Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 27 May 2015 01:07 - - {{hitsCtrl.values.hits}}

Premier blue chip John Keells Holdings (JKH) has proved its prowess in the league of listed corporate entities, finishing the 2014/15 financial year with the highest-ever profits.

Announcing its stellar performance, JKH said consolidated pre-tax profit grew by 25% to a record Rs. 19.08 billion and after-tax profit by 22% to Rs. 15.74 billion. The bottom line or profit attributable to equity holders of the parent grew in a similar fashion to Rs. 14.35 billion in comparison to FY14. JKH’s results in FY15 set an all-time record for a listed corporate entity.

JKH’s tax expense grew by 41% to Rs. 3.3 billion.

The impressive profitability came despite a modest 6% growth in Group revenue to Rs. 91.58 billion.

Results from operating activities grew by 18% to Rs. 12 billion whilst net finance income rose sharply by 64% to Rs. 7.4 billion. Finance income included interest income due to policyholders of the Union Assurance Life Insurance Fund as well as capital gains on disposals of private equity investments held under John Keells Capital, gains on short-term financial instruments, mainly at Union Assurance, exchange gains and interest income at JKH Plc.

The total assets of the JKH Group grew to Rs. 218 billion from Rs. 201.5 billion a year earlier. Total equity rose from Rs. 134.3 billion to Rs. 150 billion and included Rs. 62.6 billion in revenue reserves. Net assets per share were Rs. 138.15, up from Rs. 123.21 as at the end of FY14. Group liabilities have reported a dip to Rs. 67 billion from Rs. 68 billion.

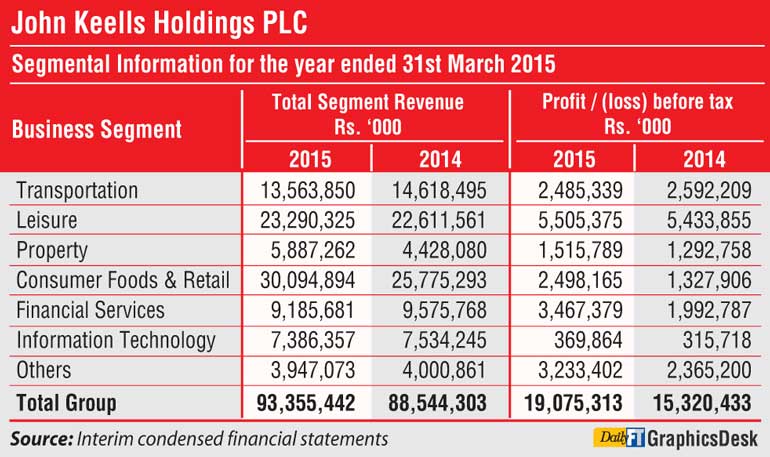

For the year ended on 31 March 2015, the transportation segment’s pre-tax profit was almost flat at Rs. 2.48 billion as against Rs. 2.59 billion in the previous year. The leisure sector too was same with Rs. 5.5 billion as against Rs. 5.43 in FY14. Property sector saw it growing from Rs. 1.3 billion to Rs. 1.5 billion. Consumer Foods and Retail achieved a pre-tax profit of Rs. 2.5 billion, up from Rs. 1.3 billion while the financial services segment saw a sharp increase from Rs. 2 billion to Rs. 3.46 billion. At post-tax level financial services’ contribution doubled to Rs. 3 billion from Rs. 1.6 billion.

The IT segment posted a pre-tax profit of Rs. 370 million, as against Rs. 316 million. The Others segment reported Rs. 3.2 billion, up from Rs. 2.36 billion.

In the fourth quarter, JKH Group revenue grew by only 1% to Rs. 22.6 billion and results from operating activities rose by 22% to Rs. 5.3 billion. Pre-tax profit was Rs. 6.9 billion, up by 11% over the fourth quarter of FY14 and the bottom line grew by 12% to Rs. 5.2 billion.

In 4Q, transportation segment improved its pre-tax profit to Rs. 641 million, up from Rs. 562 million a year earlier. Leisure was flat at Rs. 2.28 billion whilst property segment figure was down to Rs. 580 million from Rs. 848 million in 4Q of last financial year.

Consumer Foods and Retail saw significant growth in 4Q with pre-tax profit up to Rs. 947 million as against Rs. 600 million a year earlier and financial services tripled their figures to Rs. 1.57 billion from Rs. 415 million.

The JKH Board of Directors has declared a final dividend of Rs. 1.50 per share, bringing the total to Rs. 3.50, same as last year.

On Monday, the Board resolved to recommend the increase in the number of shares in issue by way of a share subdivision of the company’s shares whereby seven (7) existing shares will be subdivided into eight. Accordingly, the price and quantity of the 2015 and 2016 Warrants too will be adjusted to reflect the subdivision of shares.