Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 1 October 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

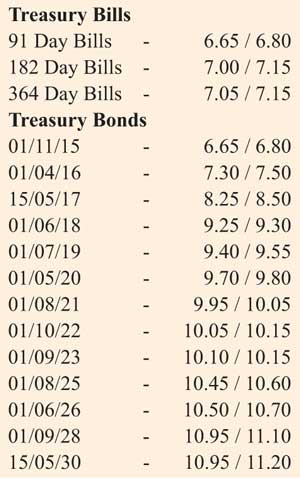

The weighted averages at yesterday’s weekly Treasury bill auction remained constant against market expectations of an increase in yields. The 91 day and 182 day maturities recorded weighted averages of 6.78% and 7.07% respectively while all bids received for the 364 day bill were rejected. The total amount accepted at the auction was Rs. 5.87 billion as against an offered amount of Rs. 20 billion.Meanwhile, in secondary bond markets, yields of the shorter tenure maturities were seen increasing during the morning hours of trading, with the 15 January 2017 and 1 June 2018 reaching intraday highs of 8.10% and 9.28% respectively. However, with buying interest coming in at these levels, subsequent to the T-bill auction, yields were curtailed from moving up any further. Two way quotes on the rest of the yield curve remained broadly steady in comparison with the previous day’s closing levels.

The weighted averages at yesterday’s weekly Treasury bill auction remained constant against market expectations of an increase in yields. The 91 day and 182 day maturities recorded weighted averages of 6.78% and 7.07% respectively while all bids received for the 364 day bill were rejected. The total amount accepted at the auction was Rs. 5.87 billion as against an offered amount of Rs. 20 billion.Meanwhile, in secondary bond markets, yields of the shorter tenure maturities were seen increasing during the morning hours of trading, with the 15 January 2017 and 1 June 2018 reaching intraday highs of 8.10% and 9.28% respectively. However, with buying interest coming in at these levels, subsequent to the T-bill auction, yields were curtailed from moving up any further. Two way quotes on the rest of the yield curve remained broadly steady in comparison with the previous day’s closing levels.

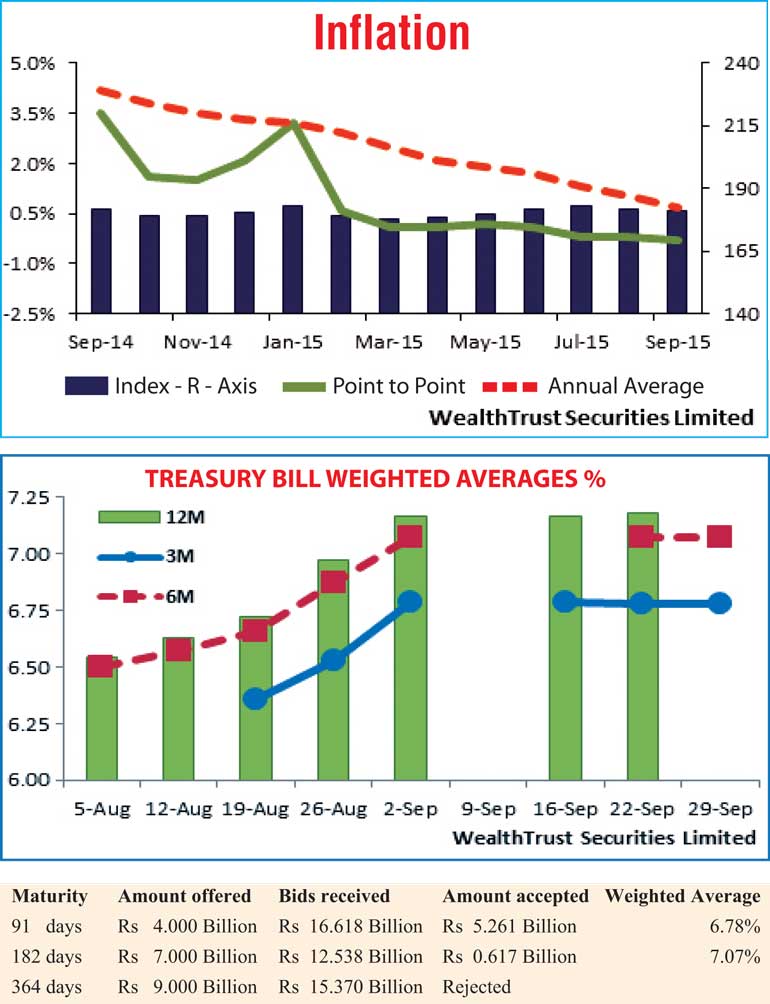

The inflation figure for the month of September which was announced last afternoon, registered a historical low of a negative 0.3% on the point to point, based on the 2007 index. The annual average inflation figure also decreased to a low of 0.7% as against its August figure of 1.0%.

In the money market, overnight call money and repo rates remained mostly unchanged to average 6.35% and 6.47% respectively as surplus liquidity remained a high Rs.62.38 billion.

Rupee trades within a narrow range

The rupee was seen trading within a narrow range of Rs.141.25 to Rs.141.35, against its previous day’s closing levels of Rs.141.20/25. The total USD/LKR traded volume for 29 September was $ 98.81 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 141.82/90; three months – 143.05/25; six months – 144.70/85.