Thursday Feb 26, 2026

Thursday Feb 26, 2026

Monday, 30 November 2015 00:00 - - {{hitsCtrl.values.hits}}

LONDON (Reuters): If anyone needed proof of the link between the environment and investment, they need only look at the likely billions of dollars that auto giant Volkswagen looks set to pay in fines and compensation for making its cars appear greener than they are.

LONDON (Reuters): If anyone needed proof of the link between the environment and investment, they need only look at the likely billions of dollars that auto giant Volkswagen looks set to pay in fines and compensation for making its cars appear greener than they are.

And yet, with a UN climate summit in Paris set to promote a switch to a low-carbon economy, data from the UN body urging investors and asset managers to give more weight to non-financial considerations, including the environment, shows a patchy response, at best.

The UN-backed initiative, Principles for Responsible Investment (PRI), encourages asset managers worldwide to commit, among other things, to factor Environment, Social and Governance (ESG) issues into their investment decision-making.

The initiative seeks to acknowledge the growing long-term influence on asset values of ‘non-financial’ factors such as carbon emissions, the gender make-up of the board or the rigour of policies on bribery, safety or low pay.

A Reuters analysis of PRI data shows that, by 21 September this year, 657 asset managers had been signed up to PRI for more than a year, and therefore published an annual report.

Series of measures

PRI comprises a series of basic compulsory measures and more advanced voluntary measures, and the reports give an insight into how prepared the managers are to handle the type of investment challenges that could be presented by the Paris meeting.

The voluntary commitments include three that particularly highlight how thoroughly ESG criteria are being applied: showing how ESG processes have influenced portfolio construction; showing how investing using ESG has improved financial or ESG performance and reduced risk; and showing how ESG has affected the firm’s investment view or performance.

Of the 350 equity- or bond-focused firms that Reuters examined in detail who published PRI reports, only 83 said they had met all three of these commitments. A further 195 firms with combined assets of roughly $ 28 trillion failed to meet at least one of the measures, while 72 firms with combined assets of just over $ 11 trillion met none of them.

Among that last group were JPMorgan Asset Management, which manages $ 1.7 trillion; Aberdeen Asset Management, which manages $ 490 billion; and UBS Global Asset Management, which manages $ 652 billion.

Both JPMorgan and UBS declined to comment, while Aberdeen said it was in the process of enhancing its ESG activity and would meet the objectives next year.

Climate decisions

Examples of companies whose value has suffered because of failings in areas covered by ESG include oil company BP, which saw its share price slide after it was forced to pay out billions of dollars after an oil spill that was ultimately down to poor business practice, as well as Volkswagen.

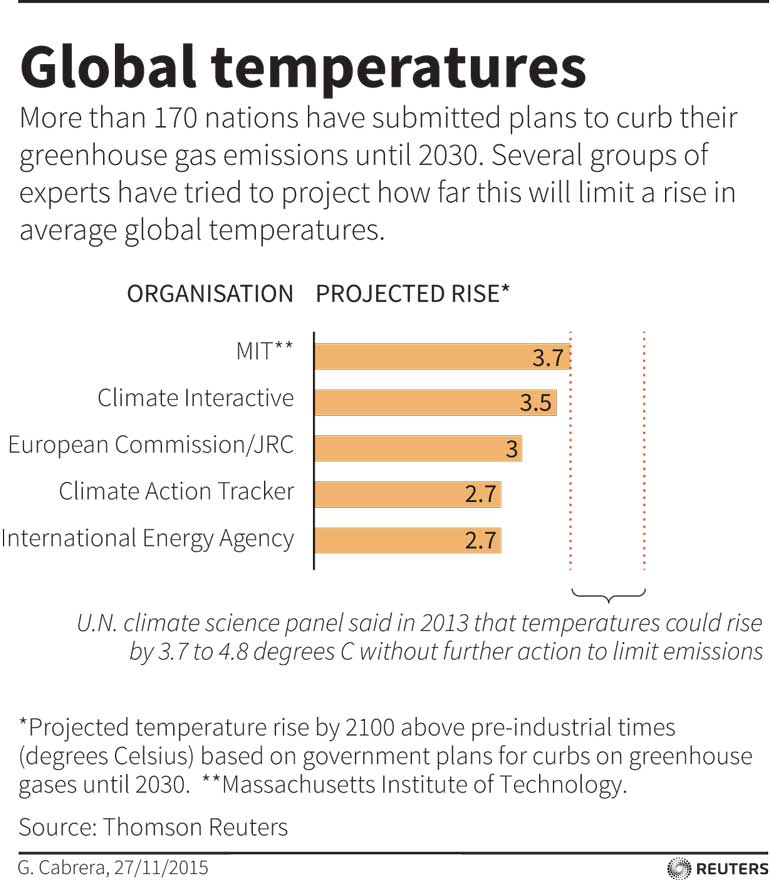

Meanwhile, if the Paris conference can produce pledges to limit greenhouse gas emissions sufficiently to keep a global temperature rise below a UN ceiling of 2 degrees Celsius (3.6 Fahrenheit), equities and infrastructure in emerging markets are one sector likely to get a boost, a report by consultants Mercer showed.

And a study published this month by the University of Cambridge Institute for Sustainability Leadership said global investment portfolios could lose up to 45% as a consequence of short-term shifts in climate change sentiment. (http://bit.ly/1WMorRi)

One firm looking to make more allowance for ESG factors in general is Standard Life Investments, its Chief Investment Officer Rod Paris told the Reuters Investment Outlook Summit last week.

“We’re seeing much greater demand for us to demonstrate that principles around (ESG) investing are meaningfully embedded in the investment and research processes of fund managers; that it’s real, that it’s part of how we look at companies.”

Paris, whose firm met some but not all of the voluntary ESG criteria, said managers needed to address ESG issues to avoid scandals like those at VW.

“If this is important to society, it will get priced into markets at some stage. And if it’s being priced into markets, as a good investor, I want to be ahead of it, I want to understand it ... that’s where the competitive advantage comes from.”

OSLO (Reuters): Leaders of 78 major companies urged governments to include the pricing of carbon emissions as part of policies to curb global warming, as world leaders prepare for a summit on climate change in Paris.

Chief executives of the companies, with combined annual turnover of $ 2.1 trillion, said in an open letter to world leaders that an ambitious deal in Paris would help create both economic growth and jobs.

It said the CEOs, organised by the World Economic Forum, were from companies including HSBC, Siemens, SOHO China, PepsiCo, Engie, Mahindra Group, Tata, Nestlé, BT Group, Unilever and PwC.

“We believe that effective climate policies have to include explicit or implicit prices on carbon achieved via market mechanisms or coherent legislative measures according to national preferences,” they wrote.

Such pricing would “trigger low-carbon investment and transform current emission patterns at a significant scale,” they added, noting they were taking voluntary actions to reduce their environmental and carbon footprints.

Almost 200 nations will meet in Paris from 30 November to 11 December to try to map out a transformation of the world economy towards a low-carbon future, breaking with an increasing reliance on fossil fuels since the Industrial Revolution.