Thursday Feb 26, 2026

Thursday Feb 26, 2026

Monday, 28 September 2015 00:02 - - {{hitsCtrl.values.hits}}

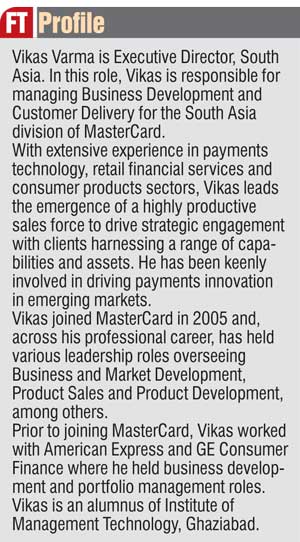

Q: What prompted MasterCard to set up a fully fledged office in Colombo?

A: We have been servicing Sri Lanka remotely for around three decades with long standing relationship with several. But after the market has crossed the ‘gating point’ we thought time to have a presence on the ground. My sense is it is only the beginning. From a domestic and international standpoint Sri Lanka is a major emerging opportunity. When you are at ground level and meeting customers every day, it is easier to harness these new opportunities and serve Sri Lanka and the customers better.

Q: Do you take a longer time to set up shop in a country, especially emerging nations?

A: Not necessarily. In fact there are several emerging markets where we have no presence but overall we are currently present in 210 countries with a base of 2 billion MasterCard holders. We don’t follow any particular paradigm but Sri Lanka is close to us, and it has reached a critical juncture where remote servicing doesn’t do justice to this market. A stable government, a steadily growing economy, single digit inflation, very high human development indicators, small, literate and educated compact population with rising per capita income are major positives for Sri Lanka. The country can realise its economic goals faster and we decided let’s be present, partner and be part of this year future.

Furthermore our association with Tourism Ministry and Sri Lanka Tourism Board, in 2012, made us realise the opportunity in Sri Lanka for international inbound tourism. Our belief has been manifested by rising tourist arrivals in post-war Sri Lanka. We are keen to partner with the Government to drive tourism, boosting inward remittances and making it efficient as well as enhance financial inclusion via leveraging mobile and digital convergence.

Q: Why are MasterCard expertise and solutions relevant?

A: We work with tourism promotion authorities in Thailand, Singapore, Beijing and several state governments in India. Because of the scale of our operations, we see lot of data where consumers spend. We are able to aggregate that data using a very large and sophisticated warehouse we have. Under MasterCard Advisors which is primarily payments consulting we offer Information Services, Implementation Services and Consulting Services.

Firstly we are able to provide a competitive benchmark of how Sri Lanka performs as a tourist destination vis-a-vis peers. Secondly we can evaluate ways where there are opportunities to target high potential but under penetrated source markets overseas and thirdly within existing markets look at segments which are underrepresented or under provided in terms. These can help Sri Lanka in facing the challenge of drawing more high spending tourists. Payment infrastructure is one aspect.

But there are other key elements when using data analytics. For example how is Sri Lanka competing with other destinations, where are people going and who is not coming here. What kind of tourists Sri Lanka can target. This will help Sri Lanka build a strategic plan or a road map, identifying gaps to be filled in infrastructure, customer segmentation, properties etc. We can also help by leveraging our capability within advisory services, by targeting relevant data bases and customers anywhere in the world who are potential tourists to Sri Lanka.

We can look at ‘ominichannel’ marketing effort as well which we can drive. MasterCard Advisors service also provides creative campaigns and execution on a turnkey basis. We have the data, trends, campaign management tools to capture those. We have done it on a tactical manner under the previous MoU with Tourism Ministry. But our keenness is to scale it to a strategy level. In May, we had courtesy call on Prime Minister who was very receptive. We are keen to have a long term partnership.

Q: Sri Lanka isn’t yet a ‘Priceless city’ in the MasterCard overall program?

