Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 13 October 2015 00:01 - - {{hitsCtrl.values.hits}}

By Naushervan Beg

The real estate sector

The real-estate sector is amongst one of the key drivers for many economies and constitutes an important contributor to national GDP, a source of revenue generator for governments and a large employment provider.

Real estate sector as an investment class

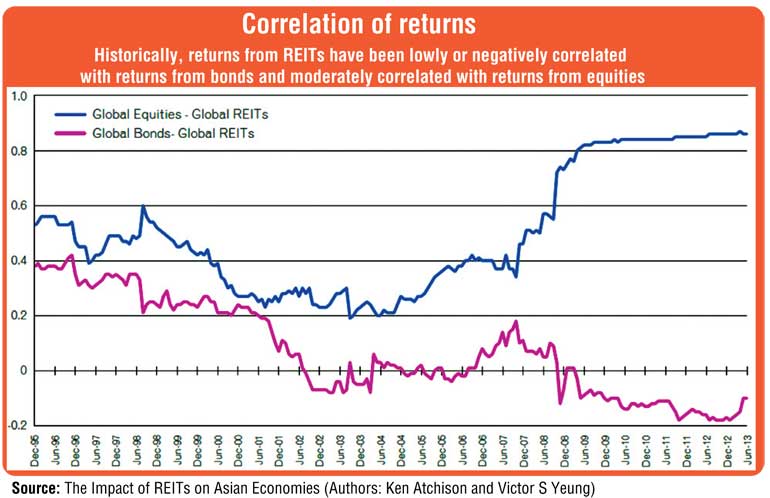

Real estate can channel savings into the economy and can be an important investment class that naturally appeals to investors, especially within the regional and Sri Lankan context, because of its inflation hedge and touch-and-feel perception. Real estate has investment characteristics that are distinct from traditional asset classes, as its returns are not directly correlated to other conventional investment classes such as debt, equity and or commodity and therefore offer better diversification and risk adjusted returns, when held within a portfolio. Many global pension funds have long valued real estate investments for its steady income, potential for capital gains and risk diversification.

Given the growth dynamics and expected real estate and infrastructure developments in Sri Lanka, the time is opportune for Sri Lanka to establish a supportive and positive REIT legislative framework. This will have a domino effect on the investment landscape, real estate sector, capital markets and the real economy – Pic by Lasantha Kumara

Challenges for investing in real estate

The desire of owning or investing in real estate is generally very high within most people’s investment objectives. However, modest income levels coupled with high inflation makes it very challenging for most people to achieve this desired objective. Investments in real estate mandate large financial commitments and can create illiquid exposures. Other challenges of investing in real estate include lack of transparency and governance, high cost of due-diligence and the technical knowhow and sophistication required for real estate development, post development and property management. These issues in-turn limit this sector from reaching its true potential as the sector remains deprived of flow from potential investors.

Improving the real estate investment landscape through REITs

A viable, modern and recognised mechanism to develop and channel money into the real sector is through Real Estate Investment Trusts (REITs). REITs are capital market structures and collective investment vehicles that invest in a diversified pool of professionally managed investment-grade real estate. A REIT is a fund based trust modelled after mutual funds or unit trusts that does not invest in securities, but purchases, owns, operates and sells real estate assets. Most REITs are listed on a public stock exchange and allow investors the secondary market facility of liquidity and participation in a similar way to that of buying and selling shares or stocks of companies.

REITs also improve information flow and property market transparency because of their status as listed and regulated entities. REITs can also modernise the real estate sector by establishing corporate governance practices and developing property management standards.

REIT Structures – Rental and developmental

REIT is a trust that owns and operates income-producing real estate. REITs can invest in properties generating income through the collection of rent or rental yields and are commonly called rental REITs.

REITs can also be structured for development or construction purposes and are generally termed as developmental REITs. Such structures are involved in the acquisition, development and disposal of real estate projects.

REITs are also hybrid in nature and can be a combination of both structures. REITs can be tied to almost all aspects of the economy, including residential apartments, office blocks, hospitals, nursing homes, hotels, industrial facilities, shopping malls, warehousing, educational facilities, agricultural lands, air and sea ports and other infrastructural developments.

Benefits to the wider economy

Creating modern, professional property markets: In order to attract investments in to the real estate sector, it is important to properly regulate its activities and bring transparency to its workings. REITs introduce regulations and transparency to this sector by bringing standardisation and best practices, resulting in proper governance and setting benchmarks for quality development, property management and related financial transactions.

REITs as a contributor to the capital markets: REITs enhance the scope and depth of capital markets as most instruments get listed on stock exchanges. This increases the capitalisation of the stock exchange which acts as an important barometer or proxy for a nation’s economy. In addition the establishment of well regulated governance enhances the overall investor perception and awareness which in turn leads to higher investor confidence and investments. REITs are suitable and popular amongst institutional investors, such as pension funds and insurance companies, which tend to be long term investors and providers of capital.

