Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Wednesday, 30 September 2015 00:07 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The dull sentiment prevailing in the secondary bond market continued, ahead of the inflation numbers for the month of September, which is due today. The annualised average inflation for the month of August, reflected a decline for the 27th consecutive month to 1.0%, while it’s point to point remained unchanged at a negative 0.2%.

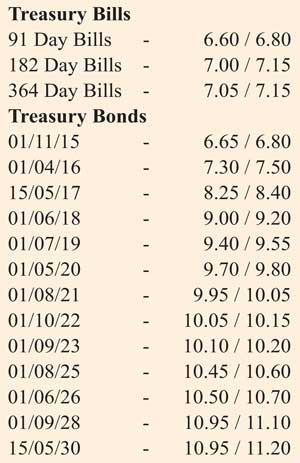

The liquid maturities consisting of 1 July 2019, 1 August 2021, 1 September 2023 and 1 September 2028 were quoted at yields ranging from 9.40/55, 9.95/05, 10.10/20 and 10.95/10 respectively while limited volumes of the 1 June 2018 maturity changed hands within the range of 8.90% to 9.00%.

Today’s weekly Treasury bill primary auction will have on offer a total amount of Rs. 20 b, consisting of Rs. 4.0 b of the 91 day bill, Rs.7 b of the 182 day bill and Rs. 9 b of the 364 day bill.

At last week’s auction the weighted average of the 91 day bill dipped by one basis point to 6.78%, the weighted average of the 364 day bill increased by one basis point to 7.18%, while the yield of the 182 day maturity remained unchanged at 7.07%.

In the money market, surplus liquidity increased to Rs.70.75 billion as overnight call money and repo rates remained mostly unchanged to average 6.35% and 6.45% respectively.

Rupee closes steadily

The rupee was seen closing the day mostly unchanged at Rs. 141.20/25, subsequent to trading at lows of Rs. 141.35 on the back of importer demand. The total USD/LKR traded volume for 28 September was $ 80.50 million.

Some of the forward USD/LKR rates that prevailed in the market were one month – 141.90/00; three months – 143.15/25; and six months – 144.75/95.