Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 29 January 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

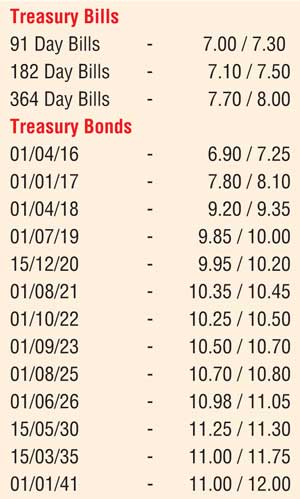

The weighted average at yesterday’s 14.03 year bond auction of 15.05.2030 was seen increasing by 07 basis points to 11.53% against its previously recorded average while the weighted average on the 10.04 year maturity of 01.06.2026 was seen recording 11.14%. The total accepted amount on these two maturities exceeded the total offered amount of Rs. 15 billion on all four maturities by Rs 6.84, despite all bids been rejected for the 4.10 year maturity of 15.12.2020 and the 29.01 year maturity of 01.03.2045.

In secondary bond markets, activity was seen increasing following the outcome of the bond auctions as buying interest on the two auction maturities of 01.06.2026 and 15.05.2030 saw its yields dip to daily lows of 11.00% and 11.25% respectively against its highs of 11.10% and 11.50% on the back of considerable volumes changing hands. In addition, activity was witnessed on the two 2019 maturities (i.e. 01.07.2019 & 15.09.2019) within the range of 9.90% to 9.95%, the two 2021 maturities (i.e. 01.05.2021 & 01.08.2021) within 10.30% to 10.40% and the 01.08.2025 maturity within 10.70% to 10.75% as well.

Meanwhile in money markets, the overnight call money and repo rates decreased further to average at 6.79% and 6.46% respectively as surplus liquidity in the system stood at Rs.62.33 billion. The OMO department of Central Bank was seen successfully draining out an amount of Rs.22.55 billion at a weighted average rate of 6.29% for a period of 6 days yesterday by way of a Repo auction.

Rupee remains stable

The USD/LKR rate on spot contracts remained steady for a sixth consecutive day to close the day at Rs.143.95/15 yesterday. The total USD/LKR traded volume for 27 January was $ 52.76 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 144.60/70; 3 Months - 145.85/95 and 6 Months - 147.60/70.

Reuters - Sri Lankan shares snapped a three-session losing streak and closed marginally higher on Thursday as investors picked up some beaten-down large-cap stocks.

The main stock index ended 0.05%, or 3.43 points, higher at 6,319.89, after posting its lowest close since Jan. 20 on Wednesday.

The index had fallen 8.4% so far this year through Wednesday as foreign investors, unnerved by global concerns over China’s economy, have cut their exposure.

Foreign investors sold a net Rs. 13.9 million ($97,081) worth of shares on Thursday, extending the year-to-date net foreign outflow to Rs. 2.71 billion worth of equities.

Turnover was Rs. 548.4 million, lower than this year’s daily average of Rs. 768.3 million.

The central bank rejected all bids at an auction on Wednesday, signalling it would not tolerate much increase in yields after the yield on the 364-day t-bill jumped 32 basis points to a more than two-year high of 7.80% last week.

This move could help investors return to the market, analysts said. The central bank, as expected, kept its key policy interest rates unchanged on Monday.

Shares of Lanka ORIX Leasing Company Plc rose 3.85%, while Ceylon Tobacco Company Plc gained 0.60%.

Dialog Axiata Plc rose 0.99%, while conglomerate John Keells Holdings Plc ended steady .

Reuters - The Sri Lankan rupee ended steady on Thursday amid importer dollar demand and some foreign outflow from t-bonds, but banks were reluctant to trade below the 144.00 level desired by the central bank, dealers said.

“There was demand for dollars. We have also seen some foreign investors selling bonds,” a dealer said asking not to be named. Another dealer said there was importer dollar demand and nobody was trading the spot rupee below 144.00.

The spot rupee ended flat at 144.00/20 per dollar.

The rupee forwards and swaps were actively traded on Thursday for a second straight session.

Dealers said the one-week forward, which acted as a proxy for the spot currency, ended at 144.45/55 per dollar compared with Wednesday’s close of 144.30/50.

The rupee is under pressure despite a 150-basis-point increase in commercial banks’ statutory reserve ratio from Jan. 16. The central bank kept its key policy interest rates unchanged on Monday.

Commercial banks parked Rs. 39.8 billion ($277.97 million) of surplus liquidity on Thursday using the central bank’s deposit facility at 6%, official data showed.

The central bank’s net holding of government securities decreased by Rs. 22.639 billion on Thursday, official data showed.