Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 16 November 2015 00:00 - - {{hitsCtrl.values.hits}}

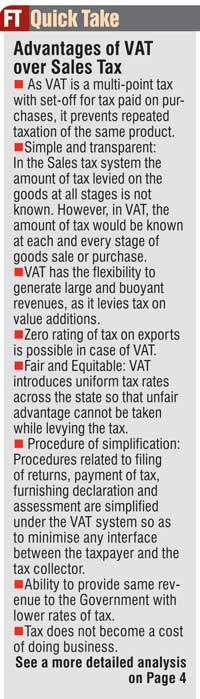

If terrorism destroyed higher growth in Sri Lanka’s tourism industry then its post-war rebound is under threat with the Yahapalana Government toying with the idea of reintroducing Turnover Tax to replace Value Added Tax.

First to formally voice concern over the damaging impact of the return of Turnover Tax (TT) has been the tourism sector while the rest of the private sector has voiced similar dismay.The reason the Government is considering TT is to boost revenue but most experts have warned of dire consequences given its cascading effect.

First to formally voice concern over the damaging impact of the return of Turnover Tax (TT) has been the tourism sector while the rest of the private sector has voiced similar dismay.The reason the Government is considering TT is to boost revenue but most experts have warned of dire consequences given its cascading effect.

“VAT is a more efficient and equitable tax system. Return to TT isn’t the solution for loss of revenue. The Government must be pragmatic to address the fundamental problems with a country’s tax collection including the widening of the net,” experts emphasised.

The reintroduction of TT, according to them, will seriously derail the new Government’s plan to boost investments, both local and foreign, to create 1 million jobs in five years.

A highly disturbed tourism industry has submitted a sincere plea to Prime Minister Ranil Wickremesinghe to reconsider any moves to reintroduce TT. This followed an emergency meeting of the Tourist Hotels Association last week.

“Any change that will move away from VAT to perhaps a Business Turnover Tax will have serious implications on the cash flow; will have an impact on the growth of new hotels and will negatively impact FDIs coming in; will have a cascading effect and is not conducive to be applied in the context of a developing economy,” THASL has warned in its submissions to the Premier.

It was emphasised that the current tax regime is conducive to the growth of the industry and should be maintained for at least a further three years so as to ensure the sustainable growth of the industry.

THASL has said the growth of the tourism sector is a national policy objective and all stakeholders, including the hotel industry, should be supported to achieve this goal.

The levy of additional taxes will result in the hotel industry being unable to contribute as it does now to growth and would ignore national policy that considers Tourism as a focus area in the Government’s national economic agenda.

It was pointed out that while the revenue generated from indirect taxes from the formal sector within the industry amounts to approximately Rs. 10 billion, the informal sector remains unregulated. Furthermore, if additional tax burdens on the hotel sector are passed on to the customer, Sri Lanka will be unable to compete effectively within the region, which will affect arrival numbers and reduce much needed foreign exchange generation.