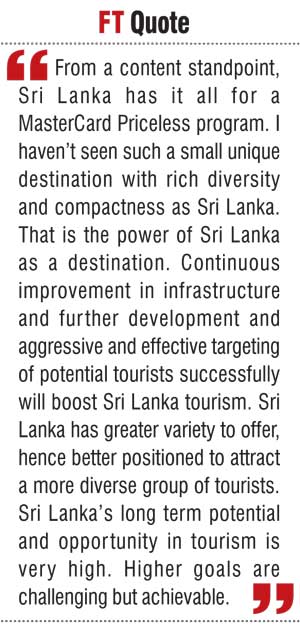

A: Yes, Sri Lanka isn’t a priceless city yet but I would love Sri Lanka to be included one day. There is a checklist and Sri Lanka needs to fulfil those but some of them are being addressed. Rising tourist arrivals is a testimony of that. However from a content standpoint, Sri Lanka has it all. I haven’t seen such a small unique destination with rich diversity and compactness as Sri Lanka. That is the power of Sri Lanka as a destination. Continuous improvement in infrastructure and further development and aggressive and effective targeting of potential tourists successfully will boost Sri Lanka tourism.

According to UN WTO data across the globe tourism contributes 9% of GDP with a significant direct, indirect and induced impact. Tourism also provides 1 in 11 jobs in the world and generates $ 1.4 trillion in exports, accounting for 6% share of the world’s exports. By 2013, international tourism numbers have grown to 1.08 billio n from 25 million in 1950 whilst by 2030 UNWTO projects 1.8 billion international tourists.

n from 25 million in 1950 whilst by 2030 UNWTO projects 1.8 billion international tourists.

Closer home, the Asia Pacific region contributed 22.8% of world’s international overnight arrivals and 31% of its international tourism receipts in 2013. Tourism also contributed 9.2% of Asia Pacific’s GDP and 8.3% of its total employment in 2014. In absolute terms this translates to $ 2.16 trillion and 150.5 million jobs in 2014. These data make Asia Pacific the fastest growing region for international tourism.

Sri Lanka has greater variety to offer, hence better positioned to attract a more diverse group of tourists. Sri Lanka’s long term potential and opportunity in tourism is very high. Higher goals are challenging but achievable.

Q: What were the core objectives of the MoU with Ministry of Tourism signed in 2012?

A: It is mainly to drive tourism traffic from India to Sri Lanka. We have around 20 merchant for year round tie ups in Sri Lanka where Indians would like to dine or shop. We promoted this in India via multiple media. We also looked at feeder markets such as Middle East and Asia. We like to expand this initiative to cover US, Europe and Chinese, Japanese markets. Having been engaged in a tactical exercise via the MOU, we would like to scale the partnership up to a more strategic level, as Sri Lanka is now ideally positioned for same.

Q: Can you expand on strategic level partnership?

A: We are proposing a strategic tie up with the Tourism Ministry which would lead to jointly constructing a road map for tourism, leveraging our consulting, data warehousing, analytics, marketing and targeting capabilities under the MasterCard Advisors value offering.

Q: What other countries have leveraged and benefitted from MasterCard Advisors?

A: We are in discussion with several agencies in Asia Pacific as well as state governments in India with facing similar challenges as Sri Lanka or have attached importance to tourism. We also successfully run the Great Singapore Sale (See box story). All of these have been long term partnerships.

Q: Of the 2 billion MasterCard base, any idea how many persons travelled or took an overseas holiday?

A: In 2013 there were 1.08 billion international travellers and half that would be MasterCard users.

Q: Of the 1 billion tourists, how many use a credit or debit card and any idea on the spend?

A: We don’t store personal data, but we have data on payment habits. For example we can have knowledge of a card that was in Sri Lanka and used at local merchants, and that left to Thailand without doing duty free shopping at BIA but did so in Phuket. For those analysing data that begs a question why not BIA Duty Free? We also can have data of set of people in the US who came to Asia Pacific for a beach holiday but didn’t consider Sri Lanka though they could have since Sri Lanka is an ideal destination. We can find out where potential tourists to Sri Lanka who are taking holidays elsewhere. We can target them and lure them to Sri Lanka. Post-war tourism has grown considerably in Sri Lanka and I understand around 1.8 million tourists are targeted in 2014. This is great but still small in comparison to competitor destinations. Imag ining the impact Sri Lanka can have if it succeeds in drawing 5 million tourists or attracting the more high spenders?

ining the impact Sri Lanka can have if it succeeds in drawing 5 million tourists or attracting the more high spenders?

