Friday Feb 27, 2026

Friday Feb 27, 2026

Tuesday, 12 September 2017 00:00 - - {{hitsCtrl.values.hits}}

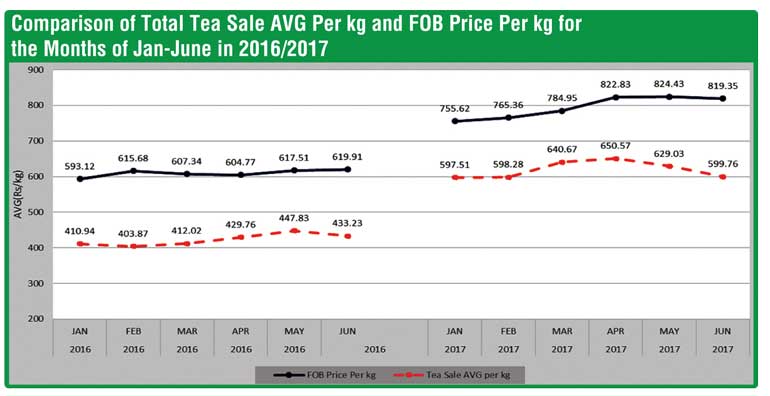

The second quarter of the Sri Lankan tea industry saw a continuation of the momentum seen in the first quarter with elevational averages recording high levels in comparison to year 2016.

Though an increase of crop was witnessed in the second quarter of 2017, the accumulated production shortfall helped prices to maintain at distinctive levels.

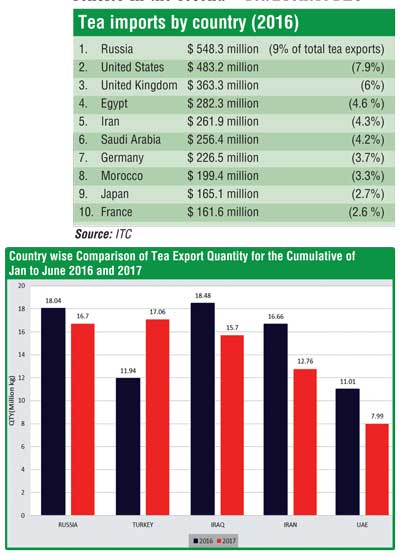

Russia, Turkey and Iran continued with strong demand for Sri Lankan tea and were the top three importers in the first six months concluded.

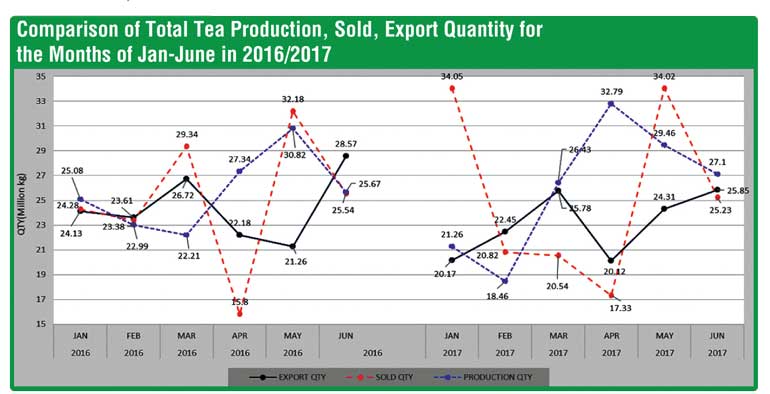

The total Sri Lanka tea production for January-June 2017 recorded 156.46 M Kgs in comparison to 154.25 M Kgs (+2.2 M Kgs) for the same period last year. Production has increased by 2.2 M Kgs and exports have decreased by 10.6 M Kgs compared to the same period in 2016.

The total national average of the teas sold for January-June 2017 was Rs.615.32 in comparison to Rs 423.70 (-Rs 191.62) for the same period last year. Low Growns averaged Rs.636.48, Mid Growns recorded Rs.572.73 with High Growns at Rs.588.29. The averages for high, medium and low growns in Rupee and Dollar terms, shows an increase for the period January-June 2017 when compared to the same period in years 2016,2015 and 2014. Low growns with the largest market share with 60.6% of the production recorded the sharpest increase of Rs.202.05 with the high growns recording an increase of Rs. 172.38 whilst the medium grown increased by Rs. 181.67 when compared to year 2016.

Sri Lanka tea exports for January - June 2017 amounted to 138.69 M Kgs vis-à-vis 149.31 M Kgs recorded for the same period last year (-10.62 M Kgs). The FOB average price per Kilo for this period stood at Rs. 796.34 as against Rs. 609.88 recorded for the same period last year. (+Rs. 186.46)

The total revenue realised for the period January-June 2017 from Tea exports was Rs. 110.44 billion (728.23m US$) compared with Rs. 89.32 billion (614.83m US$) (+Rs 21.12 billion) recorded last year. It’s an increase in Rupee and Dollar value compared to the year 2016.

Turkey has emerged as the largest buyer of Sri Lankan tea in the period of January-June 2017 outplacing Russia. Iraq and Iran records as the third and fourth largest importers of Sri Lankan tea for the mentioned period.

The global economic overview

Russia’s economic recovery kicked up in the 2nd quarter 2017 and the highest recording since fourth quarter 2013. Despite oil prices declining throughout the period exports soared up nearly 30%. The decreasing unemployment and an increase in consumer confidence with an improved economic situation has made the economic picture look brighter for Russia. However, a US congress vote to step up sanctions in Russia could undermine the economic confidence.

Successful battles against ISIS and the reconstruction of the country following years of war will support Iraq’s growth this year. It is expected to grow at 1.7% in 2017.

Iran’s economy exhibited a stellar performance in the first quarter of 2017. The economy is expected to grow by 4.3% in the second half of 2017. Iran’s strong growth could be jeopardised by oil cuts in compliance with the OPEC deal.

The European economy strengthened in second quarter in 2017. Domestic demand, improved labour market and stronger global economy has supported growth.

China’s economy expanded 6.9% in the second quarter of 2017.

The US Dollar – The US Dollar declined 4.6% against a basket of other foreign currencies in the second quarter, the worst quarterly decline since third quarter 2010.

Among the above countries the fastest growing markets for tea since 2012 were Morocco (up 19.2 %) and United States (up 10.6%).

The global purchases of imported tea amounted to $ 6.1 billion in 2016. Asian countries accounted for the highest dollar worth of imported tea during 2016 with purchases valued at $ 2.2 billion or 35.7% of the global total.

European countries accounted for 34.7% whilst 15.8% were to customers in Africa. North America accounted for 10.4%.

The Sri Lankan tea market is expected to remain buoyant for the rest of the year due to global shortfall of crop, devalued rupee and the global economic recovery which would help maintain the current price structures.

Courtesy: Ceylon Tea Brokers PLC