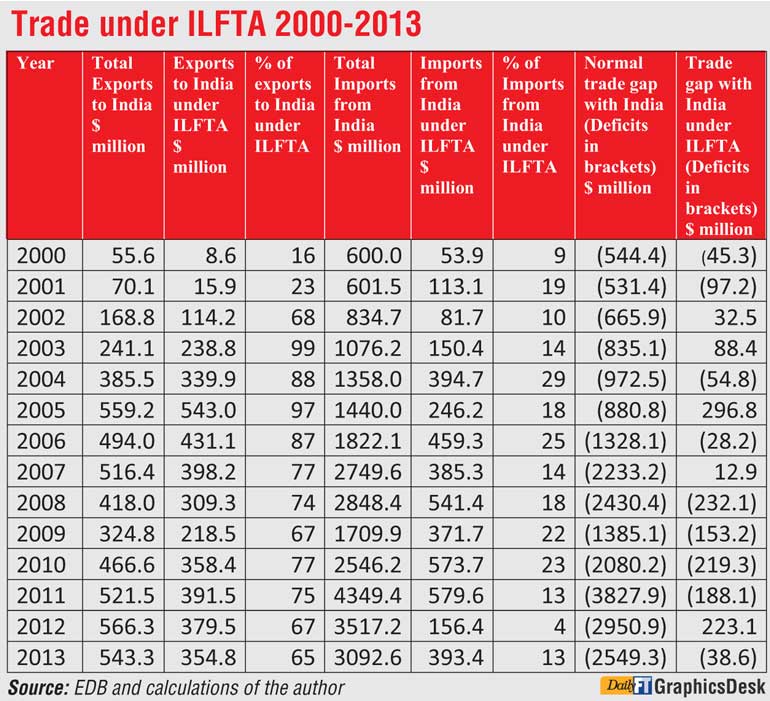

The critics have argued that the Indo-Lanka Free Trade Agreement or ILFTA has been a failure. To support their argument, they point to the widening trade gap in absolute terms with India since the signing of ILFTA. According to them, the trade gap that stood at $ 531 million in 2001 has jumped to $ 3,828 million in 2011 before declining to $ 2,549 million in 2013. Hence, the critics say that ILFTA has favoured India and not Sri Lanka. This is a misconception and a conclusion arrived at by glancing at the information available on the surface.

In ILFTA, the differences between the size of the two countries were taken care of

However, a study done by the Export Development Board in April 2014 has gone into the depth of ILFTA and reported a different story. When signing ILFTA, the difference in the size of the two countries was taken into account and sufficient safeguards were introduced to protect the interests of Sri Lanka in the event of the mighty India swallowing the country. Accordingly, Sri Lanka was permitted to have 1,180 items under tariff lines without duty reduction, also known as the negative list, when it imported goods from India.

In the opposite, India was allowed only to have 429 items at six-digit level on the HS Code in its negative list. When Sri Lanka’s negative list is converted to six-digit level on the HS Code, its negative list is substantially large protecting the interests of Sri Lanka. Hence, the fear that India was to swallow Sri Lanka through ILFTA had been harboured without foundation.

The growth in trade deficit is via imports outside ILFTA

When Sri Lanka’s trade with India after the implementation of ILFTA in 2000 is separated into those items coming under ILFTA and those outside ILFTA, the picture shows a completely different scenario. This is presented in the Table. Since Sri Lanka’s negative list is too vast, almost 90% of its imports from India are outside ILFTA. Since they are subject to normal Sri Lankan tariff rates, they would come to Sri Lanka irrespective of whether there was a free trade agreement or not. That is because those goods are needed by Sri Lankans either for consumption or for use as inputs for further production. If they had not been imported from India, they would have been imported from some other country.

Sri Lanka’s exports mainly via ILFTA

On the other hand, India had a very short list of items in its negative list of items that are not entitled to receive duty concessions. As a result, almost 90% of Sri Lanka’s exports to India had been covered under ILFTA. These exports included spices, natural rubber and rubber products, poultry feed, insulation wired and cables, copper and copper based products, paper and paper products, furniture, garments and ships and floating vessels.

Trade gap attributable to ILFTA has shown mixed results

The trade gap between Sri Lanka’s exports to and imports from India under ILFTA during 2001 and 2013 has shown mixed results. On one side, the gap had been kept at a low level indicating that both imports from and exports to India have been almost at equal levels. On the other, during this period, trade gap under ILFTA was in favour of Sri Lanka in five years; it was in favour of India in eight years. Thus, it is not possible to dismiss ILFTA straightaway as an agreement favouring India outright.

Indian State Governments’ prohibitive taxes should be neutralised by giving full duty waiver by the Central Indian Government

It is also pointed out that India’s State Governments do not cooperate with the Central Government and therefore charge additional duties when Sri Lanka’s products enter those states. The cases in point are Tamil Nadu and Maharashtra. This is inevitable since India’s State Governments are empowered to charge their own duties when such goods are moved through those states. What should be done to protect the interests of Sri Lanka’s exporters is to negotiate with the Indian Central Government to give completely a zero duty level to such goods under the new agreement to be signed.

Losing steam on ILFTA after the initial years

The opposition to ETCA is based on the perceived failure of ILFTA. The failure has been viewed from the point of India having a huge trade surplus with Sri Lanka. But this perception is erroneous, as pointed out above, since that trade surplus has been in connection with goods that have not been covered under ILFTA. However, the recent trade data with a declining share of exports under ILFTA show that Sri Lankan exporters have not been so active as they had been in the initial years of the implementation of the agreement. It appears that they have lost steam in their attempt at penetrating the Indian market. This is also a policy management issue. Thus, it is the responsibility of the Government to address such issues in continuing bilateral negotiations with India, on the one hand, and having continuous consultations with the country’s private sector, on the other.

A continuous dialogue a must for success

To be successful, it is necessary that all stakeholders involved in economic policies should be constantly kept informed of the correct facts. Such knowledge building helps to take the fear out of the vulnerable groups by empowering them. Such an empowerment will serve another purpose: That is, it will provide ammunition to ordinary laymen to assess logically and critically the arguments put forward by critics and arrive at their own conclusions. This is necessary for successful implementation of painful but essential economic reforms. This is what the Government should do in its economic policy management if it desires to attain success in policies.

(W.A. Wijewardena, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected].)