Q: How can Sri Lanka double tourist arrivals? Increasing the number as well as drawing high spending tourists?

A: One is demand creation which is targeting potential tourists who are travelling elsewhere but can also come to Sri Lanka. One reason could be lack of awareness, or not in the radar. I believe some simple campaigns that drive awareness will lead to conversion within a shorter span. Second is the demand servicing aspect. If you create demand and people are coming, then how do you service? Sri Lanka needs to look at infrastructure including payment infrastructure, transportation – getting from one destination to another, upgrading of lodging - hotels and properties as well as facilities and offering with focus on big markets such as Indians, Chinese, Europeans and Arabs.

Q: How is the level of awareness of Sri Lanka?

A: In June, Sri Lanka was ranked as the fastest growing city in terms of international overnight visitor numbers in the annual MasterCard Global Destinations Cities Index. Sri Lanka was placed ahead of 2. Chengdu, 3. Abu Dhabi, 4. Osaka, 5. Riyadh, 6. Xi An, 7. Taipei, 8. Tokyo, 9. Lima, and 10. Ho Chi Minh City. Many were surprised but to me it is not as I am captivated by Sri Lanka destination and have seen the changes. The MasterCard Global Destination Cities Index noted the rapid rise in tourism after the end of Sri Lanka’s long running civil war brought about Colombo’s double-digit cumulative annual growth rate over the last six years.

Q: Sri Lanka isn’t the only bikini on the beach? There are emerging economies such as Myanmar and Cambodia which are being more progressive?

A: Yes there are hence I said a more strategic involvement between MasterCard and Sri Lankan tourism authorities will enable a robust tourism roadmap which is critical for the country to leapfrog from its current trajectory and position, fast forward plans and achieve higher growth. Sri Lanka can achieve its goals faster than others.

Despite increasing competition globally for retail spending whether by travel or through e-commerce, spend and transaction volumes on MasterCard cards continued to grow for the Great Singapore Sale this year.

Spend on MasterCard cards alone during the GSS 2015 (30 May to 26 July 2015) amounted to S$ 2.12 billion, a 2.2% increase on last year.

During the eight-week GSS period, Singapore merchants saw over 14.5 million transactions made by local and overseas-issued MasterCard cards, a 7.3% growth from 2014.

Compared to 2011, local and visiting cardholder spend grew by a compound annual growth rate (CAGR) of 7% and usage of MasterCard cards grew at a CAGR of 12% in 2015 compared to five years ago at Singapore’s annual mid-year shopping extravaganza.

Overall GSS figures were boosted by tourists, with double digit increases recorded in both spend amount and transaction volume. Compared to last year, visiting MasterCard cardholders spent 15.3% more and used their cards 21.8% more.

MasterCard data revealed that the GSS continues to appeal strongly to its key tourist markets, with the same five countries topping the 2015 list as last year.

In order of ranking, Australia, Malaysia and China have retained their top spots while Indonesia has overtaken Japan this year for fourth placing, leaving Japan in fifth place.

Local cardholders contributed to the bulk of the GSS spend, making up two-thirds of spend volume, with spend dipping slightly from S$ 1.46 billion to S$ 1.41 billion. This year also saw more MasterCard card payments from local cardholders, growing by 2.6% from the year before to 10.5 million transactions.

MasterCard Singapore Group Head and General Manager Deborah Heng said, “The attractiveness of offers at the GSS and Singapore’s appeal as a tourist destination are holding strong as evidenced by the growth in both spend and transactions made on MasterCard cards this year. What’s interesting is that this year we are seeing dining places emerge consistently as a top spend category for visitors – an indication that fine dining may be growing in appeal for travellers to Singapore. Visitors are also increasingly recognising the benefit of electronic payments, as seen by the growth in the number of transactions made on MasterCard cards from 2011 to 2015.”

There is also a growing market for e-commerce at Singapore-based online merchants. S$ 303.5 million was spent online by Singapore cardholders in Singapore during the GSS, a 5.6% increase from 2014. The number of e-commerce transactions also rose by 9.8% with 2.3 million MasterCard card transactions recorded during GSS 2015.