Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 26 November 2015 00:00 - - {{hitsCtrl.values.hits}}

By Uditha Jayasinghe and Shehana Dain

By Uditha Jayasinghe and Shehana Dain

Taking an independent view, Budget 2016 fails to fall in line with the Economic Policy Statement outlined by the National Government, insisted Economist Dr. W.R. Wijewardena and warned it included significant deficit and taxation loopholes that could create conundrums for fiscal management.

Delivering a clear and concise analysis of the latest Budget at the Daily FT-Colombo University MBA Alumni Association post-Budget seminar, the former Central Bank Deputy Governor pointed out the new proposals outlined fell short of two key aims outlined by Prime Minister Ranil Wickremesinghe during his landmark Economic Policy Statement (EPS) to Parliament earlier this month.

The first goal was to reduce the Budget deficit to 3.5% by 2020, which Dr. Wijewardena noted would be hard to meet as Budget 2016 aims to keep the revenue and expenditure gap at 6%. Decreasing the deficit would be made additionally difficult as Sri Lanka has overshot its deficit target for 2015.The second was increasing the component of direct taxes to 40% from the current 80:20 ratio but under Budget 2016, indirect taxes would balloon to 86% of Government revenue while direct taxes would only be 14%.

However, he praised the Prime Minister and Finance Minister for formulating a Budget that managed to maintain a delicate balance between much-needed liberalisation reforms and the expectations of the public who demand price reductions on essential goods in every budget.

The economist called for the Government to tighten budget oversight, recalling that no budget in post-independent Sri Lanka had managed to stick to its targets, and urged more oversight in making sure Budget proposals were actually implemented during the fiscal year in question.

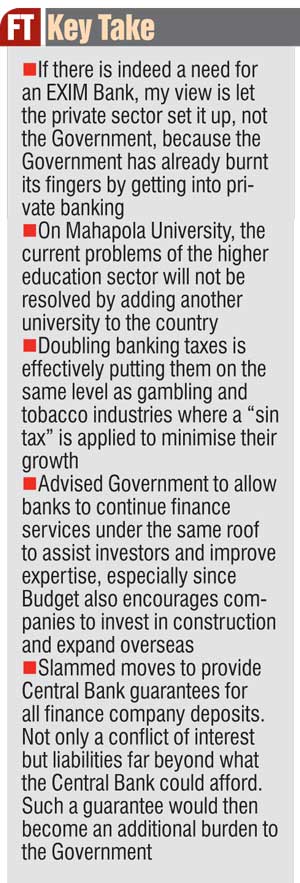

He also cautioned against proposals to establish an Export Import Bank or EXIM Bank, stressing Sri Lanka’s exports had not grown to the point of justifying such an institution. Drawing examples from troubled banks Lankaputhra and National Enterprise Bank, the economist advocated an EXIM Bank be set up by the private sector. He reminded the packed conference room that Lankaputhra Bank went bankrupt after it bankrolled Mihin Air and the National Enterprise Bank also took a nosedive within a year of opening.

“If there is indeed a need for an EXIM Bank, my view is let the private sector set it up, not the Government, because the Government has already burnt its fingers by getting into private banking.Let the private sector finance it, let them capitalise it. Because what happens when the Government gets into this banking business, eventually if the bank is in trouble, the taxpayers’ money will have to be used to recapitalise it and we know taxpayers’ money has more important things to do than recapitalising bankrupt commercial banks,” was the frank assessment of Dr. Wijewardena.

Turning to higher education, Dr. Wijewardena advised the Government to find a more appropriate avenue to laud former UNP politician Lalith Athulathmudali rather than spending public funds to set up a new university.

“The current problems of the higher education sector will not be resolved by adding another university to the country. The current problem in higher education is consolidating the existing university system and improving its quality and getting academics to do more research so we can implement and realise this complex economic system the Prime Minister wants to have in the country.”

He was also critical of doubling banking taxes, effectively putting them on the same level as gambling and tobacco industries where a “sin tax” is applied to minimise their growth.

“For the first time banking has been branded as a sinful activity and they have raised taxes from 15% to 30%. Another issue in the Budget is that banks have been prohibited from undertaking leasing businesses,” he went onto say, advising the Government to allow banks to continue finance services under the same roof to assist investors and improve expertise, especially since the Budget also encourages companies to invest in construction and expand overseas. Such large-scale projects might not be competently supported by small-scale finance companies.

Dr. Wijewardena slammed moves to provide Central Bank guarantees for all finance company deposits, pointing out it was not only a conflict of interest but the liabilities were far beyond what the Central Bank could afford. Such a guarantee would then become an additional burden to the Government, which is already responsible for Rs.500 billion deposits at the National Savings Bank (NSB) and does not possess sufficient tax revenue to meet the responsibility. Dr. Wijewardena also warned the move could encourage depositors to move their savings out of banks into finance companies.

“As at the end of 2014, the total deposits of license finance companies amounted to Rs.415 billion but the Central Bank has a capital base of only Rs.82 billion. I think the Finance Minister will have the Central Bank becoming bankrupt before any of these finance companies become bankrupt. This is the hard message I have to deliver.”