Recycling of exiting capital: REIT structures give corporates an alternative mechanism to raise low cost capital by unlocking their lands banks and utilising the unlocked cash towards their core business activities and revenue generation. Accordingly REITs can also provide long term sustainable funding for developers by giving them a structure through which they can utilise their exiting real estate assets and fund fresh projects.

Benefits for the government: Tax authorities are normally concerned that they will lose tax revenue as REITs demand fair pass-through tax treatment. However, favourable tax treatment at the REIT level does not create a net loss in tax revenue, rather just makes REITs competitive with direct property investments. REITs also establish transparent documentation practices which in turn ensure actual transaction prices being recorded and subsequently allowing tax collection on the actual price. Historically in underdeveloped markets this has been a problem as documented prices are understated from the actual transaction prices, for tax averting purposes. Additionally, with the reduction of flows to an undocumented economy governments’ ability to plan based on better statistics also improves, as it reduces the ability of the underground economy to use real estate as safe-haven for storing wealth.

Benefits to the investors

Small time savers: REITs allow general public or small investors with the opportunity to invest in the real estate sector which otherwise requires sizeable capital commitments. REITs also enables small savers to own fairly liquid exposures in real estate, as listed REITs are traded on a stock exchange, creating a readily available secondary market, in case, one wants to reconvert the asset into cash.In contrast, a middle income property owner would have to sell the entire property to generate liquidity when needed, as opposed to selling the requisite number of REIT units.

Institutional Investors: REITs offer high level of transparency and governance through an established regulated environment this attracts investments from corporates and investment funds which otherwise are not allowed to have exposure to the real estate sector. Institutional investors such as pension funds and insurance companies prefer having substantial exposure to real estate for its steady income and potential for capital gain.

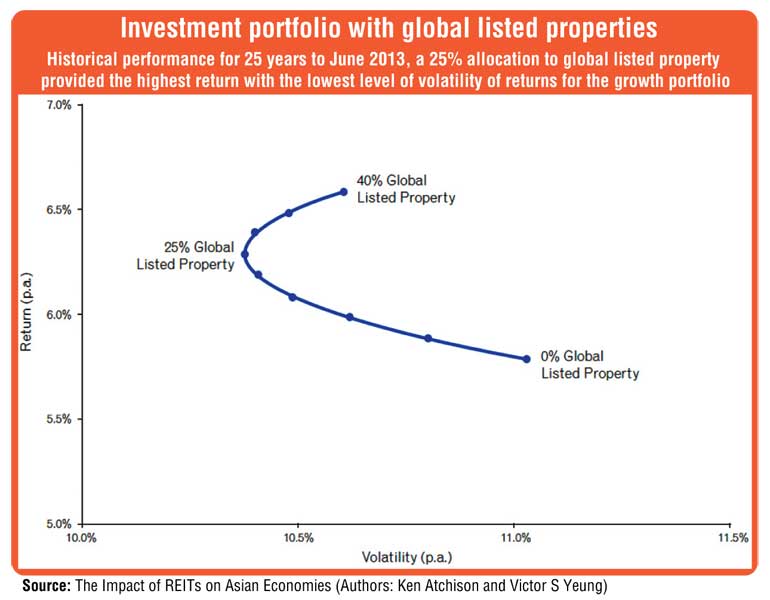

Portfolio diversification: Real estate have investment characteristics that are distinct from traditional asset classes as its returns are not directly correlated to other conventional investment classes such as debt, equity and or commodity and therefore offer better diversification benefits and risk adjusted returns, when held within larger portfolio. REITs also provide investors with regular income streams, diversification, long-term capital appreciation and hedge against inflation, as the derived investment return are linked to the escalation in real estate rentals and prices.

High effective returns: REITs in many countries are a pass-through vehicle for tax purposes, that is the trust is not taxed but the beneficiaries or investors are taxed on their returns. This tax treatment is only available provided the trust distributes 90% or more of its profits annually. In contrast, if such investments were routed through a company structure, profits are taxed and subsequently shareholders are taxed on dividends, thereby resulting in double taxation. In addition the 90% requirement also appeals to investors as it ensures a large chunk of the profit being received by them.

Creating a supportive regulatory environment

Real estate prices and valuations in developing markets do not necessarily follow transparent price discovery mechanisms and valuation criteria, that otherwise would be expected in developed markets, where the real estate sectors have evolved. Further documentation also remains a major problem, and in the absence of proper documentation it is very complex to value a piece of land or property, adding to this difficulty. This in turn makes regulators extremely careful in their course of actions as they fear, overvalued properties could be sold into REIT structures and the burden of this overpricing ultimately could trickle down to the small time saver. These concerns are easily manageable as further discussed in the next topic.

The regional REITs landscape

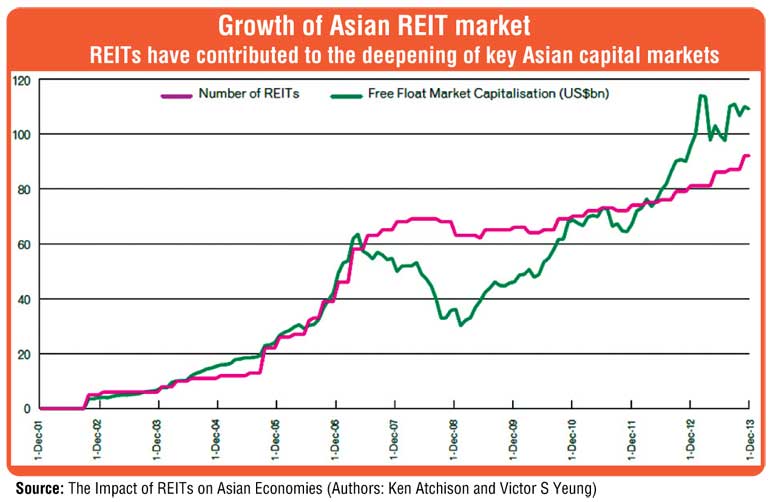

The REIT market in the Asia-Pacific region is valued at more than $250 billion, according to Bloomberg; Australia, Japan and Singapore are the region’s three-largest REIT markets. There are 34 REITs and business trusts listed in Singapore. From a south Asian perspective, both India and Pakistan have leaped forward in developing supportive REIT regulations in order to support the potential multi-billion dollar REIT market.

Pakistan has been able to launch South Asia’s first public listed REIT. In Pakistan the local government, that imposes transfer tax on real estate, came out with a significantly reduced rate of tax for transfers to and from REITs, so as to promote recording of the real transaction value (which) the REIT has to do so as to be publically traded.

Further to have the required confidence of the regulator, a book building process was adopted, where a minimum of 75% of the units were offered to sophisticated investors, through a Pre-IPO Dutch Auction process. The rest of the 25% was open to small savers who participated via an IPO process on the discovered strike price. (Source: Management, Arif Habib Dolmen REIT Management Ltd.)

The Indian Finance Ministry is considering scrapping stamp duty on transfer of properties to REITs and also allowing REITs a pass through status. Theseissues were brought-up during Prime Minister Narendra Modi’s meetings with top investment bankers and chief executives of companies in New York. India is expected to introduce its first public REIT early next year. (Source: http://naredco.in/news-updates-details.asp?id=14228&prYear=2015)

A Sri Lankan perspective

Given the growth dynamics and expected real estate and infrastructure developments in Sri Lanka, the time is opportune for Sri Lanka to establish a supportive and positive REIT legislative framework. This will have a domino effect on the investment landscape, real estate sector, capital markets and the real economy.

Retail savers: One of the major objectives of the policy makers has been to encourage the small time savers to participate more actively in the local capital market. The introduction of REITs would add a new dimension in enhancing the investment opportunities available to small scale savers. Traditional interest bearing deposits and instruments are no longer conducive to meeting long-term saving objectives, especially in the context of Sri Lanka’s aging demographics and recent single digit interest rates regime. The fact that REITs would provide a mechanism for such investors to diversify their risks and meet their required investment objective makes the introduction and formalisation of this investment class into the capital market a vital requirement.

Institutional funds: Local institutional funds tend to have large weightage towards traditional interest rate baring instruments and deposits, with some allocation towards listed equities. With limited capital market depth and availability of investment instruments, institutional funds face an ongoing challenge of diversification, risk management and investment growth (returns). Global institutional funds, especially pension funds and insurance companies have long benefited from real estate investments. With the introduction of REITs the local institutional funds will also have additional investment avenues to manage their required commitments.

Foreign investors: REITs will provide foreign fund managers an opportunity to invest in Sri Lanka’s real estate sector through a formal, transparent and well governed mechanism. This will establish the required overall investor confidence which is essential for attracting international long term capital. REITs could also be of special interest to the Gulf investors, given that the investment is asset backed and appealing to the larger investor appetite of that region. Further due to its inherent structure, REIT can also serve as an avenue for foreign investors to invest in Sri Lankan’s Real Estate Sector, who otherwise to some extent are restricted, due to the recent additions made to the Land Act.

[The writer is associated with the Entrust Group and is a Director/CEO for its equity brokerage house. His prior work experience includes involvement with large Canadian capital market related institutions. The article draws on valuable information and extracts provided by Yasir Maqbool (CFA Regional Head Risk, Sri Lanka and Maldives, Habib Bank Ltd.) and Ishraf Rauff (Managing Director/CEO, ADL Capital Ltd.).]